Get the FREE MORTAGE HEALTH CHECK - Sheridans Accountants - sheridans net

Show details

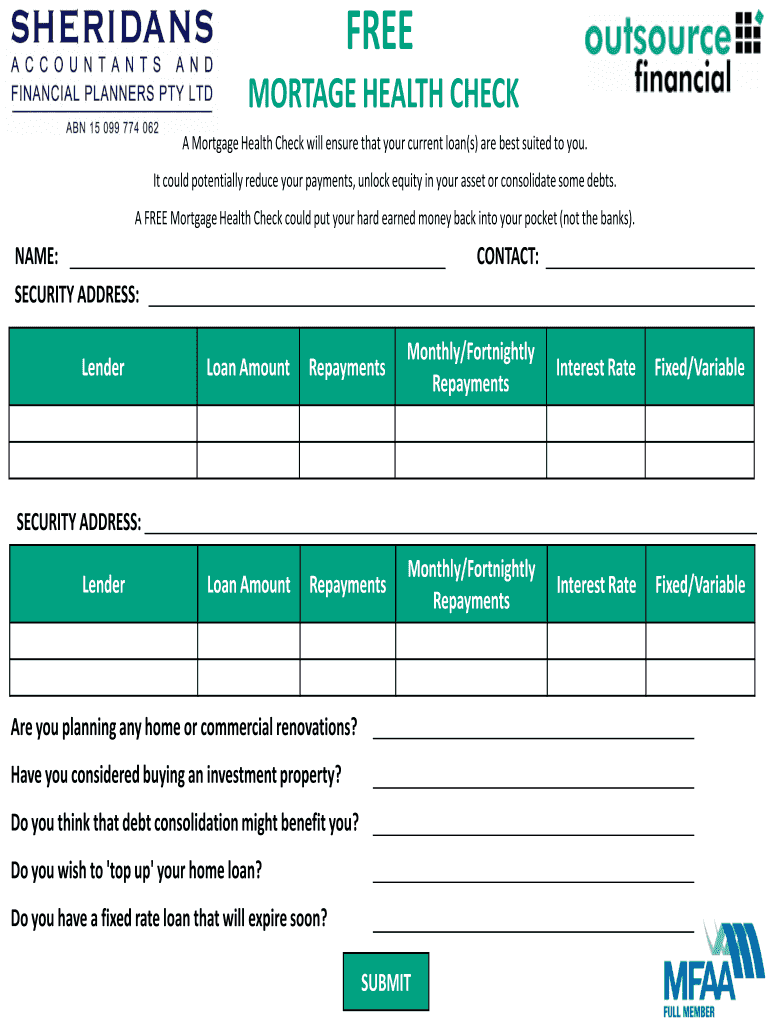

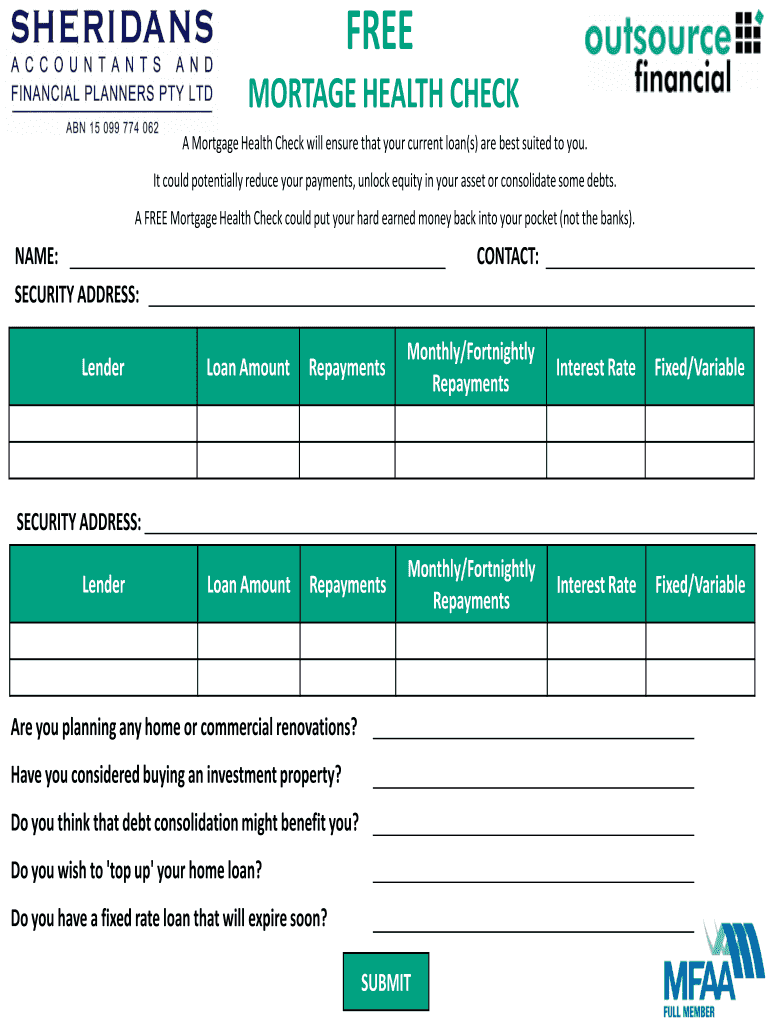

FREE MORTGAGE HEALTH CHECK. A Mortgage Health Check will ensure that your current loan’s) are best suited to you. It could potentially reduce your payments, unlock ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortage health check

Edit your mortage health check form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortage health check form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortage health check online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mortage health check. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortage health check

How to Fill Out Mortgage Health Check:

01

Start by gathering all the necessary documents such as your current mortgage statement, income documentation, and any other financial information that may be required.

02

Review the mortgage health check form and familiarize yourself with the questions and sections. This will help you understand what information you need to provide.

03

Begin by filling out your personal information section, including your name, address, contact details, and any other relevant details requested.

04

Move on to the mortgage details section, where you will need to provide information about your current mortgage, such as the lender's name, loan amount, interest rate, and remaining term.

05

The form may also ask for details about any additional loans or liens that you may have on the property, so make sure to fill out that section accurately.

06

Proceed to the financial information section, where you will need to provide details about your income, assets, and liabilities. This can include information on your employment, income sources, bank accounts, investments, and debts.

07

It's important to be honest and accurate when providing financial information as it will help the lender assess your current financial situation.

08

The form may also include sections where you can explain any financial hardships or changes in your circumstances that may impact your ability to make mortgage payments.

09

Once you have completed all the necessary sections, review the form for any errors or missing information. It's essential to double-check your responses to ensure they are accurate.

10

Finally, sign and date the mortgage health check form, acknowledging that the information provided is true and accurate to the best of your knowledge.

Who Needs Mortgage Health Check:

01

Homeowners who currently have a mortgage and want to evaluate their financial situation and mortgage terms.

02

Individuals who are considering refinancing their mortgage and want to assess whether it would be beneficial for them.

03

Those who are experiencing financial difficulties and want to explore options to avoid foreclosure or mitigate risks associated with their mortgage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit mortage health check online?

With pdfFiller, the editing process is straightforward. Open your mortage health check in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit mortage health check in Chrome?

mortage health check can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for the mortage health check in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your mortage health check in minutes.

What is mortage health check?

A mortgage health check is a process of reviewing and evaluating a borrower's financial situation to assess their ability to repay the mortgage.

Who is required to file mortage health check?

Borrowers who are applying for a mortgage or seeking to refinance their existing mortgage are required to undergo a mortgage health check.

How to fill out mortage health check?

To fill out a mortgage health check, borrowers need to provide details about their income, expenses, debts, assets, and credit history to the lender.

What is the purpose of mortage health check?

The purpose of a mortgage health check is to ensure that the borrower can afford the mortgage repayments and to assess the risk of default.

What information must be reported on mortage health check?

The information that must be reported on a mortgage health check includes income, expenses, debts, assets, employment status, credit history, and financial commitments.

Fill out your mortage health check online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortage Health Check is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.