Get the free Initial Notice of Insured Loss - treasury

Show details

This document is used to submit a notice to the Treasury regarding incurred aggregate insured losses related to terrorism for insurance purposes under the Terrorism Risk Insurance Program.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign initial notice of insured

Edit your initial notice of insured form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your initial notice of insured form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing initial notice of insured online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit initial notice of insured. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

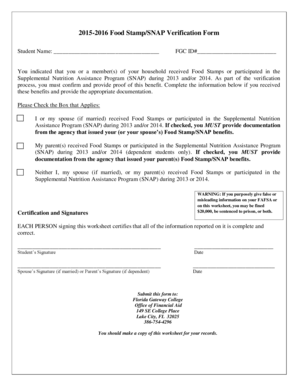

How to fill out initial notice of insured

How to fill out Initial Notice of Insured Loss

01

Obtain a copy of the Initial Notice of Insured Loss form from your insurance provider.

02

Fill in your personal information, including your name, address, and policy number.

03

Provide details of the loss incident, including the date, time, and nature of the loss.

04

Describe the circumstances surrounding the loss briefly but clearly.

05

List any witnesses or other parties involved in the incident, including their contact information.

06

Detail any immediate actions taken in response to the loss, such as contacting authorities or securing the property.

07

Sign and date the form to certify that the information provided is true and accurate.

08

Submit the completed form to your insurance company via the method specified (email, mail, or online submission).

Who needs Initial Notice of Insured Loss?

01

Policyholders who have experienced a loss or damage covered by their insurance policy.

02

Individuals filing a claim for property, casualty, or any insured loss under their insurance policy.

Fill

form

: Try Risk Free

People Also Ask about

What is the first notification of loss in insurance?

What is the First Notification of Loss (FNOL) in insurance? First Notification of Loss (FNOL) is the first step in the insurance claims process. This is when your insurer is first notified of damage, loss, or theft of an insured vehicle.

What is the first notice of loss in insurance?

FNOL, or First Notice of Loss, is the first formal report an insured submits to notify their insurer of an incident that may result in a claim. This marks the official beginning of the claims process and is a crucial moment for both insurers and policyholders.

What does notice of loss mean in insurance?

Notice of loss refers to a formal communication or notification that an insured individual or entity must provide to their company to report a claim. This can include situations such as a car accident, a fire at a home, or theft of property. This notification serves as the first step in initiating the claims process.

What are the two types of losses in insurance?

Thus, insurers distinguish between two types of damage: primary or direct damage, such as destruction by fire, and indirect or consequential loss, such as a cessation of business due to the fire.

What is a notice of loss in insurance?

Notice of loss refers to a formal communication or notification that an insured individual or entity must provide to their company to report a claim. This can include situations such as a car accident, a fire at a home, or theft of property. This notification serves as the first step in initiating the claims process.

What is the difference between a notice of loss and a proof of loss?

A loss notice simply lets your insurer know that you've experienced a loss and are filing a claim. A proof of loss is a legal document that provides detailed information about the damages you've incurred and the financial loss they represent.

What is the first notice of loss for insurance?

What is FNOL? FNOL, or First Notice of Loss, is the first formal report an insured submits to notify their insurer of an incident that may result in a claim.

What is a notice of loss form?

The First Notice of Loss (FNOL), also known as the first notification of loss, is the first notification by a policy holder of an asset's loss, damage, theft, or injury, which informs their insurer that they have cause to make a claim.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Initial Notice of Insured Loss?

The Initial Notice of Insured Loss is a formal notification submitted by an insured party to their insurance company to report a loss or damage that may be covered under their policy.

Who is required to file Initial Notice of Insured Loss?

The insured party, or the policyholder, is required to file the Initial Notice of Insured Loss with their insurance provider.

How to fill out Initial Notice of Insured Loss?

To fill out the Initial Notice of Insured Loss, the insured should provide relevant details about the loss including date, location, type of loss, and a brief description of what occurred, along with any supporting documentation if available.

What is the purpose of Initial Notice of Insured Loss?

The purpose of the Initial Notice of Insured Loss is to inform the insurance company of a potential claim, initiate the claims process, and allow the insurance provider to assess the situation and begin an investigation.

What information must be reported on Initial Notice of Insured Loss?

The information that must be reported includes the policyholder's details, date and time of the loss, description of the loss or damage, location of the incident, and any witnesses or police reports if applicable.

Fill out your initial notice of insured online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Initial Notice Of Insured is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.