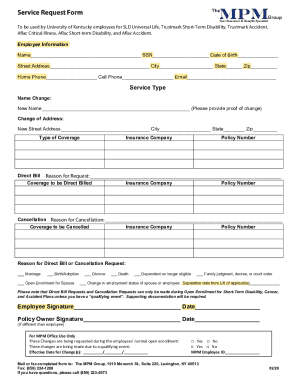

Get the free Contents insurance checklist - Whitbread Insurance Brokers

Show details

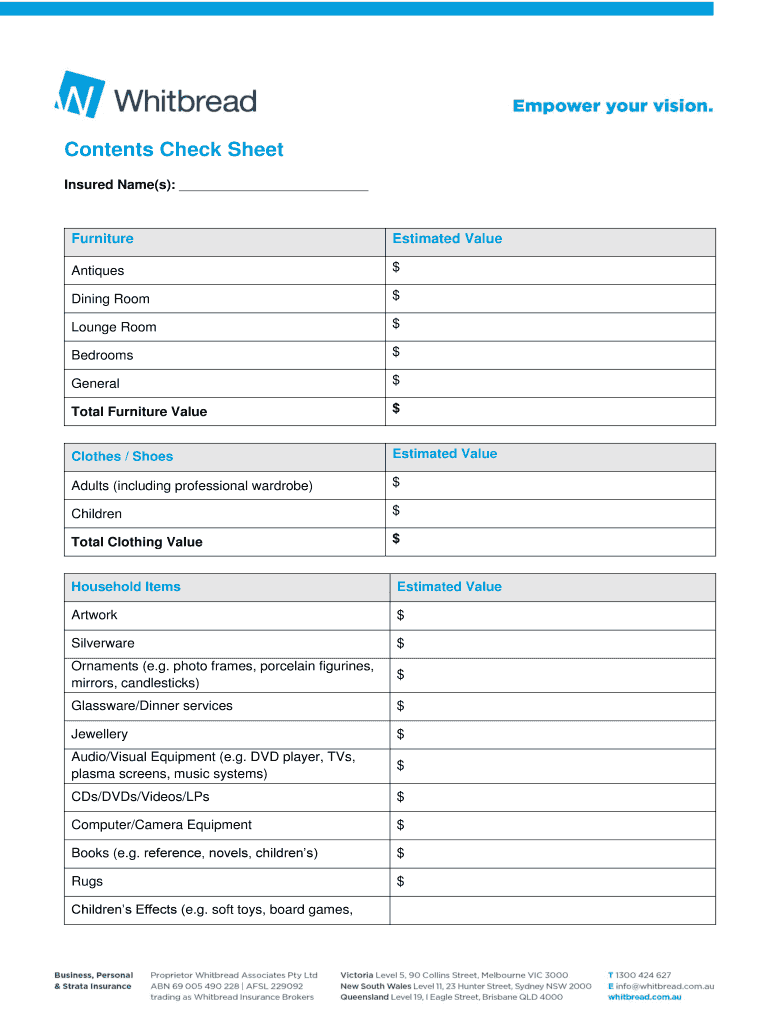

Home Contents Calculator Helping you get the right cover for your contents When it comes to insuring the contents in your home, one of the most difficult things is calculating their true replacement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign contents insurance checklist

Edit your contents insurance checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your contents insurance checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing contents insurance checklist online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit contents insurance checklist. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out contents insurance checklist

How to Fill Out Contents Insurance Checklist:

01

Start by gathering all necessary information about your belongings. This includes making a list of items you want to insure and their estimated value. Take inventory of each room in your home and note down any valuable possessions.

02

Assess the replacement cost of each item. This involves determining how much it would cost to replace each item at current market prices. Consider factors such as age, condition, and brand of the item.

03

Take clear and detailed photographs or videos of each item to support your insurance claim in case of theft, damage, or loss. Ensure that these visuals capture any distinguishing features or serial numbers.

04

Review your existing insurance policy or consult with an insurance expert to determine the coverage you currently have and identify any gaps in protection. Make note of any additional coverage you might need, such as coverage for high-value items or specific perils.

05

Compare different insurance providers and policies to find the best fit for your needs. Consider factors such as coverage limits, deductibles, premiums, and any special endorsements or add-ons available.

06

Complete the contents insurance application form, providing accurate and detailed information. Double-check that all information is correct, as inaccurate or incomplete information could result in a claim denial or reduced coverage.

07

Review the policy terms and conditions carefully before signing. Seek clarification from your insurance provider if you have any doubts or concerns regarding the coverage or policy exclusions.

08

Keep a copy of your completed contents insurance checklist, application form, and policy documents in a safe and easily accessible place. It is also advisable to share copies with a trusted family member or keep them stored securely online.

09

Regularly review and update your contents insurance coverage as your belongings change or new valuable possessions are acquired. It is recommended to ensure that your insurance coverage adequately reflects the current value of your belongings.

Who Needs Contents Insurance Checklist?

01

Homeowners: If you own a home, having contents insurance is vital to protect your belongings from risks such as theft, fire, vandalism, or natural disasters.

02

Renters: Even if you don't own a home, having contents insurance as a renter is essential. Your landlord's insurance will not cover your personal belongings in case of damage or theft.

03

Condo Owners: While your condominium association may provide some coverage, it is usually limited to the building's structure and common areas. Having contents insurance ensures that your personal belongings are protected.

04

Students: Whether living in a dorm or renting off-campus housing, students have valuable possessions that need protection. Contents insurance can provide coverage for items like laptops, electronics, textbooks, and furniture.

05

Anyone with Valuable Possessions: If you own high-value items such as jewelry, artwork, collectibles, or antiques, it's crucial to have contents insurance that offers specialized coverage for these valuables.

In summary, filling out a contents insurance checklist involves gathering information, assessing the value of your belongings, reviewing existing coverage, comparing policies, completing the application form, and thoroughly reviewing the policy terms. Anyone who owns a home, rents a property, or has valuable possessions should have a contents insurance checklist to ensure their belongings are adequately protected.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send contents insurance checklist for eSignature?

When you're ready to share your contents insurance checklist, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete contents insurance checklist online?

Filling out and eSigning contents insurance checklist is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I edit contents insurance checklist on an Android device?

You can edit, sign, and distribute contents insurance checklist on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is contents insurance checklist?

The contents insurance checklist is a list of items and their value that are covered by an insurance policy.

Who is required to file contents insurance checklist?

Policyholders or individuals who have contents insurance are required to file the contents insurance checklist.

How to fill out contents insurance checklist?

To fill out the contents insurance checklist, you must list all items covered by the policy with their corresponding value.

What is the purpose of contents insurance checklist?

The purpose of the contents insurance checklist is to provide a detailed inventory of items covered by the insurance policy.

What information must be reported on contents insurance checklist?

The contents insurance checklist must include a list of items covered by the policy and their corresponding value.

Fill out your contents insurance checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Contents Insurance Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.