Get the free Volunteer Fire Department Tax Exemption Program - clintonct

Show details

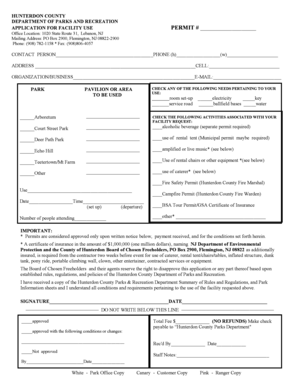

This document outlines the tax exemption program for active members of the Clinton Volunteer Fire Department, detailing eligibility, instructions for application, and the process for granting tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign volunteer fire department tax

Edit your volunteer fire department tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your volunteer fire department tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing volunteer fire department tax online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit volunteer fire department tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out volunteer fire department tax

How to fill out Volunteer Fire Department Tax Exemption Program

01

Review the eligibility criteria for the Volunteer Fire Department Tax Exemption Program in your locality.

02

Gather necessary documentation, including proof of volunteer status, identification, and any required financial information.

03

Obtain the application form from your local fire department or government website.

04

Fill out the application form accurately, ensuring that all requested information is included.

05

Attach any supporting documents as required by the application guidelines.

06

Submit the completed application form and documents to the designated office or department by the specified deadline.

07

Follow up with the office to confirm receipt of your application and inquire about the processing timeline.

Who needs Volunteer Fire Department Tax Exemption Program?

01

Individuals who are active volunteer firefighters in their local community.

02

Volunteer fire departments that wish to provide tax benefits to their active members.

Fill

form

: Try Risk Free

People Also Ask about

Do volunteer firefighters get paid in Maryland?

As of Sep 2, 2025, the average hourly pay for a Volunteer Firefighter in Maryland is $18.66 an hour. While ZipRecruiter is seeing salaries as high as $26.60 and as low as $8.40, the majority of Volunteer Firefighter salaries currently range between $15.62 (25th percentile) to $20.77 (75th percentile) in Maryland.

What is the Maryland firefighter tax credit?

The program allows qualifying individuals to reduce their Maryland taxable income in 2020 by up to $6,000. In 2021, that number increases to up to $6,500 and up to $7,000 for 2022 and beyond.

What are the benefits of volunteering for firefighters in Maryland?

Being a volunteer with a Maryland Fire/EMS department brings with it many benefits including a healthy state income tax deduction, a LOSAP (Length of Service Award Program) with retirement benefits, scholarship opportunities, professional development and leadership training and much more.

What is the tax credit for volunteer firefighters in Maryland?

The program allows qualifying individuals to reduce their Maryland taxable income in 2020 by up to $6,000. In 2021, that number increases to up to $6,500 and up to $7,000 for 2022 and beyond.

What is the tax credit for volunteer firefighters in Oklahoma?

Four Hundred Dollars ($400.00) for tax years 2005 through 2023 and Six Hundred Dollars ($600.00) for tax years 2024 and subsequent tax years following the taxable years for which a taxpayer is eligible for the credit provided by paragraph 1 of this subsection for a volunteer firefighter providing proof of certification

What is the tax credit for retirement in Maryland?

Residents who are at least 65 on the last day of the tax year may be eligible for a nonrefundable tax credit. If a taxpayer's federal adjusted gross income does not exceed $100,000 (if filing single), the amount of the tax credit is equal to $1,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Volunteer Fire Department Tax Exemption Program?

The Volunteer Fire Department Tax Exemption Program is a financial initiative that provides tax benefits to qualified volunteer fire departments, helping them to reduce operational costs and allocate more resources towards community safety.

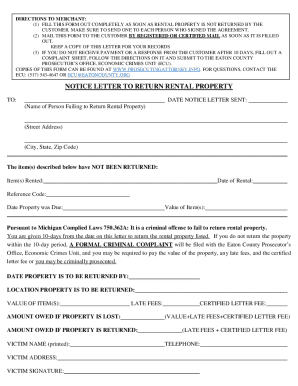

Who is required to file Volunteer Fire Department Tax Exemption Program?

Volunteer fire departments that wish to receive tax exemptions are required to file the Volunteer Fire Department Tax Exemption Program application with their local government or tax authority.

How to fill out Volunteer Fire Department Tax Exemption Program?

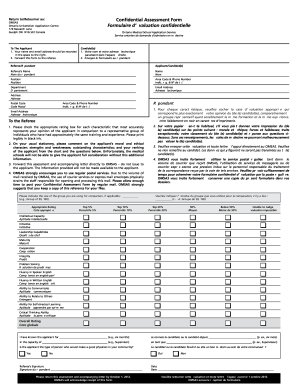

To fill out the Volunteer Fire Department Tax Exemption Program application, the fire department must provide accurate information about its operations, financial details, and any required documentation that demonstrates compliance with local regulations.

What is the purpose of Volunteer Fire Department Tax Exemption Program?

The purpose of the Volunteer Fire Department Tax Exemption Program is to support and encourage volunteer fire departments by reducing their financial burdens, thereby enhancing their capacity to serve the community effectively.

What information must be reported on Volunteer Fire Department Tax Exemption Program?

The information that must be reported typically includes the fire department's operational budget, membership details, volunteer hours, and any other data that illustrates the department's contributions to public safety and community service.

Fill out your volunteer fire department tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Volunteer Fire Department Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.