OPM SF 3106A 1996 free printable template

Show details

You cannot be one of the witnesses. Additional copies of the SF 3106A should be available from your employing office or you can photocopy both sides of the form for each spouse/former spouse. /day/yr. SF 3106A Revised March 1996 Previous editions are not usable Notification To Current and Former Spouses of Your Refund Application The Federal Employees Retirement law provides that your retirement contributions may be refunded to you only if you no...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OPM SF 3106A

Edit your OPM SF 3106A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OPM SF 3106A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OPM SF 3106A online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit OPM SF 3106A. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

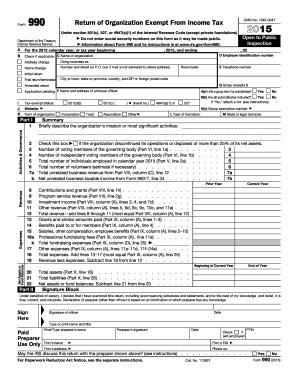

OPM SF 3106A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OPM SF 3106A

How to fill out OPM SF 3106A

01

Begin with the personal information section at the top of the form, filling in your name, Social Security number, and date of birth.

02

Specify your employments details, including the agency you worked for and the period of employment.

03

Indicate the type of retirement or separation for which you are applying.

04

Fill out all relevant sections concerning your federal service history and contributions to retirement funds.

05

Provide any necessary additional information, such as survivor information, if applicable.

06

Review all entries for accuracy and completeness before signing the application.

07

Submit the completed form as per the submission instructions provided.

Who needs OPM SF 3106A?

01

Federal employees who are retiring or separating from service and need to apply for a retirement benefit.

02

Individuals who need to document their federal employment history for retirement purposes.

Fill

form

: Try Risk Free

People Also Ask about

How does OPM calculate retirement pay?

60% of your high-3 average salary minus 100% of your Social security benefit for any month in which you are entitled to Social Security benefits. However, you are entitled to your “earned” annuity, if it is larger than this amount.

What is refund of retirement deductions?

A refund is a lump-sum payment of the total contributions plus interest paid by Federal employees into the Civil Service Retirement and Disability Fund (CSRDF) which includes the Civil Service Retirement System (CSRS) or Federal Employees Retirement System (FERS).

How do I calculate my federal retirement pay?

So let's say you have 25 years of service and your high-3 is $100k, your annual pension would be: 25 X $100,000 X 1% = $25,000 Gross Annual Pension. As you can see, (most federal employees) get 1% of their high-3 salary for every year of service they have. 25 X $100,000 X 1.1% = $27,500 Gross Annual Pension.

How long does it take to get federal retirement refund?

You can typically expect to receive your refund within 30 to 45 days from the date OPM receives all your necessary forms. However, timeframes can vary if there are holds or other restrictions on your account that require review and action.

What is SF 3106A for?

Standard Form 3106A, Current/Former Spouse(s) Notification of Application for Refund of Retirement Deductions under FERS, is used by refund applicants to notify their current/former spouse(s) that they are applying for a refund of retirement deductions, which is required by law.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my OPM SF 3106A in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your OPM SF 3106A and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit OPM SF 3106A in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your OPM SF 3106A, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I complete OPM SF 3106A on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your OPM SF 3106A, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is OPM SF 3106A?

OPM SF 3106A is a form used by federal employees to apply for a refund of retirement contributions when they separate from federal service.

Who is required to file OPM SF 3106A?

Federal employees who are separating from government service and have made retirement contributions to the retirement system are required to file OPM SF 3106A.

How to fill out OPM SF 3106A?

To fill out OPM SF 3106A, you must provide personal information, employment details, and retirement contribution information as specified on the form. Follow the instructions carefully to ensure all required fields are completed.

What is the purpose of OPM SF 3106A?

The purpose of OPM SF 3106A is to formally request the refund of retirement contributions from the federal retirement system upon separation from service.

What information must be reported on OPM SF 3106A?

The information that must be reported on OPM SF 3106A includes the employee's identifying information, details of the federal service, and the amounts of contributions to be refunded.

Fill out your OPM SF 3106A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OPM SF 3106a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.