Get the free 2011-12 ASSET CLARIFICATION FORM - PARENT - mtsac

Show details

This form is used to clarify asset information submitted on the FAFSA for students attending Mt. San Antonio College, especially when the reported amounts are identical for different asset categories.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2011-12 asset clarification form

Edit your 2011-12 asset clarification form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011-12 asset clarification form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2011-12 asset clarification form online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2011-12 asset clarification form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

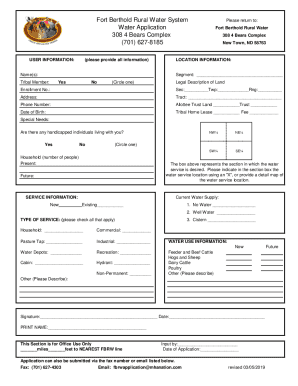

How to fill out 2011-12 asset clarification form

How to fill out 2011-12 ASSET CLARIFICATION FORM - PARENT

01

Obtain the 2011-12 ASSET CLARIFICATION FORM - PARENT from the appropriate institution or website.

02

Carefully read the instructions provided on the form to understand the requirements.

03

Fill out the parent information section with accurate personal details including names, addresses, and contact information.

04

Provide information regarding the assets held by the household for the specified period, including bank statements and investment details.

05

Include any other required financial information as specified in the form.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form in the manner specified (e.g., mail, email, or online submission) by the deadline.

Who needs 2011-12 ASSET CLARIFICATION FORM - PARENT?

01

Parents of students applying for financial aid who need to clarify their asset information for the 2011-12 academic year.

Fill

form

: Try Risk Free

People Also Ask about

How to calculate parents' total assets?

Total parent assets. This includes all cash, money in savings and checking accounts, real estate, investments and the value of businesses owned. It does not include the primary home or retirement accounts.

How to calculate parents' assets?

Add up total parent assets. Include all cash, money in savings and checking accounts, net investments, net real estate, and net business/farm value, but don't include your primary home or your retirement accounts. Add in any child support received for the last complete calendar year.

What do parents' current assets mean?

For purposes of the FAFSA, assets include: Current total of cash, savings, and checking accounts. Current net worth of businesses and investment farms but not including the value of crops that are grown solely for consumption by the student and his or her family.

How to calculate total family assets?

Determine total assets by combining your liabilities with your equity. Since liabilities represent a negative value, the simplest method for finding total assets with this formula is to subtract the value of liabilities from the value of equity or assets. The resulting figure equals your total assets.

What is the #1 most common FAFSA mistake?

Some of the most common FAFSA errors are: Leaving blank fields: Too many blanks may cause miscalculations and an application rejection. Enter a '0' or 'not applicable' instead of leaving a blank. Using commas or decimal points in numeric fields: Always round to the nearest dollar.

What to put for parent assets on FAFSA?

Most money and property owned by the parent or the child is counted as an asset on the FAFSA. This includes savings and checking accounts, cash, the net worth of a business with over one hundred full-time employees, a farm that is not the family's

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2011-12 ASSET CLARIFICATION FORM - PARENT?

The 2011-12 ASSET CLARIFICATION FORM - PARENT is a document used by parents to provide financial information for their children's college financial aid applications specifically for the academic year 2011-12.

Who is required to file 2011-12 ASSET CLARIFICATION FORM - PARENT?

Parents of students applying for financial aid who are required to clarify the details of their assets must file the 2011-12 ASSET CLARIFICATION FORM - PARENT.

How to fill out 2011-12 ASSET CLARIFICATION FORM - PARENT?

To fill out the 2011-12 ASSET CLARIFICATION FORM - PARENT, parents should carefully read the instructions, gather necessary financial documents, and accurately report their assets, including bank statements, investments, and other relevant financial information.

What is the purpose of 2011-12 ASSET CLARIFICATION FORM - PARENT?

The purpose of the 2011-12 ASSET CLARIFICATION FORM - PARENT is to verify and clarify the financial situation of parents in order to determine the student’s eligibility for financial aid.

What information must be reported on 2011-12 ASSET CLARIFICATION FORM - PARENT?

The information that must be reported includes total cash, savings, and checking accounts, investments, real estate, and any other assets that may be relevant to financial aid assessment.

Fill out your 2011-12 asset clarification form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2011-12 Asset Clarification Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.