Get the free Developing Financing Solutions - e TecK - eteck co

Show details

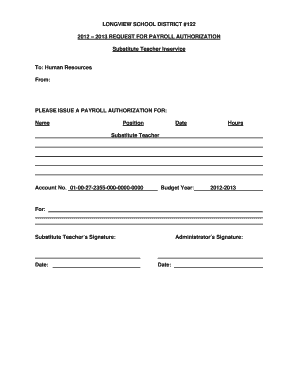

E Deck invites you to attend our seminar on developing financing solutions for the ICT Clusters in Trinidad and Tobago Developing Financing Solutions for the ICT Clusters offers you the invaluable

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign developing financing solutions

Edit your developing financing solutions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your developing financing solutions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing developing financing solutions online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit developing financing solutions. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out developing financing solutions

01

Identify the specific financing needs: Before filling out developing financing solutions, it is crucial to have a clear understanding of the specific financing needs your business or project has. This includes determining the amount of funding required, the purpose of the funding, and the timeline for the financing.

02

Assess your current financial situation: Take a close look at your current financial standing. Evaluate your assets, liabilities, cash flow, and any existing financing arrangements. This will help you determine if additional funding is needed and how it can be structured to best suit your needs.

03

Research available financing options: Familiarize yourself with the various financing options that are available to you. This can include traditional bank loans, government grants or loans, venture capital investments, equity financing, crowdfunding, and more. Each option has its own advantages and disadvantages, so it is important to carefully evaluate which option aligns best with your needs and goals.

04

Create a comprehensive business plan: Developing financing solutions requires a solid business plan that outlines your company's vision, market analysis, operational structure, financial projections, and growth strategy. This plan will not only showcase the viability of your project to potential investors or lenders but also guide your decision-making process throughout the financing process.

05

Seek professional help if needed: If the process of filling out developing financing solutions seems overwhelming or complex, it may be beneficial to seek professional help. Financial advisors, accountants, or business consultants can provide valuable insights and guidance throughout the process, ensuring all necessary details are addressed and increasing your chances of securing the right financing options.

06

Tailor your financing solutions to specific needs: Once you have identified potential financing options, it is important to tailor your approach based on your specific needs and goals. This may involve negotiating interest rates, repayment terms, collateral requirements, or equity stake percentages. Customizing your financing solutions ensures that they align with your unique circumstances and increase the likelihood of obtaining the necessary funding.

07

Regularly review and update your financing solutions: As your business or project evolves, it is essential to regularly review and update your financing solutions. This can include reassessing the amount of funding required, renegotiating terms, or exploring new financing opportunities. By staying proactive and adaptable, you can ensure that your financing solutions continue to meet your growing needs.

Who needs developing financing solutions?

01

Startups and entrepreneurs: Aspiring entrepreneurs or startup companies often require developing financing solutions to fund their initial operations, product development, and market entry strategies.

02

Small and medium-sized enterprises (SMEs): Established SMEs that are looking to expand their operations, enter new markets, or invest in research and development may also require developing financing solutions to support their growth.

03

Infrastructure and real estate projects: Large-scale infrastructure projects, such as the construction of roads, bridges, or airports, as well as real estate developments, often rely on developing financing solutions to cover the high upfront costs associated with these projects.

04

Non-profit organizations and social enterprises: Non-profit organizations and social enterprises focused on addressing social or environmental issues may need developing financing solutions to support their impactful initiatives and achieve their mission.

05

Existing businesses undergoing transformation or restructuring: Businesses that are going through a period of transformation or restructuring, such as mergers, acquisitions, or rebranding, may require developing financing solutions to navigate these changes successfully.

Overall, developing financing solutions are relevant to a wide range of individuals, organizations, and projects that require financial support to realize their objectives and drive growth.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find developing financing solutions?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the developing financing solutions. Open it immediately and start altering it with sophisticated capabilities.

How do I make edits in developing financing solutions without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your developing financing solutions, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an eSignature for the developing financing solutions in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your developing financing solutions right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is developing financing solutions?

Developing financing solutions involves creating strategies and plans to secure funding for various projects or initiatives.

Who is required to file developing financing solutions?

Anyone involved in a project or initiative that requires funding may be required to file developing financing solutions, such as project managers, financial analysts, or executives.

How to fill out developing financing solutions?

Developing financing solutions can be filled out by gathering relevant financial information, analyzing funding options, and creating a detailed plan to secure financing.

What is the purpose of developing financing solutions?

The purpose of developing financing solutions is to ensure that projects or initiatives have the necessary funding to be successful and sustainable.

What information must be reported on developing financing solutions?

Information that may need to be reported on developing financing solutions includes project budgets, funding sources, financing terms, and financial projections.

Fill out your developing financing solutions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Developing Financing Solutions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.