Get the free Keeping Tabs on Your Cash - srdc msstate

Show details

Este documento es un taller diseñado para ayudar a los propietarios de pequeñas empresas y hogares a establecer y mantener un sistema de registros contables simple para rastrear el flujo de ingresos

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign keeping tabs on your

Edit your keeping tabs on your form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your keeping tabs on your form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit keeping tabs on your online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit keeping tabs on your. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out keeping tabs on your

How to fill out Keeping Tabs on Your Cash

01

Gather your cash flow statements and receipts.

02

List all sources of income, including salary, bonuses, and any side jobs.

03

Record all your expenses, categorizing them into fixed and variable costs.

04

Track your daily spending by noting down each transaction in a dedicated journal or digital app.

05

Review your cash flow regularly, noting any trends or areas of concern.

06

Adjust your budget as necessary based on your findings.

Who needs Keeping Tabs on Your Cash?

01

Individuals managing personal finances.

02

Small business owners tracking income and expenses.

03

Anyone trying to save money or budget effectively.

04

Students learning to manage a fixed budget.

05

Anyone seeking financial stability or planning for future investments.

Fill

form

: Try Risk Free

People Also Ask about

How do you say "keeping tabs professionally"?

check out. check over. check up. do research. give the eagle eye. look into. sort out.

What does "keeping tabs" mean in slang?

informal. : to carefully watch (someone or something) in order to learn what that person or thing is doing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Keeping Tabs on Your Cash?

Keeping Tabs on Your Cash is a financial tracking method or tool that helps individuals or businesses monitor their cash flow, expenses, and income, ensuring better financial management and oversight.

Who is required to file Keeping Tabs on Your Cash?

Individuals and businesses that need to maintain accurate financial records or comply with regulatory requirements regarding cash transactions are often required to file Keeping Tabs on Your Cash.

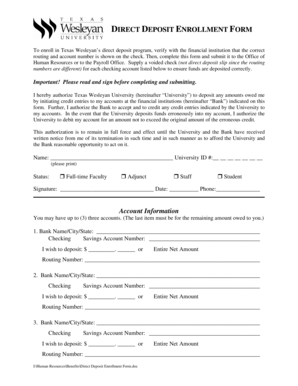

How to fill out Keeping Tabs on Your Cash?

To fill out Keeping Tabs on Your Cash, you should provide detailed entries of cash transactions, including dates, amounts, sources of income, and categories of expenses, ensuring all information is accurate and current.

What is the purpose of Keeping Tabs on Your Cash?

The purpose of Keeping Tabs on Your Cash is to provide a clear and organized view of cash flow, assisting in budgeting, financial planning, and ensuring compliance with any legal requirements concerning cash management.

What information must be reported on Keeping Tabs on Your Cash?

Keeping Tabs on Your Cash must report information such as the date of transactions, amount of cash received and spent, sources of income, expenses categories, and overall cash balance to maintain transparency in financial reporting.

Fill out your keeping tabs on your online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Keeping Tabs On Your is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.