Get the free FA mended return

Show details

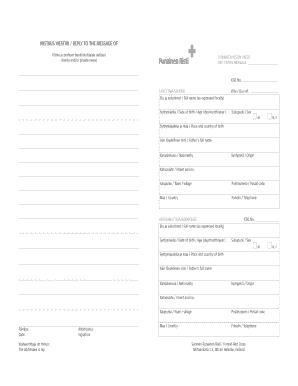

L file GRAPHIC print — DO NOT PROCESS Form As Filed Data DAN: 93491216002051 OMB No 1545-0052 Return of Private Foundation 990 -PF or Section 4947 (a)(1) Nonexempt Charitable Trust Treated as a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fa mended return

Edit your fa mended return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fa mended return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fa mended return online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fa mended return. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fa mended return

How to fill out a mended return?

01

Gather all necessary documents: Before filling out a mended return, make sure you have all the required documents such as your original tax return, any relevant income statements, and any additional forms or schedules that need to be included.

02

Obtain Form 1040X: The IRS provides Form 1040X, which is used for amending a previously filed tax return. You can download this form from the IRS website or request a copy by mail.

03

Understand the reason for the amendment: Determine the specific reason for amending your return. This could be correcting errors, adding missed income, or claiming additional deductions or credits.

04

Complete the Form 1040X: Fill out the necessary information on Form 1040X, including your personal details, the tax year you are amending, and the changes you are making to your original return. Provide a detailed explanation of each amendment you are making.

05

Include supporting documents: Attach any supporting documents, such as new W-2s, 1099s, or receipts, to substantiate the changes you are making. Make sure to keep copies of these documents for your records.

06

Review and double-check: Carefully review all the information you have entered on the Form 1040X to ensure accuracy. Mistakes or omissions could delay the processing of your amended return.

07

File the amended return: Once you have completed the Form 1040X and double-checked everything, you can mail it to the appropriate IRS address. Make sure to include any additional payments or request any refunds if necessary.

Who needs a mended return?

01

Individuals who made errors on their original tax return: If you made mistakes on your original tax return, such as reporting incorrect income or deductions, you may need to file a mended return to correct those errors.

02

Individuals who realized they missed reporting income: If you forgot to report certain income, such as freelance earnings or investment gains, on your original tax return, you will need to file a mended return to include that income.

03

Individuals who discovered missed deductions or credits: If you became aware of deductions or credits that you missed on your original tax return, filing a mended return can help you claim those additional benefits and potentially lower your tax liability.

04

Individuals who received an IRS notice: If the IRS sent you a notice indicating discrepancies or errors in your original tax return, you may need to file a mended return to resolve those issues.

05

Individuals who had life changes: Significant life events, such as marriage, divorce, or the birth of a child, could impact your tax situation. If these events weren't reflected on your original return, you might need to amend it.

Remember, it is always best to consult a tax professional or refer to the official IRS guidelines for specific instructions on how to fill out and file a mended return.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is a mended return?

A mended return, also known as an amended return, is a tax return that is filed to correct errors or make changes to a previously filed tax return.

Who is required to file a mended return?

Anyone who needs to correct errors or update information on a previously filed tax return is required to file a mended return. This includes individuals, businesses, and other entities.

How to fill out a mended return?

To fill out a mended return, you will need to obtain the appropriate tax form for the specific tax year you are amending. Complete the form with the updated or corrected information and include any necessary supporting documentation. Check the instructions for the specific form for guidance on completing the amended return.

What is the purpose of a mended return?

The purpose of a mended return is to correct errors, omissions, or changes to a previously filed tax return. It allows individuals or entities to update their tax information and ensure they are accurately reporting their income, deductions, and credits.

What information must be reported on a mended return?

On a mended return, you must report the updated or corrected information that needs to be changed from the original tax return. This may include changes to income, deductions, credits, or other relevant information.

How can I modify fa mended return without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your fa mended return into a dynamic fillable form that can be managed and signed using any internet-connected device.

Where do I find fa mended return?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific fa mended return and other forms. Find the template you need and change it using powerful tools.

Can I create an eSignature for the fa mended return in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your fa mended return right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Fill out your fa mended return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fa Mended Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.