Get the free Voluntary Deduction for

Show details

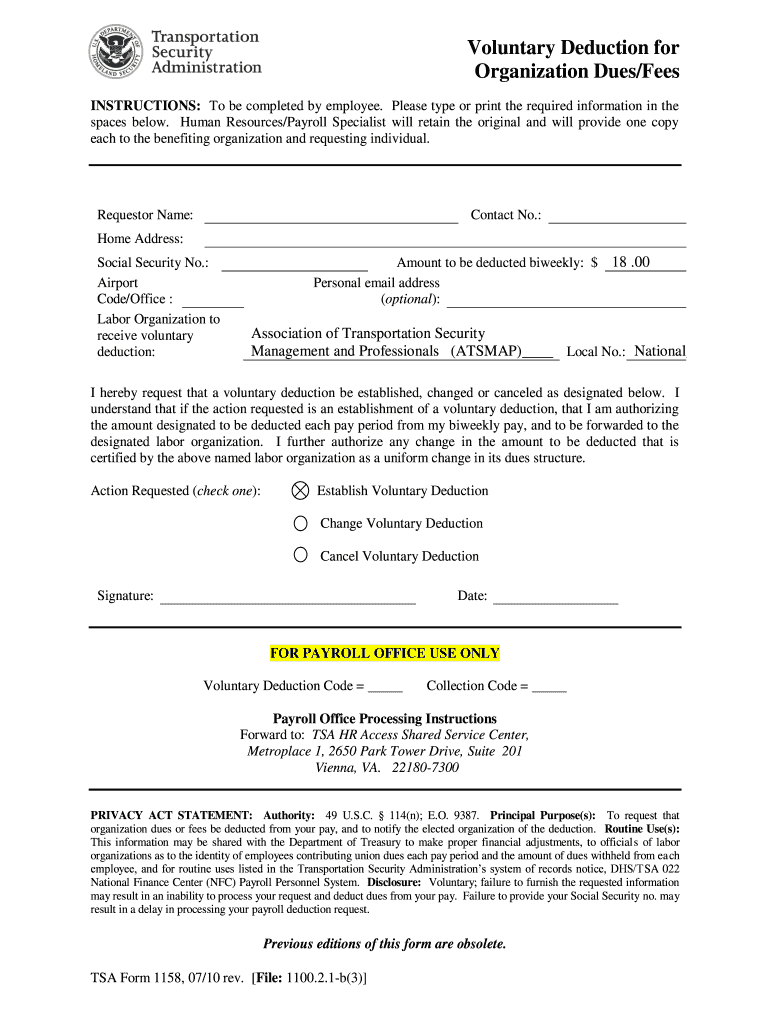

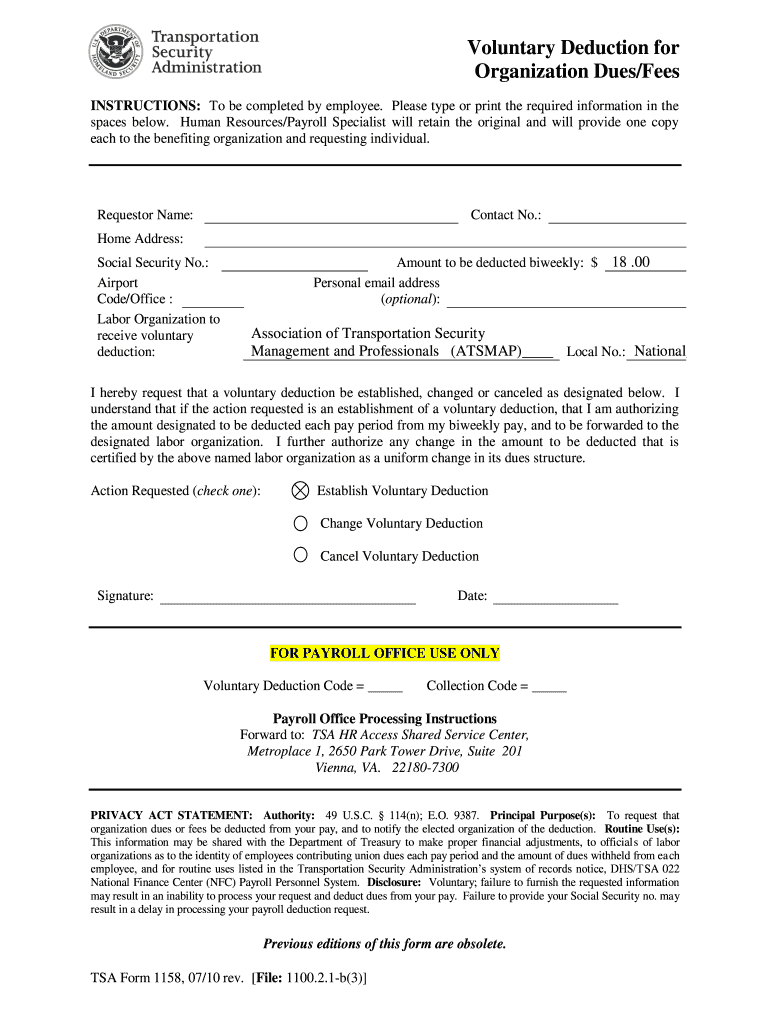

Voluntary Deduction for

Organization Dues×Fees

INSTRUCTIONS: To be completed by employee. Please type or print the required information in the

spaces below. Human Resources×Payroll Specialist will

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign voluntary deduction for

Edit your voluntary deduction for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your voluntary deduction for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing voluntary deduction for online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit voluntary deduction for. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out voluntary deduction for

How to Fill Out Voluntary Deduction Form:

01

Obtain the voluntary deduction form from your employer or HR department. It may be available in both electronic and paper format.

02

Begin by providing your personal information, such as your name, employee ID, and contact details. This ensures that the deduction is correctly attributed to your account.

03

Carefully read the instructions on the form to understand what type of voluntary deduction you are applying for. Common examples include retirement plans, healthcare premiums, and charitable donations.

04

Fill out the deduction amount you wish to contribute. Ensure that it complies with any specified minimum or maximum limits outlined in the instructions.

05

If applicable, select the frequency of the deductions. You may have the option to choose from options such as weekly, bi-weekly, monthly, or a lump sum.

06

If necessary, provide additional details or select specific options related to your chosen deduction. For instance, if you are contributing to a retirement plan, you might need to specify investment options or beneficiaries.

07

Review the information you have entered on the form to ensure accuracy. Double-check your name, employee ID, deduction amount, and other relevant details.

08

Sign and date the form according to the instructions. This validates your voluntary participation in the deduction program.

09

Submit the completed form to your employer or HR department. Follow any specific submission instructions outlined on the form or communicated by your employer.

10

Retain a copy of the filled-out form for your records. It can serve as proof of your voluntary deduction participation.

Who Needs Voluntary Deductions:

01

Employees who wish to save for retirement can utilize voluntary deductions to contribute to a retirement plan, such as a 401(k) or IRA. These deductions allow individuals to set aside a portion of their paycheck before taxes, potentially providing tax benefits.

02

Many employers offer voluntary deductions for healthcare premiums. Employees can choose to have a portion of their wages deducted to cover medical, dental, vision, or other insurance premiums.

03

Charitable individuals may opt for voluntary deductions to make regular donations to their chosen charities. This makes it easier to contribute consistently and support causes they care about without the hassle of individual donations.

04

Some employers provide voluntary deductions for transportation expenses, such as commuter benefits or parking fees. This allows employees to save money by using pre-tax dollars to cover these costs.

05

Voluntary deductions can also be utilized for various other purposes, such as flexible spending accounts, life insurance premiums, or loan repayments.

Overall, voluntary deductions benefit a wide range of individuals who wish to automate contributions or payments directly from their wages, making it convenient and efficient to allocate funds toward specific purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete voluntary deduction for online?

pdfFiller has made it simple to fill out and eSign voluntary deduction for. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make changes in voluntary deduction for?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your voluntary deduction for to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I complete voluntary deduction for on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your voluntary deduction for. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is voluntary deduction for?

Voluntary deduction is for employees to authorize specific deductions from their paychecks, such as retirement contributions or charitable donations.

Who is required to file voluntary deduction for?

Employers are required to file voluntary deduction forms on behalf of their employees.

How to fill out voluntary deduction for?

Employers must accurately record and report any authorized voluntary deductions from employees' paychecks.

What is the purpose of voluntary deduction for?

The purpose of voluntary deduction forms is to ensure that employees' chosen deductions are accurately processed and recorded.

What information must be reported on voluntary deduction for?

Voluntary deduction forms must include details about the employee, the specific deduction being made, and the amount being deducted.

Fill out your voluntary deduction for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Voluntary Deduction For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.