Get the free FORM D4 - ducc du ac

Show details

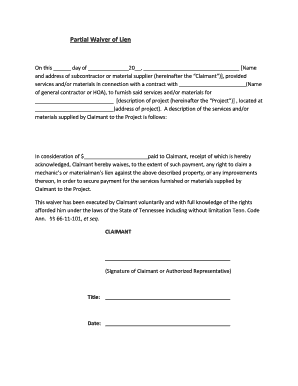

This document serves as a permit for conducting safety studies on genetically modified organisms (GMOs) and living modified organisms (LMOs) as required by the Review Committee on Genetic Manipulation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form d4 - ducc

Edit your form d4 - ducc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form d4 - ducc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form d4 - ducc online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form d4 - ducc. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form d4 - ducc

How to fill out FORM D4

01

Obtain FORM D4 from the relevant authority or website.

02

Read the instructions carefully to understand the requirements.

03

Gather necessary documents required for the application.

04

Fill out personal information such as name, address, and contact details in the designated fields.

05

Complete any relevant sections pertaining to the purpose of the form.

06

Double-check your entries for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the form in accordance with the provided submission instructions.

Who needs FORM D4?

01

Individuals or organizations applying for a specific permit or license.

02

Businesses seeking to register certain activities with authorities.

03

Applicants requiring governmental approval or documentation.

Fill

form

: Try Risk Free

People Also Ask about

What is de4 form for?

The Employee's Withholding Allowance Certificate (DE 4) is for California Personal Income Tax (PIT) withholding purposes only. The DE 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation.

How many should I claim to get more on my paycheck?

If you'd rather get more money with each paycheck instead of having to wait for your refund, claiming 1 on your taxes is typically a better option. Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund.

Is it better to claim 3 or 4 dependents?

Claiming fewer allowances on Form w-4 will result in more tax being withheld from your paychecks and less take-home pay. This might result in a larger tax refund. On the other hand, claiming too many allowances could mean that not enough tax is withheld during the year.

What does claiming 2 on taxes mean?

Claiming Two Allowances • If you are single, claiming two allowances will get you close to your tax liability but may. result in tax due when filing your taxes. • If you are single and work more than one job, you can claim one allowance at each job or. two allowances at one job and zero at the other.

Is it better to claim 1 or 0 on your taxes?

Thus, claiming ``0'' results in the smallest paycheck, but a larger tax refund at tax time. The larger the number (ie 1, 2, 3, etc) will result in larger paychecks, but will reduce tax withholdings which may result in a smaller tax refund or owing at tax time.

What is form D4?

Federal W-4: The state DE 4 form is distinct from the federal Form W-4, specifically tailored for California's personal income tax requirements. California Personal Income Tax: The DE 4 form is used for calculating the correct amount of California personal income tax to withhold from an employee's paycheck.

What can I claim to get the most out of my paycheck?

Itemized deductions or tax credits - Medical expenses, taxes, interest expense, gifts to charity, dependent care expenses, education credit, Child Tax Credit, Earned Income Tax Credit.

What is a D-4 DC withholding allowance certificate?

Use this form “D-4” Withholding Allowance Certificate” to designate your withholding allowances if you live in the District of Columbia. Note: DC Retirement Board Benefits staff cannot provide tax advice or guidance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM D4?

FORM D4 is a regulatory document used for reporting certain financial activities and transactions to regulatory authorities, often related to investment firms and securities.

Who is required to file FORM D4?

Entities involved in securities transactions or investment activities that meet certain regulatory criteria are typically required to file FORM D4.

How to fill out FORM D4?

To fill out FORM D4, provide required information such as your name, entity details, transaction specifics, and any relevant financial data as outlined in the filing instructions or guidelines.

What is the purpose of FORM D4?

The purpose of FORM D4 is to ensure transparency in financial transactions and compliance with regulatory requirements, helping to protect investors and maintain market integrity.

What information must be reported on FORM D4?

FORM D4 typically requires reporting on transaction details, party information, amounts involved, dates of transactions, and any other relevant financial data specified by the regulatory body.

Fill out your form d4 - ducc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form d4 - Ducc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.