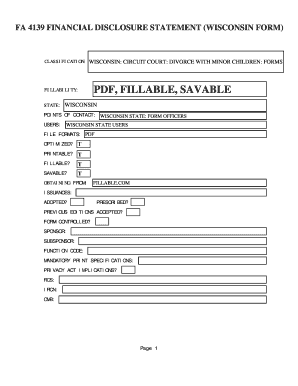

Get the free Form 10 bImport declarationb - WordPresscom

Show details

OZONE DEPLETING SUBSTANCES REGULATIONS 2010 FORM 10 DEPARTMENT OF ENVIRONMENT IMPORT DECLARATION (Sections 16 and 17 of the Act and Regulation 23) TO: Fiji Islands Revenue Customs Authority at port×airport

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 10 bimport declarationb

Edit your form 10 bimport declarationb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 10 bimport declarationb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 10 bimport declarationb online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 10 bimport declarationb. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 10 bimport declarationb

How to fill out form 10 "import declaration"?

01

Start by obtaining a copy of form 10 "import declaration" from the relevant government agency or website. This form is typically used for declaring imported goods and providing necessary information related to the import process.

02

Begin filling out the form by entering your personal information, such as your name, address, contact details, and any identification numbers required.

03

Provide details about the imported goods, including the name, description, quantity, unit price, and total value. Be as specific and accurate as possible to ensure smooth customs clearance.

04

Include information related to the country of origin and the customs territory where the goods will be imported. This typically includes the name of the country, port of entry, and the mode of transportation.

05

Specify the purpose of the importation, such as whether it is for personal use, commercial purposes, or for a specific project. Provide any supporting documents or references as required, such as invoices, bills of lading, or purchase orders.

06

If applicable, indicate any special permits or licenses required for the importation, such as certifications for restricted goods or hazardous materials. Attach copies of these permits with the form.

07

Declare the correct tariff classification code for the goods being imported. This code helps determine the applicable customs duties and taxes. It is important to consult the customs tariff or seek professional advice to ensure accuracy.

08

Calculate and include the customs duties, taxes, and fees payable for the imported goods. This information can be obtained from the customs authority or through the customs tariff. Ensure that all calculations are accurate and properly documented.

09

Sign and date the form once you have completed all the necessary information. Ensure that the form is neatly filled out and all required fields are duly completed.

Who needs form 10 "import declaration"?

01

Importers: Individuals or businesses involved in importing goods into a country are generally required to fill out form 10 "import declaration." This helps the customs authority assess the nature and value of the imported goods, determine the applicable duties, and ensure compliance with relevant regulations.

02

Customs Agents: Professionals or companies acting as intermediaries between importers and customs authorities may also be required to fill out form 10 "import declaration" on behalf of their clients. These agents facilitate the customs clearance process and ensure that all necessary information is accurately provided.

03

Government Agencies: Government agencies responsible for regulating and monitoring imports often require the submission of form 10 "import declaration" for record-keeping, statistical analysis, and compliance purposes. This allows them to monitor trade flows, enforce trade policies, and collect relevant data for economic analysis.

Note: The specific requirements for form 10 "import declaration" may vary depending on the country or customs territory. It is essential to consult the relevant customs authority or seek professional advice to ensure compliance with the applicable regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 10 Import Declaration?

Form 10 Import Declaration is a document required by customs authorities to declare details of goods imported into a country.

Who is required to file form 10 Import Declaration?

Importers or their authorized agents are required to file form 10 Import Declaration.

How to fill out form 10 Import Declaration?

Form 10 Import Declaration can be filled out online or in person by providing information such as details of the imported goods, their value, quantity, and other relevant details.

What is the purpose of form 10 Import Declaration?

The purpose of form 10 Import Declaration is to provide customs authorities with necessary information about imported goods for the purpose of taxation, regulation, and monitoring.

What information must be reported on form 10 Import Declaration?

Information such as the description of goods, quantity, value, country of origin, and other relevant details must be reported on form 10 Import Declaration.

How do I modify my form 10 bimport declarationb in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign form 10 bimport declarationb and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an electronic signature for the form 10 bimport declarationb in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your form 10 bimport declarationb.

Can I edit form 10 bimport declarationb on an Android device?

You can make any changes to PDF files, like form 10 bimport declarationb, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your form 10 bimport declarationb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 10 Bimport Declarationb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.