Get the free Travel Paid by Non-Federal Source Request - asc army

Show details

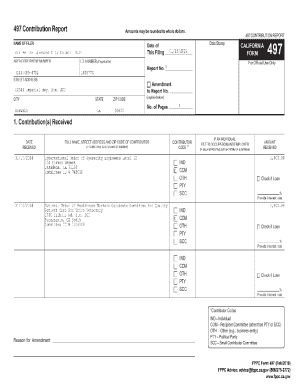

This document serves as a memorandum for requesting travel paid by a non-Federal source for temporary duty (TDY) assignments. It outlines fields for personal information, travel details, costs, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign travel paid by non-federal

Edit your travel paid by non-federal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your travel paid by non-federal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit travel paid by non-federal online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit travel paid by non-federal. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out travel paid by non-federal

How to fill out Travel Paid by Non-Federal Source Request

01

Gather all necessary travel details including dates, locations, and purpose of travel.

02

Obtain and include the source of funding information, specifying the non-federal entity funding the travel.

03

Complete the required form with personal identification information, such as name and position.

04

Detail the travel expenses to be covered by the non-federal source, including transportation, lodging, meals, etc.

05

Attach any supporting documentation required by your organization, such as invoices or confirmations.

06

Submit the completed form along with all required attachments to the appropriate department for review.

Who needs Travel Paid by Non-Federal Source Request?

01

Employees who are traveling for work and their travel expenses are being covered by a non-federal source.

02

Anyone involved in a project or event that receives funding from a non-federal entity and needs to report travel arrangements.

Fill

form

: Try Risk Free

People Also Ask about

What is the Federal travel Expense Act?

Federal Civilian Employee and Contractor Travel Expenses Act of 1985 - Title I: Travel Expenses of Federal Civilian Employees - Revises provisions regarding travel and subsistence expenses for Federal employees and consultants by replacing current per diem allowance rates with rates to be established by locality.

What is another name for travel allowance?

Allowances are taxed according to the law in the specific country. Please refer to our Benefits advisor to learn more about statutory benefits for team members. Expenses are costs that team members initially pay out of pocket to be reimbursed by the company.

What is the difference between travel allowance and travel expenses?

Receiving a travel allowance from your employer does not automatically entitle you to claim a deduction for travel expenses. A travel allowance expense is a deductible travel expense: you incur when you're travelling away from your home overnight to perform your employment duties.

What is a travel allowance in English?

Travel Allowance (TA) is an allowance or reimbursement provided by employers to employees for business-related travel expenses. It helps cover transportation, lodging, and meals incurred during official assignments. Business-related expenses – Tax-free reimbursement if properly documented.

What is a travel allowance?

per diem allowance. A travel allowance is typically a broad term referring to funds provided to employees for covering various travel-related expenses, which could be fixed, reimbursed, or based on mileage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

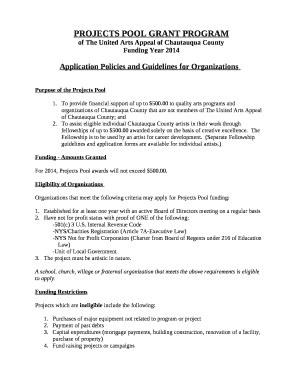

What is Travel Paid by Non-Federal Source Request?

Travel Paid by Non-Federal Source Request is a form that federal employees must submit to disclose travel expenses covered by non-federal entities, ensuring transparency and compliance with ethical guidelines.

Who is required to file Travel Paid by Non-Federal Source Request?

Federal employees who receive travel reimbursements or payments from non-federal sources must file this request to properly report such financial support.

How to fill out Travel Paid by Non-Federal Source Request?

To fill out the request, the person must provide details such as the purpose of travel, the source of payment, dates of travel, and any additional relevant information regarding the trip.

What is the purpose of Travel Paid by Non-Federal Source Request?

The purpose of the request is to ensure accountability and integrity in federal travel practices by disclosing any external funding received for travel-related activities.

What information must be reported on Travel Paid by Non-Federal Source Request?

The request must report information such as the traveler's name, travel dates, the purpose of the trip, the identity of the non-federal source, and the amount of funding or reimbursement received.

Fill out your travel paid by non-federal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Travel Paid By Non-Federal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.