Get the free sepa direct debit danske bank - danskebank

Show details

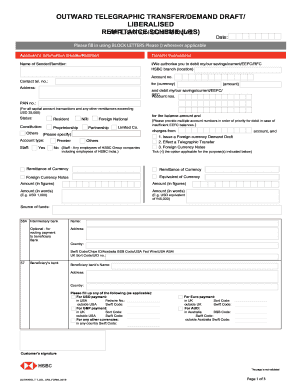

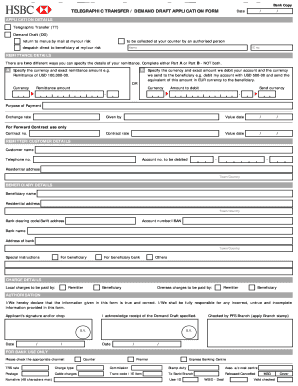

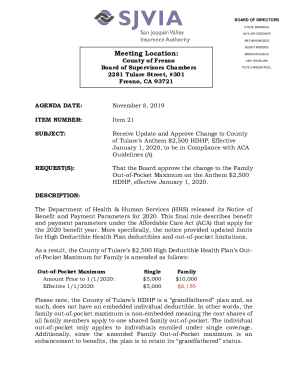

SEPA direct debit mandate for SEPA businesstobusiness (B2B) direct debits To Name and address of payee Creditor identifier1 (of payee) Mandate reference (maximum length: 35 characters) Mandate for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sepa direct debit danske

Edit your sepa direct debit danske form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sepa direct debit danske form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sepa direct debit danske online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sepa direct debit danske. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sepa direct debit danske

How to fill out SEPA direct debit danske:

01

Gather the necessary information: Before filling out the SEPA direct debit danske form, make sure you have all the required information. This includes the payer's name and address, the payer's bank account details, and the payee's name and address.

02

Fill in the payer's information: Start by providing the payer's name and address in the designated fields on the form. This should be the individual or company authorizing the direct debit payment.

03

Enter the payer's bank account details: Next, fill in the payer's bank account information, including the International Bank Account Number (IBAN) and the Bank Identifier Code (BIC). These details ensure that the payment is processed correctly.

04

Specify the payee's details: Proceed by entering the payee's name and address. This should be the individual or company receiving the direct debit payment.

05

Provide the payee's mandate reference: In this section, include the unique mandate reference number assigned to the direct debit agreement. This number serves as a reference point for tracking and identifying the payment.

06

Determine the payment amount: Indicate the specific amount that will be debited from the payer's bank account. Ensure that the currency is specified correctly.

07

Choose the payment frequency: Select the desired payment frequency, whether it's a one-time payment or recurring on a specific schedule (e.g., monthly, quarterly, annually).

08

Sign the form: The payer should sign and date the form to authorize the SEPA direct debit danske payment. This signature confirms their consent to the payment and acknowledges their understanding of the terms and conditions.

Who needs SEPA direct debit danske:

01

Individuals making regular payments: SEPA direct debit danske is useful for individuals who need to make regular payments, such as monthly bills or subscriptions. It offers a convenient and automated way to ensure timely payments without manual intervention.

02

Businesses collecting recurring payments: Companies or organizations that receive recurring payments from customers or clients can benefit from SEPA direct debit danske. This payment method allows them to collect funds efficiently and provides a predictable cash flow.

03

Service providers and utility companies: Service providers, such as telecommunications companies, utility providers, and insurance companies, often use SEPA direct debit danske as a convenient payment option for their customers. It simplifies the billing process and reduces administrative efforts.

04

Merchants and e-commerce websites: Online merchants and e-commerce websites can integrate SEPA direct debit danske as a payment option for customers. This expands the range of payment choices and improves customer satisfaction.

05

Non-profit organizations: Non-profit organizations that rely on regular donations or membership fees can utilize SEPA direct debit danske to streamline their collection process. It offers a hassle-free method for supporters to contribute on a recurring basis.

Fill

form

: Try Risk Free

People Also Ask about

How do I make an international transfer with Danske bank?

International Transfers - Danske eBanking Log on to Danske eBanking. Click 'Pay and transfer' on the top menu and select 'Transfer funds abroad' Fill in the 'Information about transfer' fields and click 'Next' Fill in the 'Information about payee' fields and click 'OK' We will then ask you to approve.

What is required for a SEPA direct debit?

In order to debit an account, businesses must collect their customer's name and bank account number in IBAN format. During the payment flow, customers must accept a mandate that gives the business an authorization to debit the account.

How do I set up a SEPA direct debit?

To set up a Mandate, your customer will need to complete a SEPA Direct Debit Mandate form. This can be done in three ways: Paper - A paper Mandate form can be completed by your customer and returned to you. Paperless – An electronic Mandate form can be completed by your customer through an electronic channel.

How do I set up a SEPA transfer?

To conduct your SEPA transfer you will need: Name of recipient (person or business) IBAN of their account. Their BIC (Bank identifier code), also called SWIFT code. The country the bank account is registered in. The currency you have, and the currency you're converting to.

How do I do a SEPA transfer with Danske bank?

The following rules apply to SEPA payments: The payment must be in euro. The beneficiary account number must be an International Bank Account Number (IBAN) The beneficiary must be located in one of the countries within the SEPA. Each party pays the costs payable to its own bank. The transfer type must be Standard.

How do I set up a direct debit with Danske bank?

FAQs Log on to eBanking (eBanking is best accessed on a desktop device) Select 'Pay and transfer' Click 'Regular transfers – View and amend Direct Debits/Standing Orders' Click the 'New standing order' button. Fill in the details when you're asked. Select OK and enter your passcode.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute sepa direct debit danske online?

With pdfFiller, you may easily complete and sign sepa direct debit danske online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for the sepa direct debit danske in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your sepa direct debit danske in seconds.

Can I edit sepa direct debit danske on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign sepa direct debit danske on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is sepa direct debit danske?

SEPA Direct Debit Danske is a payment method that allows creditors to collect funds directly from the bank accounts of customers within the SEPA (Single Euro Payments Area) countries using standardized procedures.

Who is required to file sepa direct debit danske?

Any business or organization that wants to collect payments directly from the bank accounts of customers within SEPA countries can file for SEPA Direct Debit Danske.

How to fill out sepa direct debit danske?

To fill out SEPA Direct Debit Danske, the creditor needs to provide the necessary information about the transaction, including the debtor's bank details, the amount to be collected, and the due date.

What is the purpose of sepa direct debit danske?

The purpose of SEPA Direct Debit Danske is to simplify and streamline the process of collecting payments from customers across different SEPA countries, making it more efficient and cost-effective.

What information must be reported on sepa direct debit danske?

The information that must be reported on SEPA Direct Debit Danske includes the creditor's identifying information, the debtor's bank details, the amount to be collected, the due date, and the purpose of the payment.

Fill out your sepa direct debit danske online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sepa Direct Debit Danske is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.