Get the free Form 8390 - stuff mit

Show details

This document provides instructions for life insurance companies to report their earnings rates for tax purposes, detailing filing requirements, penalties for non-compliance, and specific guidance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 8390 - stuff

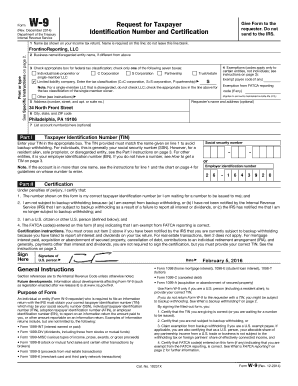

Edit your form 8390 - stuff form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8390 - stuff form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 8390 - stuff online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 8390 - stuff. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8390 - stuff

How to fill out Form 8390

01

Obtain Form 8390 from the official IRS website or relevant tax authority.

02

Read the instructions carefully at the beginning of the form.

03

Fill out your personal information in Section 1, including your name, address, and Social Security number.

04

Proceed to Section 2 and provide details about the specific tax credit you are claiming.

05

In Section 3, include any required financial information or documentation as indicated.

06

Review all information for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed form to the appropriate address provided in the instructions.

Who needs Form 8390?

01

Individuals who are claiming the specific tax credit associated with Form 8390.

02

Taxpayers who have a qualifying circumstance as outlined by the IRS.

03

People who have received a notice requiring them to submit Form 8390 for tax compliance.

Fill

form

: Try Risk Free

People Also Ask about

What is form 8996 used for?

A corporation or partnership uses Form 8996 to certify that it is organized to invest in QOZ property. In addition, a corporation or partnership files Form 8996 annually to report that the QOF meets the 90% investment standard of section 1400Z-2 or to figure the penalty if it fails to meet the investment standard.

What do you do with form 8986?

Form 8986 is used by the audited partnership to push out imputed underpayments to its partners.

What is form 8894?

Form 8894 is used only by small partnerships revoking a prior election to be governed by the unified audit and litigation procedures as set forth in section 6231(a)(1)(B)(ii).

Who should fill out form 8995?

Form 8995 is the IRS tax form that owners of pass-through entities — sole proprietorships, partnerships, LLCs, or S corporations — use to take the qualified business income (QBI) deduction, also known as the pass-through or Section 199A deduction.

What is IRS Form 1099r used for?

IRS Form 1099-R provides information on benefits paid and amounts withheld for federal income tax. A copy of the form should be included with federal income tax filings if any federal tax is withheld. PERS will report the same information to the IRS for each retiree who is sent a form.

What is form 8896?

Qualified small business refiners use this form to claim the low sulfur diesel fuel production credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 8390?

Form 8390 is a tax form used by corporations and partnerships to report certain foreign transactions and provide information regarding foreign corporations.

Who is required to file Form 8390?

Corporations and partnerships that engage in specific foreign transactions or hold interests in foreign corporations are required to file Form 8390.

How to fill out Form 8390?

To fill out Form 8390, taxpayers need to provide specific details about the foreign transactions, including identification information of the entity, descriptions of the transactions, and relevant financial data.

What is the purpose of Form 8390?

The purpose of Form 8390 is to ensure compliance with U.S. tax laws regarding foreign investments and to report foreign income, expenses, and other related financial information.

What information must be reported on Form 8390?

Information that must be reported on Form 8390 includes the name and address of the foreign corporation, details about the ownership interest, income from the foreign corporation, and any taxes paid to foreign governments.

Fill out your form 8390 - stuff online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8390 - Stuff is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.