Get the free Donation only - St. Vincent's Hospital Westchester - stvincentswestchester

Show details

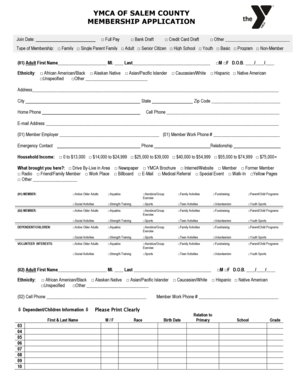

SPONSORSHIPS Date LEADING $10,000 Saturday, May 7, 2016, EVENT $5,000 TITLE $2,500 Time 8:00 a.m. Checking GOLD $1,000 9:00 a.m. Start SILVER $500 BRONZE $250 Location SIGN $125 St Vincent's Westchester

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donation only - st

Edit your donation only - st form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donation only - st form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit donation only - st online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit donation only - st. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donation only - st

How to fill out donation only - st?

01

Visit the website or platform that is accepting the donations.

02

Look for the "donation only - st" option or category.

03

Click on the option and fill out the necessary information requested, such as your name, contact details, and the amount you wish to donate.

04

If there are any additional fields or questions, provide the required information accurately.

05

Review all the entered information to ensure its accuracy and completeness.

06

If there are any terms and conditions or privacy policies, make sure to read and understand them before proceeding.

07

If prompted, choose your preferred payment method and provide the necessary details, such as credit card information or bank account details.

08

Double-check all the entered payment information to avoid any errors or discrepancies.

09

After completing the form, submit your donation by clicking the designated button or option.

10

You may be provided with a confirmation message or email indicating the success of your donation.

Who needs donation only - st?

01

Individuals or organizations who want to contribute to a specific cause or support a specific initiative or project may opt for the donation only - st option.

02

Donors who prioritize giving without receiving any physical goods or services in return may prefer the donation only - st option.

03

Non-profit organizations, charities, or crowdfunding platforms may offer the donation only - st option to attract philanthropic individuals or businesses willing to make financial contributions without expecting any tangible benefits.

04

Fundraising campaigns, disaster relief efforts, or community-driven projects may specifically request donation only - st to ensure that all contributed funds go directly towards the intended purpose without overhead costs or administrative fees.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is donation only - st?

Donation only - st is a tax form used by organizations that only receive donations and do not generate any other income.

Who is required to file donation only - st?

Organizations that solely rely on donations for income are required to file donation only - st.

How to fill out donation only - st?

To fill out donation only - st, organizations must provide details of all donations received, along with any other relevant financial information.

What is the purpose of donation only - st?

The purpose of donation only - st is to report the donations received by an organization and ensure compliance with tax regulations.

What information must be reported on donation only - st?

On donation only - st, organizations must report details of all donations received, including the amount, date, and source of the donation.

How can I send donation only - st to be eSigned by others?

Once your donation only - st is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete donation only - st online?

pdfFiller has made it simple to fill out and eSign donation only - st. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an eSignature for the donation only - st in Gmail?

Create your eSignature using pdfFiller and then eSign your donation only - st immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your donation only - st online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donation Only - St is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.