Get the free RESIDENTIAL MORTGAGE LICENSE APPLICATION - mortgage nationwidelicensingsystem

Show details

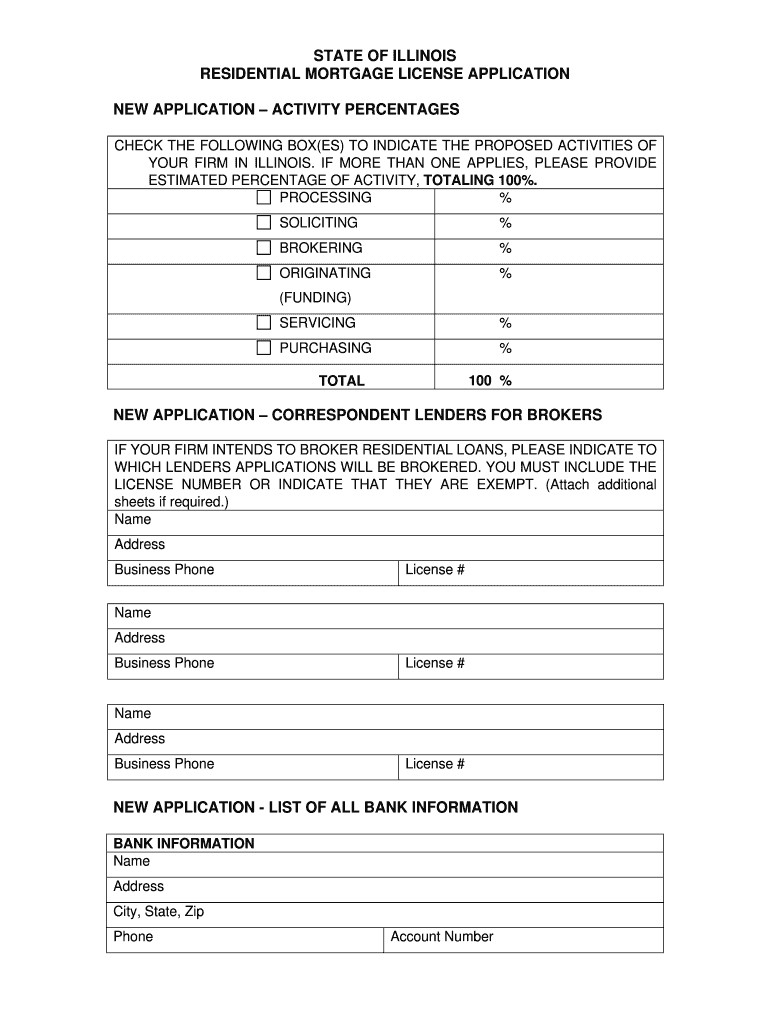

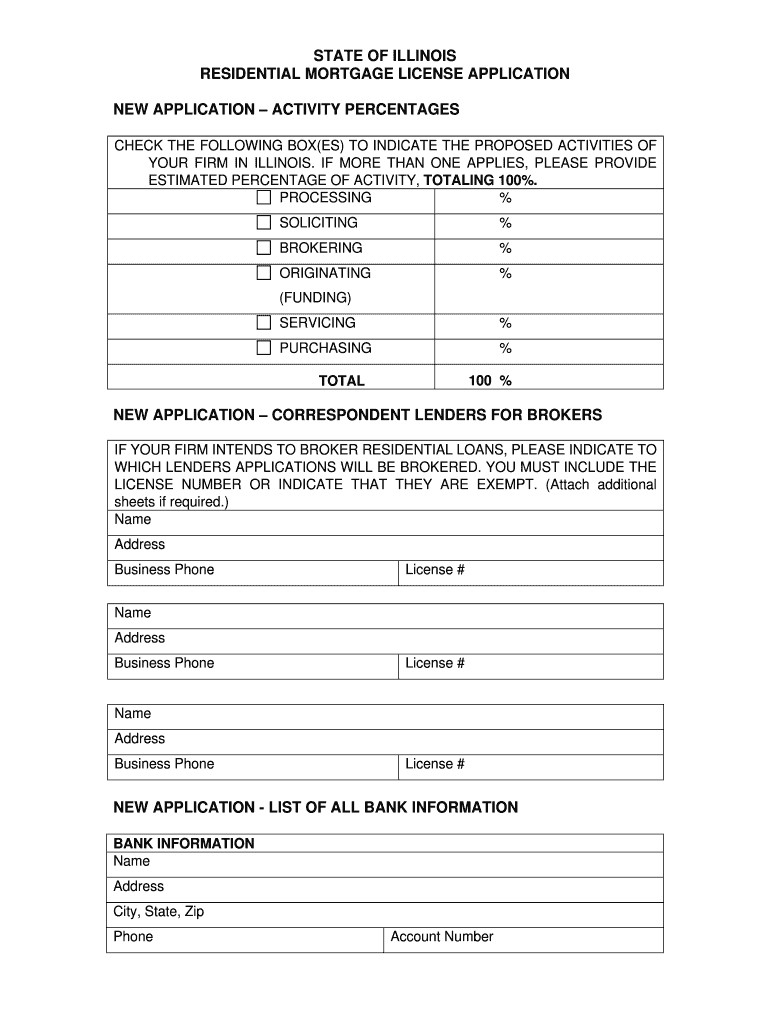

This document is an application for obtaining a residential mortgage license in the State of Illinois, detailing the proposed activities of the firm, correspondent lenders for brokers, and bank information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign residential mortgage license application

Edit your residential mortgage license application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your residential mortgage license application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing residential mortgage license application online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit residential mortgage license application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out residential mortgage license application

How to fill out RESIDENTIAL MORTGAGE LICENSE APPLICATION

01

Gather all necessary documentation such as identification, financial statements, and proof of residency.

02

Visit the licensing authority's website to obtain the Residential Mortgage License Application form.

03

Fill out the application form completely, providing accurate and up-to-date information.

04

Include any required fees along with your application as specified by the licensing authority.

05

Submit the application form and any additional documentation either online or via mail as directed.

Who needs RESIDENTIAL MORTGAGE LICENSE APPLICATION?

01

Individuals or businesses planning to offer residential mortgage loans.

02

Real estate professionals, including loan officers and mortgage brokers, who are involved in the lending process.

03

Anyone looking to operate as a residential mortgage lender in their state or region.

Fill

form

: Try Risk Free

People Also Ask about

Is it worth it to get a mortgage license?

Becoming a Mortgage Loan Officer can be a great career choice for professionals looking to interact with clients, unlock high-earning potential, and enjoy solid job security.

How much commission do loan officers make on a $500,000 loan?

The typical MLO is paid 1% of the loan amount in commission. On a $500,000 loan, a commission of $5,000 is paid to the brokerage, and the MLO will receive the percentage they have negotiated. If the portion of the commission for the MLO is 80%, they will receive $4,000 of the $5,000 brokerage percentage fee.

How to get a mortgage license in CA?

To do business as a mortgage loan originator, you need to: Apply for an NMLS account and ID number. Complete your California mortgage Pre-license Education ("PE"). Pass a licensing exam. Apply for your California mortgage license though the NMLS. Complete background checks and pay all fees.

Is getting your mortgage license hard?

Mortgage Loan Originators must act ethically, and understand the business for both clients and larger financial systems as a whole. With that said, the NMLS licensing exam is purposely designed to be difficult. Did you know that only 56% of NMLS test takers pass the exam on their first attempt?

How fast can you be approved for a mortgage?

The mortgage approval process typically takes 30-45 days, so it's smart to start it early in your home-buying journey. If you're denied, you can work to improve your credit and reduce debt, or you could apply for a different home loan.

How fast can you get your mortgage license?

Typically, it takes 45 days to complete the necessary requirements to become a licensed mortgage loan officer. However, since each state has unique requirements, this may vary and be contingent on your ability to pass required examinations and background checks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RESIDENTIAL MORTGAGE LICENSE APPLICATION?

The Residential Mortgage License Application is a formal request to obtain a license that allows individuals or entities to conduct residential mortgage lending activities.

Who is required to file RESIDENTIAL MORTGAGE LICENSE APPLICATION?

Individuals or businesses that wish to engage in the business of residential mortgage lending must file a Residential Mortgage License Application.

How to fill out RESIDENTIAL MORTGAGE LICENSE APPLICATION?

To fill out the Residential Mortgage License Application, applicants must provide accurate personal and business information, documentation of financial stability, and any required disclosures as outlined by regulatory authorities.

What is the purpose of RESIDENTIAL MORTGAGE LICENSE APPLICATION?

The purpose of the Residential Mortgage License Application is to ensure that mortgage lenders meet regulatory standards and are qualified to operate within the residential lending industry.

What information must be reported on RESIDENTIAL MORTGAGE LICENSE APPLICATION?

The application typically requires information such as the applicant's identity, business structure, financial statements, credit history, and any prior regulatory actions or bankruptcy filings.

Fill out your residential mortgage license application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Residential Mortgage License Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.