Get the free MORTGAGE BROKER/ MORTGAGE LOAN ORIGINATOR BOND - mortgage nationwidelicensingsystem

Show details

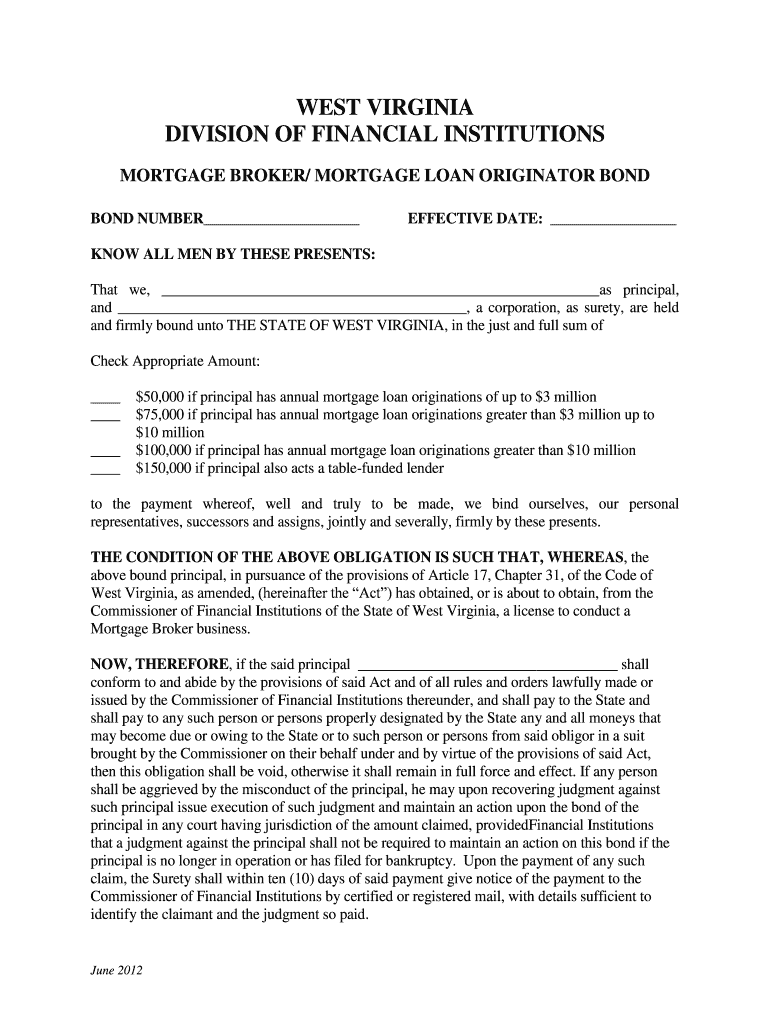

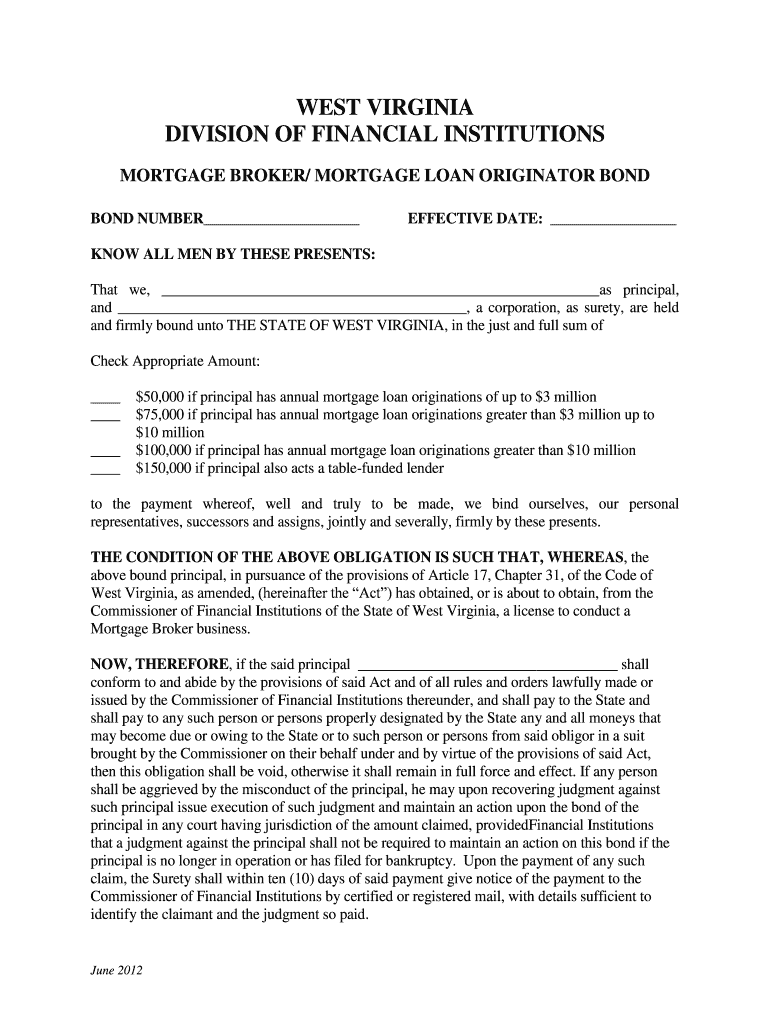

This document serves as a bond for mortgage brokers and mortgage loan originators in West Virginia, securing the payment of moneys owed to the state or designated persons, and ensuring compliance

We are not affiliated with any brand or entity on this form

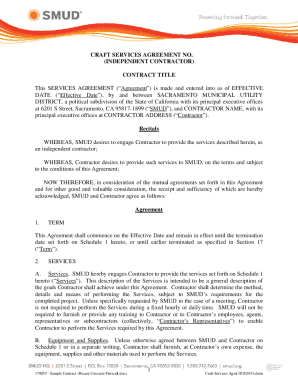

Get, Create, Make and Sign mortgage broker mortgage loan

Edit your mortgage broker mortgage loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage broker mortgage loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage broker mortgage loan online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mortgage broker mortgage loan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage broker mortgage loan

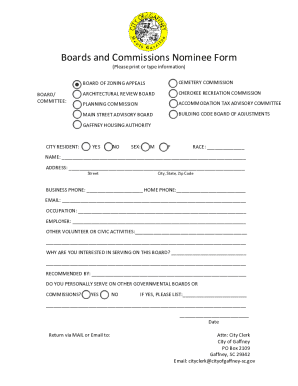

How to fill out MORTGAGE BROKER/ MORTGAGE LOAN ORIGINATOR BOND

01

Obtain the bond form from your state’s regulatory agency or a bonding company.

02

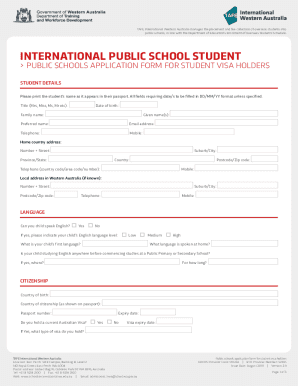

Fill in your personal information, including your name, address, and license number.

03

Include information about the bond amount required by your state.

04

Choose a surety company that is licensed to operate in your state.

05

Complete the surety bond application provided by the surety company.

06

Provide any necessary financial documents or credit information required by the surety company.

07

Pay the premium for the bond, which is typically a percentage of the total bond amount.

08

Review the bond details carefully before signing it.

09

Submit the completed bond to your state’s regulatory agency as per their submission guidelines.

10

Keep a copy of the bond for your records.

Who needs MORTGAGE BROKER/ MORTGAGE LOAN ORIGINATOR BOND?

01

Mortgage brokers who facilitate home loans between borrowers and lenders.

02

Mortgage loan originators who assist in the application and approval process for those loans.

03

Individuals and businesses that must comply with state regulations concerning mortgage lending.

Fill

form

: Try Risk Free

People Also Ask about

How do I introduce myself as a mortgage broker?

Example Script for a Client Meeting: "Good morning/afternoon, I'm [Name], and I've been a mortgage broker with [Company] for [X years], focusing on [area of specialization]. I understand you're looking into [buying your first home/refinancing]. How can I assist you with that today?"

What is the difference between a loan officer and a loan originator?

The easiest way to remember the difference is that loan officers are almost always people while loan originators can be people or financial institutions. Another way to think of it is that a loan officer could be employed by a loan originator.

Is a mortgage loan a bond?

A mortgage bond is an investment backed by a pool of mortgages that a lender trades to another party. A mortgage bond is different from a mortgage loan, which is an agreement between a lender and a borrower that allows a borrower to own a property they could not purchase outright.

Is there a difference between a loan officer and a mortgage broker?

A loan officer works for a bank, a credit union, or a mortgage lender and generally offers only the programs and mortgage rates available from that institution. A mortgage broker works on a borrower's behalf to find the best rate and loan from various institutions.

What are the duties of a mortgage loan originator?

MLOs are responsible for securing loan file financial documents from potential borrowers, analyzing the loan file data, and consulting with prospective borrowers to educate them on varying loan products. Aside from these main tasks, they are also expected to: Collect and organize client's financial information.

What is a mortgage loan originator?

A mortgage loan originator (MLO) is an individual who, for compensation or gain, or in the expectation of compensation or gain, takes a residential mortgage loan application or offers or negotiates terms of a residential mortgage loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MORTGAGE BROKER/ MORTGAGE LOAN ORIGINATOR BOND?

A Mortgage Broker/Mortgage Loan Originator Bond is a type of surety bond required by state regulatory authorities for individuals or companies engaged in mortgage brokerage or loan origination. It acts as a financial guarantee that the bondholder will comply with relevant laws and regulations.

Who is required to file MORTGAGE BROKER/ MORTGAGE LOAN ORIGINATOR BOND?

Individuals or businesses acting as mortgage brokers or loan originators are typically required to file a Mortgage Broker/Mortgage Loan Originator Bond as part of their licensing requirements in many states.

How to fill out MORTGAGE BROKER/ MORTGAGE LOAN ORIGINATOR BOND?

To fill out the bond, the applicant must provide information including their name, address, the name of the bonding company, the bond amount, and any other required details stipulated by the state regulatory agency.

What is the purpose of MORTGAGE BROKER/ MORTGAGE LOAN ORIGINATOR BOND?

The purpose of the bond is to protect consumers by ensuring that mortgage brokers and loan originators adhere to ethical practices and comply with all applicable laws. It provides financial recourse for individuals harmed by the broker's or originator's misconduct or negligence.

What information must be reported on MORTGAGE BROKER/ MORTGAGE LOAN ORIGINATOR BOND?

Typically, required information includes the names and addresses of the principal (broker/originator), the surety company, the bond amount, the effective date, and the terms of the bond. Some jurisdictions may have additional reporting requirements.

Fill out your mortgage broker mortgage loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Broker Mortgage Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.