Get the free NEW ZEALAND BUSINESS LAW SEMINAR PROGRAMME REGISTRATION FORM

Show details

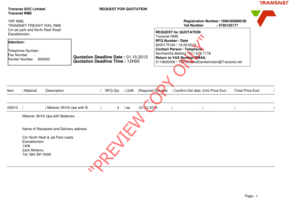

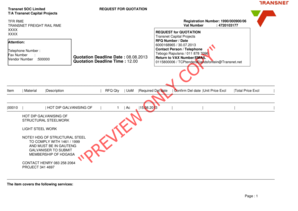

NEW ZEALAND BUSINESS LAW SEMINAR Program REGISTRATION FORM Friday 21 September 2012 Kennedy Room, Conrad Hong Kong Quite Partners is a New Zealand corporate law firm that specializes in assisting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new zealand business law

Edit your new zealand business law form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new zealand business law form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new zealand business law online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit new zealand business law. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new zealand business law

How to fill out new zealand business law:

01

Research and understand the legal requirements: Familiarize yourself with the various laws and regulations that apply to businesses in New Zealand. This includes studying the Companies Act, contract law, employment law, tax obligations, and any industry-specific regulations.

02

Seek professional advice: It is recommended to consult with a lawyer or a legal expert who specializes in New Zealand business law. They can provide guidance on compliance, contractual issues, intellectual property rights, and other legal matters.

03

Register your business: To operate legally in New Zealand, you need to register your business with the appropriate authorities. This may involve registering a company, obtaining necessary licenses or permits, and complying with any industry-specific requirements.

04

Set up legal contracts: Ensure that you have legally binding contracts in place for various business interactions. This includes contracts with suppliers, clients, employees, and any other relevant parties. These contracts should protect your rights, outline obligations, and clearly define terms and conditions.

05

Comply with taxation regulations: Familiarize yourself with New Zealand's tax laws and comply with your tax obligations. This includes registering for Goods and Services Tax (GST) if applicable, keeping organized financial records, filing tax returns, and paying taxes on time.

06

Protect intellectual property: If your business involves unique logos, trademarks, patents, or copyrights, it is crucial to understand how to protect your intellectual property rights. Consult with an intellectual property lawyer to ensure your creations are properly protected.

07

Maintain compliance with employment laws: New Zealand has specific laws governing employment, including minimum wage requirements, employment agreements, and health and safety regulations. Familiarize yourself with these laws to ensure you maintain compliance in your business operations.

08

Stay updated on legal changes: Laws and regulations can evolve over time. It is essential to stay updated on any changes that may impact your business. Regularly review government websites and consult with legal experts to ensure ongoing compliance.

Who needs New Zealand business law:

01

Business owners: Any individual planning to establish or run a business in New Zealand needs to understand and comply with New Zealand business law. This includes both local entrepreneurs and foreign investors.

02

Entrepreneurs and startups: Those looking to start a new venture or launch a startup in New Zealand must navigate the legal landscape to operate legally and protect their interests.

03

Employers and employees: Understanding employment laws is crucial for both employers and employees to ensure fair treatment, proper representation, and compliance with legal requirements.

04

Investors and shareholders: Individuals or entities looking to invest in New Zealand businesses or become shareholders should be aware of the legal framework surrounding business investments and shareholder rights.

05

Professionals and consultants: Lawyers, accountants, business consultants, and other professionals who provide services to businesses in New Zealand need to have a comprehensive understanding of the country's business laws to offer accurate advice and guidance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is new zealand business law?

New Zealand business law refers to the legal framework that governs businesses and commercial transactions in New Zealand.

Who is required to file new zealand business law?

All businesses operating in New Zealand are required to comply with New Zealand business law.

How to fill out new zealand business law?

New Zealand business law can be filled out by following the guidelines provided by the New Zealand government or seeking the assistance of a legal professional.

What is the purpose of new zealand business law?

The purpose of New Zealand business law is to regulate and protect businesses, consumers, and the economy in New Zealand.

What information must be reported on new zealand business law?

Information such as financial reports, business structure, ownership details, and tax information must be reported on New Zealand business law.

How can I send new zealand business law for eSignature?

Once you are ready to share your new zealand business law, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for the new zealand business law in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your new zealand business law in minutes.

How do I edit new zealand business law straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing new zealand business law right away.

Fill out your new zealand business law online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Zealand Business Law is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.