Get the free CHAPTER 11 ACCOUTING PROCEDURE FOR LUMP-SUM

Show details

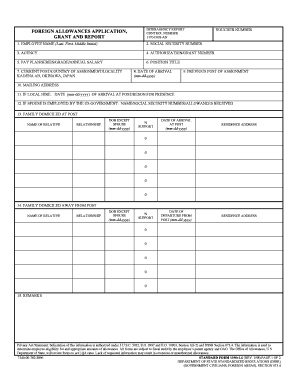

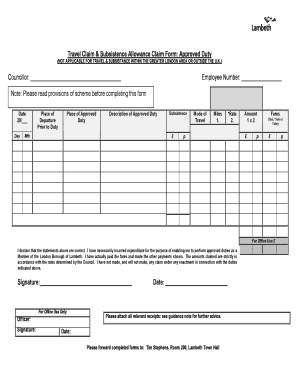

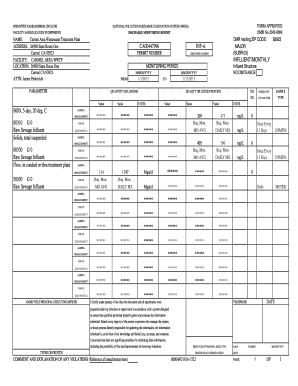

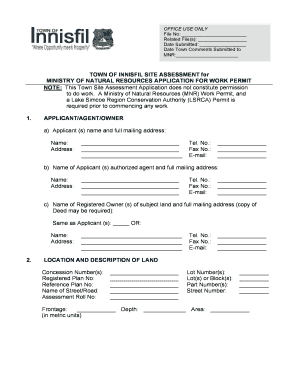

This document outlines the accounting procedures and guidelines for handling lump-sum contracts, including payment processes, certification requirements, and the use of specific billing forms.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 11 accouting procedure

Edit your chapter 11 accouting procedure form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 11 accouting procedure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing chapter 11 accouting procedure online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit chapter 11 accouting procedure. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 11 accouting procedure

How to fill out chapter 11 accounting procedure:

01

Start by familiarizing yourself with the specific requirements and guidelines outlined in the chapter 11 accounting procedure. Understand the purpose of the procedure and the steps involved in the accounting process for chapter 11 bankruptcy.

02

Gather all the necessary financial documentation and records related to the bankruptcy case. This may include income statements, balance sheets, cash flow statements, creditor lists, and any other relevant financial information.

03

Carefully review and analyze these financial documents to identify any discrepancies, errors, or inconsistencies. Ensure that all the information is accurate and up-to-date.

04

Follow the prescribed accounting procedures outlined in chapter 11. This typically involves categorizing and classifying transactions, recording them in the appropriate accounts, and ensuring that they align with the bankruptcy laws and regulations.

05

Prepare and maintain detailed reports to document the financial status and transactions of the bankrupt entity. These reports may include monthly financial statements, cash flow projections, budget analyses, and other relevant financial information.

06

Communicate and liaise with key stakeholders involved in the bankruptcy process, such as attorneys, creditors, and court-appointed officials. Provide them with accurate financial information and address any inquiries or concerns they may have.

07

Monitor and track the progress of the bankruptcy case by regularly reconciling and reviewing financial records. This will help identify any discrepancies or deviations from the established accounting procedures.

08

Seek professional assistance or consult with bankruptcy experts if needed. Chapter 11 accounting procedures can be complex, and it is important to ensure compliance with all legal and financial requirements.

Who needs chapter 11 accounting procedure?

01

Companies or organizations that have filed for chapter 11 bankruptcy protection may need to utilize the chapter 11 accounting procedure. This includes corporations, partnerships, and other business entities facing financial distress and seeking to restructure their debts.

02

Creditors and lenders who are involved in the bankruptcy case may also need to understand and follow the chapter 11 accounting procedure. This helps them assess the financial condition of the bankrupt entity and make informed decisions regarding debt recovery.

03

Legal professionals, such as bankruptcy lawyers and trustees, require knowledge of the chapter 11 accounting procedure to effectively represent their clients' interests and ensure compliance with bankruptcy laws.

04

Court-appointed officials, such as bankruptcy judges and examiners, rely on the chapter 11 accounting procedure to evaluate the financial condition of the debtor and oversee the bankruptcy proceedings.

05

Investors, shareholders, and other stakeholders of the bankrupt entity may also have an interest in understanding the chapter 11 accounting procedure. This helps them assess the viability and potential outcomes of the bankruptcy case.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send chapter 11 accouting procedure to be eSigned by others?

Once you are ready to share your chapter 11 accouting procedure, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I edit chapter 11 accouting procedure on an iOS device?

Create, modify, and share chapter 11 accouting procedure using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How can I fill out chapter 11 accouting procedure on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your chapter 11 accouting procedure by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is chapter 11 accouting procedure?

Chapter 11 accounting procedure refers to the financial reporting and disclosure requirements outlined in the Chapter 11 bankruptcy process.

Who is required to file chapter 11 accouting procedure?

Any business or individual that files for Chapter 11 bankruptcy is required to follow the accounting procedures outlined in the process.

How to fill out chapter 11 accouting procedure?

Filling out the Chapter 11 accounting procedure involves preparing financial statements, disclosing financial information, and adhering to the reporting requirements outlined by the bankruptcy court and relevant accounting standards.

What is the purpose of chapter 11 accouting procedure?

The purpose of the Chapter 11 accounting procedure is to provide transparency and accurate financial information to the bankruptcy court, creditors, and other stakeholders involved in the bankruptcy process.

What information must be reported on chapter 11 accouting procedure?

The specific information to be reported on the Chapter 11 accounting procedure may vary, but typically includes financial statements, disclosures of assets and liabilities, income statements, and other relevant financial information.

Fill out your chapter 11 accouting procedure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 11 Accouting Procedure is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.