How to fill out

donation pursuant to the

Point by point instructions for filling out a donation pursuant to the:

01

Start by gathering all the necessary information. This includes the recipient's name, address, and contact details, as well as any specific instructions provided by the organization or individual receiving the donation.

02

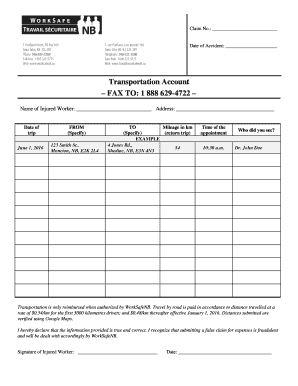

Next, determine the nature of the donation you intend to make. It could be a monetary donation, where you will need to specify the amount and any accompanying check or payment details. Alternatively, it could be a donation of goods or services, wherein you should include a detailed description of the items or services being donated.

03

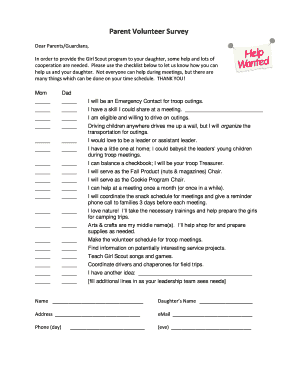

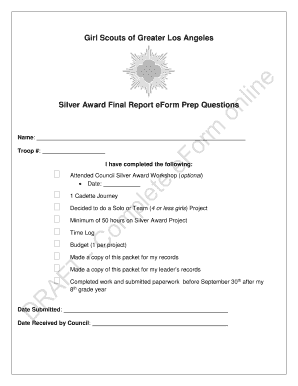

Ensure you have the appropriate donation form or document. This may be provided by the organization or individual receiving the donation, or you can find a generic donation form online. These forms typically require you to fill in your personal details, such as your name, address, and contact information.

04

Follow the instructions on the donation form carefully. This may include providing your tax identification number if applicable, as well as indicating any specific designation or purpose for the donation, such as funding a particular program or event.

05

If you are making a monetary donation, ensure you have the necessary financial information to complete the donation. This may include your bank account details, payment method, or credit/debit card information.

06

Review all the information you have entered on the donation form for accuracy. Double-check the recipient's details, the donation amount or items being donated, and any additional information required.

07

Once you have reviewed and verified all the information, sign and date the donation form. If there are any witnesses required for the donation, ensure they also sign and provide their contact information.

Who needs donation pursuant to the?

01

Individuals or families facing financial hardships or personal crises may require donations to meet their basic needs or specific expenses.

02

Nonprofit organizations, charities, or community-based initiatives often rely on donations to fund their programs, support their causes, and help those they serve.

03

Educational institutions may require donations to support scholarships, infrastructure development, or specific educational programs.

04

Hospitals, medical research centers, or healthcare organizations may seek donations to fund medical advancements, provide treatment to disadvantaged individuals, or support ongoing research efforts.

05

Disaster relief organizations often depend on donations to provide immediate assistance, supplies, and support to communities affected by natural disasters or humanitarian crises.

In summary, filling out a donation pursuant to the requires gathering the necessary information, determining the nature of the donation, and carefully following the instructions on the donation form. Donations can be needed by individuals, nonprofit organizations, educational institutions, healthcare organizations, and disaster relief organizations, among others.