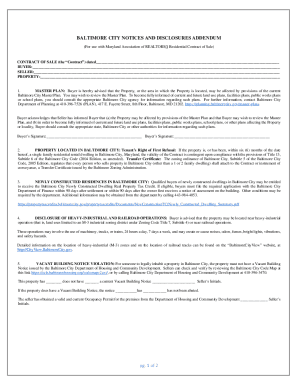

Canada University of Windsor Wire Transfer Request Form 2012-2026 free printable template

Show details

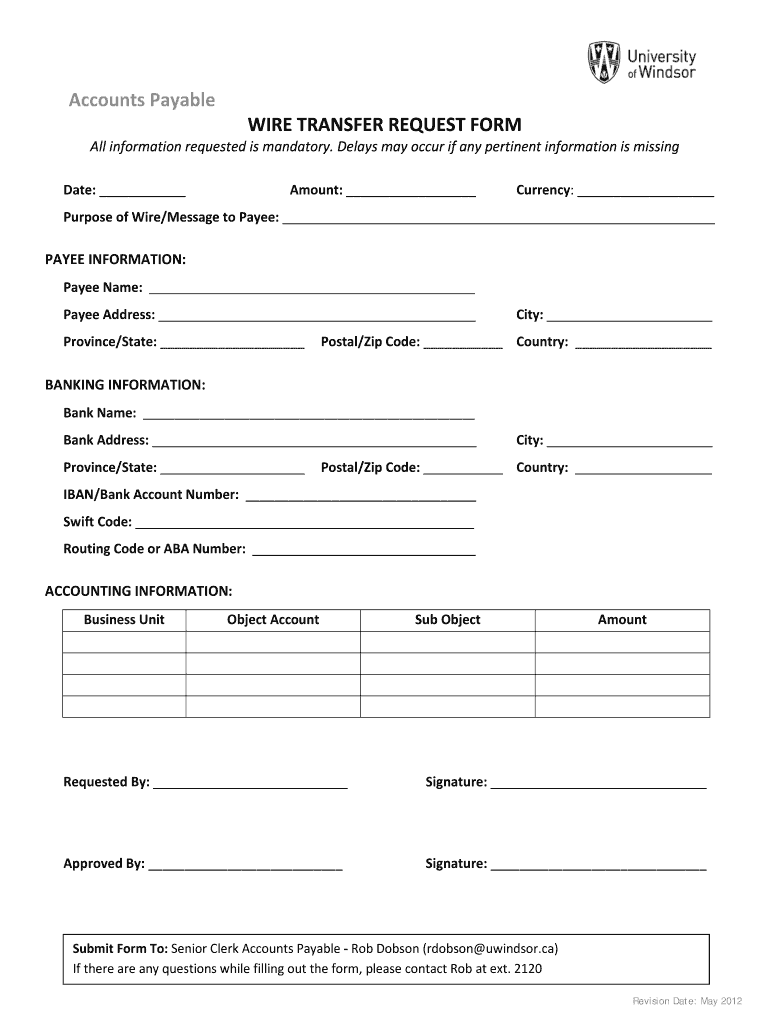

Accounts Payable WIRE TRANSFER REQUEST FORM All information requested is mandatory. Delays may occur if any pertinent information is missing Date: Amount: Currency: Purpose of Wire/Message to Payee:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ca 2012 transfer form

Edit your canada 2012 payable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ca 2012 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2012 wire payable online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2012 windsor form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ca university 2012 form

How to fill out Canada University of Windsor Wire Transfer Request Form

01

Download the Canada University of Windsor Wire Transfer Request Form from the university's official website.

02

Fill out the personal information section with your full name, student ID, and contact details.

03

Complete the section regarding the amount you wish to transfer and the purpose of the funds.

04

Provide the bank details including the name of the bank, account number, and any relevant routing information.

05

Review the form for accuracy and completeness.

06

Sign and date the form to confirm that all information is correct.

07

Submit the completed form via email or in person as directed by the university's instructions.

Who needs Canada University of Windsor Wire Transfer Request Form?

01

Current students who are making tuition fee payments.

02

International students requiring to transfer funds from abroad.

03

Any prospective students submitting application fees or deposits.

Fill

ca university 2012 request form

: Try Risk Free

People Also Ask about canada 2012 transfer

What is a W 2 form in Canada?

The W-2 reports how much you earned from your employer as well as how much tax was withheld on your behalf during the tax year. You should consider reviewing your tax withholding annually to ensure you withhold the correct amount of money from your paychecks.

Where do I get Canadian tax forms?

view, download and print the package at canada.ca/taxes-general-package. order the package online at canada.ca/get-cra-forms. order a package by calling the CRA at 1-855-330-3305 (be ready to give your social insurance number)

Can I still file my 2012 tax return?

You can file back taxes for any past year, but the IRS usually considers you in good standing if you have filed the last six years of tax returns. If you qualified for federal tax credits or refunds in the past but didn't file tax returns, you may be able to collect the money by filing back taxes.

Can I efile a 2012 tax return in Canada?

Mandatory electronic filing applies to the filing of tax returns for the 2012 and later tax years. As a tax preparer, you will need to register with the CRA in order to be allowed to file tax returns electronically. This must be done at least 30 days before the service is required.

Which tax forms do I need to fill out Canada?

Canadian tax checklist. T4 slips (Employment income) Employment insurance benefits (T4A or T4E) COVID-19 relief payments or repayments (T4A) Interest, dividends, mutual funds (T3, T5, T5008) T2202 Tuition and Enrollment Certificate. Old Age Security and CPP benefits (T4A-OAS, T4AP) Other pensions and annuities (T4A)

How far back can you efile tax returns in Canada?

The CRA EFILE service allows you to electronically transmit T1 tax returns of prior years, up to a maximum of three preceding years, using your current-year transmission credentials. However, prior year T1 returns (2015, 2016 and 2017) should be transmitted before the 2018 T1 returns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Canada University of Windsor Wire Transfer Request to be eSigned by others?

Once your Canada University of Windsor Wire Transfer Request is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit Canada University of Windsor Wire Transfer Request straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing Canada University of Windsor Wire Transfer Request, you can start right away.

How do I edit Canada University of Windsor Wire Transfer Request on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as Canada University of Windsor Wire Transfer Request. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is Canada University of Windsor Wire Transfer Request Form?

The Wire Transfer Request Form is a document used by the University of Windsor in Canada to authorize and facilitate the transfer of funds electronically.

Who is required to file Canada University of Windsor Wire Transfer Request Form?

Students, applicants, or any individuals or organizations needing to send funds to the University of Windsor are required to file this form.

How to fill out Canada University of Windsor Wire Transfer Request Form?

To fill out the form, provide necessary details such as the sender's information, recipient's information, amount to be transferred, and the purpose of the transfer, and ensure all required fields are completed.

What is the purpose of Canada University of Windsor Wire Transfer Request Form?

The purpose of the form is to ensure the proper processing and tracking of wire transfers to the University, providing a clear request for payment associated with tuition, fees, or other financial obligations.

What information must be reported on Canada University of Windsor Wire Transfer Request Form?

The form must include the sender's name, address, account details, amount being transferred, receiver's details, purpose of the transfer, and any reference number if applicable.

Fill out your Canada University of Windsor Wire Transfer Request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada University Of Windsor Wire Transfer Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.