Get the free Medical Savings Account MSA Claim Form - ironworkers527

Show details

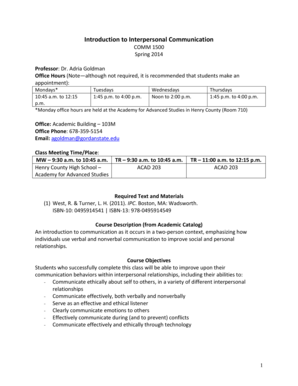

SHIPMENT LOCAL 527 BENEFIT FUND 2945 JANESVILLE ROAD PITTSBURGH, PA 15216 ×412× 3416183 Toll Free # 1 ×800× 8587870 MEDICAL SAVINGS ACCOUNT (MSA) CLAIM FORM INSTRUCTIONS: 1. Please print and include

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign medical savings account msa

Edit your medical savings account msa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your medical savings account msa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing medical savings account msa online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit medical savings account msa. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out medical savings account msa

How to fill out medical savings account (MSA):

01

Gather necessary documents: Before filling out the MSA application, make sure you have the required documents, such as your identification, insurance policy information, and any other relevant paperwork.

02

Understand the eligibility criteria: Familiarize yourself with the eligibility requirements for an MSA. Typically, individuals must have a high-deductible health insurance plan (HDHP) and cannot be enrolled in any other non-HDHP coverage or Medicare.

03

Complete the application form: Fill out the MSA application form accurately, providing your personal information, including your name, address, social security number, and contact details.

04

Choose a financial institution: Select a financial institution that offers MSA accounts. Research different providers to find one that suits your preferences and meets all the necessary regulations.

05

Fund your MSA: Decide how much money you want to contribute to your MSA and transfer the funds to the account. Be sure to adhere to the annual contribution limits set by the IRS.

06

Keep records of qualified medical expenses: Maintain organized records of all eligible medical expenses associated with your HDHP. This will help when it's time to withdraw funds for medical purposes and provide documentation for tax purposes.

07

Withdraw funds when necessary: When you need to pay for eligible medical expenses, submit a withdrawal request to your MSA provider. Ensure that you follow their specific procedures and provide all required documentation.

Who needs medical savings account (MSA)?

01

Individuals with high-deductible health insurance plans (HDHP): MSAs are designed for individuals who have an HDHP and want to save and pay for medical expenses without incurring taxes on the funds used.

02

Self-employed individuals: Those who are self-employed and have an HDHP can benefit from MSAs as a means of tax-free savings for healthcare expenses.

03

Individuals seeking greater control over healthcare spending: For individuals who want more control over the distribution and allocation of their healthcare funds, an MSA can offer greater flexibility and choice.

04

Those interested in tax advantages: MSAs offer tax advantages, as contributions to the account are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

05

Individuals who anticipate high medical expenses: If you anticipate having significant healthcare costs throughout the year, an MSA can provide a tailored savings approach to cover those expenses with pre-tax dollars.

In conclusion, filling out an MSA involves gathering necessary documents, understanding eligibility criteria, completing the application form, choosing a financial institution, funding the account, maintaining records of qualified medical expenses, and making withdrawals when needed. MSAs are suitable for those with HDHPs, self-employed individuals, individuals seeking more control over healthcare spending, those interested in tax advantages, and individuals with anticipated high medical expenses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is medical savings account msa?

A medical savings account (MSA) is a type of tax-advantaged savings account that is designed to help individuals and families save money for medical expenses.

Who is required to file medical savings account msa?

Individuals who have a high-deductible health plan and meet certain other requirements are eligible to open and contribute to a medical savings account.

How to fill out medical savings account msa?

To fill out a medical savings account (MSA), individuals should follow the instructions provided by their financial institution or tax advisor.

What is the purpose of medical savings account msa?

The purpose of a medical savings account (MSA) is to help individuals save money for medical expenses, while also taking advantage of certain tax benefits.

What information must be reported on medical savings account msa?

When filing a medical savings account (MSA), individuals must report information such as their contributions, withdrawals, and account balance.

How can I modify medical savings account msa without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your medical savings account msa into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I get medical savings account msa?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific medical savings account msa and other forms. Find the template you want and tweak it with powerful editing tools.

How do I fill out medical savings account msa on an Android device?

Use the pdfFiller app for Android to finish your medical savings account msa. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your medical savings account msa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Medical Savings Account Msa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.