Get the free Importance of Financial Benchmarking - Analytix Solutions

Show details

Click Here to view it online. ANALYTIC SOLUTIONS The Company that CPA's Recommend Importance of Financial Benchmarking Many business owners employ the strategy of benchmarking to assess the health

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign importance of financial benchmarking

Edit your importance of financial benchmarking form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your importance of financial benchmarking form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing importance of financial benchmarking online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit importance of financial benchmarking. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out importance of financial benchmarking

How to fill out the importance of financial benchmarking:

01

Understand the purpose: To accurately fill out the importance of financial benchmarking, it is crucial to have a clear understanding of why it is necessary in the first place. Financial benchmarking is used to compare an organization's financial performance with industry standards or competitors. It helps identify areas where improvement is needed, allows organizations to set realistic goals, and provides insights into how the business is performing in relation to others in the industry.

02

Gather relevant financial data: In order to accurately fill out the importance of financial benchmarking, you need to gather comprehensive and relevant financial data. This includes financial statements, balance sheets, income statements, cash flow statements, and any other pertinent financial information. The accuracy and completeness of the data will greatly impact the results obtained from the benchmarking process.

03

Identify benchmarking criteria: Determine the specific financial metrics and ratios that will be used for benchmarking purposes. This could include metrics such as profitability ratios, liquidity ratios, efficiency ratios, or any other key performance indicators that are relevant to the industry or organization. The selection of benchmarking criteria should align with the organization's goals and objectives.

04

Compare financial performance: Once the benchmarking criteria have been identified, compare the organization's financial performance against industry benchmarks or competitors. This can be done by analyzing the financial data and calculating the relevant ratios or metrics. This step will help identify any gaps or areas for improvement in the organization's financial performance.

05

Analyze and interpret results: After comparing financial performance, it is important to analyze and interpret the results. Look for patterns, trends, or significant differences between the organization's performance and the benchmarking data. This analysis will provide valuable insights into areas that require attention or improvement.

06

Take action: Based on the analysis and interpretation of the benchmarking results, take proactive steps to address any identified concerns or areas for improvement. Develop strategies, set goals, and allocate resources to bridge the gaps between the organization's performance and the benchmarks. Continuous monitoring and evaluation of financial performance will help ensure that the organization remains on track towards achieving its financial objectives.

Who needs the importance of financial benchmarking:

01

Small businesses: Small businesses can greatly benefit from financial benchmarking as it provides a means to measure their performance against industry standards and competitors. It allows them to identify areas of weakness and implement strategies for improvement.

02

Large corporations: Financial benchmarking is equally important for large corporations as it helps assess their financial performance on a broader scale. It assists in evaluating various business units or divisions, identifying key areas for cost reduction, and optimizing resource allocation.

03

Financial professionals: Financial benchmarking is a valuable tool for financial professionals such as accountants, financial analysts, and CFOs. It enables them to assess the financial health of an organization, identify potential risks, and make informed decisions based on industry standards and trends.

04

Investors and lenders: Investors and lenders often rely on financial benchmarks to evaluate the financial stability and growth potential of a company. Benchmarking helps them assess the risk associated with investment or lending decisions and provides a basis for comparison among potential investment options.

In conclusion, filling out the importance of financial benchmarking involves understanding its purpose, gathering relevant financial data, identifying benchmarking criteria, comparing financial performance, analyzing results, and taking proactive action. Various stakeholders, including small businesses, large corporations, financial professionals, investors, and lenders, can benefit from the insights provided by financial benchmarking.

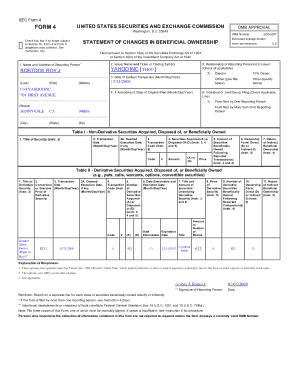

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in importance of financial benchmarking?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your importance of financial benchmarking and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How can I edit importance of financial benchmarking on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit importance of financial benchmarking.

How do I edit importance of financial benchmarking on an Android device?

You can make any changes to PDF files, such as importance of financial benchmarking, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is importance of financial benchmarking?

Financial benchmarking helps organizations compare their financial performance against industry standards or competitors to identify areas for improvement.

Who is required to file importance of financial benchmarking?

Any organization looking to improve their financial performance or compare their financials to industry standards or competitors may be required to file financial benchmarking.

How to fill out importance of financial benchmarking?

To fill out financial benchmarking, organizations should gather financial data, compare it to industry standards or competitors, and analyze the results to make informed decisions.

What is the purpose of importance of financial benchmarking?

The purpose of financial benchmarking is to identify strengths and weaknesses in an organization's financial performance, set goals for improvement, and make informed decisions based on industry standards or competitor data.

What information must be reported on importance of financial benchmarking?

Financial statements, key performance indicators, profitability ratios, liquidity ratios, and other relevant financial data must be reported on financial benchmarking.

Fill out your importance of financial benchmarking online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Importance Of Financial Benchmarking is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.