Get the free SIMPLE IRA bContribution Transmittalb Form - ProFunds

Show details

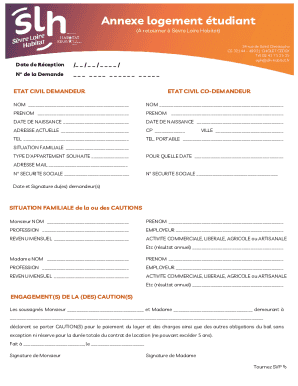

Clear Form Print Form SIMPLE IRA Contribution Transmittal Form Use this form for subsequent contributions. Send the completed form with your check. For assistance, please call 18887763637. Financial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign simple ira bcontribution transmittalb

Edit your simple ira bcontribution transmittalb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your simple ira bcontribution transmittalb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit simple ira bcontribution transmittalb online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit simple ira bcontribution transmittalb. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out simple ira bcontribution transmittalb

How to fill out a Simple IRA contribution transmittal:

01

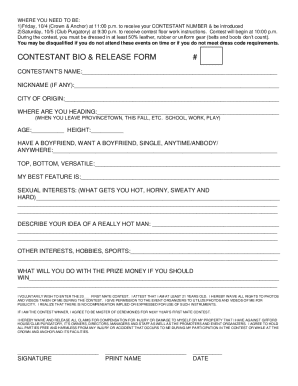

Start by gathering the necessary information: You will need the employee's name, Social Security number, and contribution amount. Additionally, make sure to have the employer's name, address, and Employer Identification Number (EIN).

02

Complete the top section: Fill in the employer's information including the name, address, and EIN. This section is typically labeled as "Employer Information" or something similar.

03

Enter the employee details: List each employee's name, Social Security number, and the contribution amount for each employee. Double-check to ensure accuracy and that the totals match with the corresponding amounts from your records.

04

Indicate contribution types: Many forms will have checkboxes or a column where you can specify the type of contribution being made. This could include salary deferral, employer matching, or non-elective contributions. Mark the appropriate box or enter the correct code for each employee and their respective contribution type.

05

Calculate totals: Deduct the contribution amounts from each employee to get the total amount being transmitted. Some forms may have a designated section for this, while others may require you to manually calculate the totals.

06

Sign and date: Once you have completed all the necessary sections, sign and date the form as the employer. This certifies that the information provided is accurate to the best of your knowledge.

Who needs a Simple IRA contribution transmittal:

01

Employers with Simple IRA plans: If you are an employer offering a Simple IRA plan to your employees, you will likely need a Simple IRA contribution transmittal form. This form helps in reporting and transmitting employee contribution amounts to the financial institution managing the Simple IRA accounts.

02

Small business owners: Simple IRAs are often favored by small businesses due to their lower administrative costs and ease of implementation. If you own a small business and have set up a Simple IRA plan for your employees, you will need a contribution transmittal form to report and transmit the employee contributions.

03

HR or payroll personnel: Human resources or payroll personnel responsible for managing employee benefits and payroll may also need a Simple IRA contribution transmittal form. They play a crucial role in ensuring accurate reporting and timely transmission of employee contributions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit simple ira bcontribution transmittalb from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your simple ira bcontribution transmittalb into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute simple ira bcontribution transmittalb online?

pdfFiller has made it easy to fill out and sign simple ira bcontribution transmittalb. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit simple ira bcontribution transmittalb in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing simple ira bcontribution transmittalb and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is simple ira contribution transmittal?

Simple IRA contribution transmittal is a form used by employers to report and transmit SIMPLE IRA plan contributions to the financial institution that holds the plan.

Who is required to file simple ira contribution transmittal?

Employers who have a SIMPLE IRA plan for their employees are required to file simple IRA contribution transmittal.

How to fill out simple ira contribution transmittal?

Simple IRA contribution transmittal can be filled out by entering the required information such as employee names, contribution amounts, and plan details.

What is the purpose of simple ira contribution transmittal?

The purpose of simple IRA contribution transmittal is to ensure that employer contributions to SIMPLE IRA plans are accurately reported and transmitted to the financial institution.

What information must be reported on simple ira contribution transmittal?

Information such as employee names, contribution amounts, dates of contributions, and plan details must be reported on simple IRA contribution transmittal.

Fill out your simple ira bcontribution transmittalb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Simple Ira Bcontribution Transmittalb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.