Get the free OVERDRAFT PROTECTION - First Capital Bank

Show details

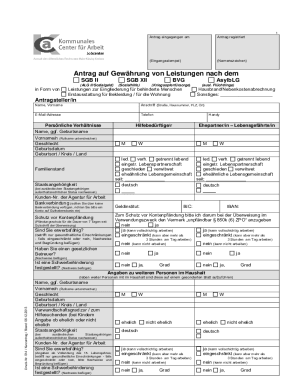

OVERDRAFT PROTECTION For Those times you may need overdraft protection, First Capital offers you a personal line of credit linked directly to your checking account. If you write a check for more than

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign overdraft protection - first

Edit your overdraft protection - first form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your overdraft protection - first form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing overdraft protection - first online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit overdraft protection - first. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out overdraft protection - first

How to fill out overdraft protection - first?

01

Gather necessary documents: Before filling out an overdraft protection form, make sure you have your identification documents, such as your driver's license or passport, as well as your banking information, including your account number and bank branch details.

02

Contact your bank: Reach out to your bank either through a phone call or by visiting a branch to inquire about the process of applying for overdraft protection. They will provide you with the necessary forms and instructions on how to proceed.

03

Understand the terms and conditions: Carefully read and understand the terms and conditions associated with overdraft protection. This will help you make informed decisions and avoid any surprises or hidden fees in the future.

04

Fill out the application form: Complete the overdraft protection application form accurately and legibly. Ensure that you provide all requested information, such as your personal details, bank account information, and any additional requirements.

05

Review and submit: Take a moment to review the filled-out form for any errors or missing information. Once you are satisfied, submit the form to the bank as per their instructions.

06

Follow up with the bank: If required, follow up with the bank to ensure that your application has been received and processed. They may require additional documents or information, so stay in touch with them until the process is complete.

Who needs overdraft protection - first?

01

Individuals with irregular income: If you have a variable or irregular income, such as freelancers, self-employed individuals, or seasonal workers, overdraft protection can provide a financial safety net during lean periods.

02

People with frequent expenses: If you have numerous bills, automatic payments, or regular debits from your bank account, overdraft protection can help you avoid bounced payments and the associated fees.

03

Those who experience unexpected expenses: Life is full of surprises, and unforeseen expenses can leave you short of funds in your account. Overdraft protection can act as a buffer, ensuring that important payments, such as rent or utilities, are not missed.

04

Individuals with limited savings: If you don't have a significant emergency fund, overdraft protection can be a useful tool to avoid financial hardship when unexpected expenses arise.

05

Banking convenience: Overdraft protection provides added convenience. Instead of worrying about declined transactions, you can have peace of mind knowing that your bank will cover them up to a certain limit.

Note: It is essential to assess your financial situation and bank's terms before applying for overdraft protection.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my overdraft protection - first directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your overdraft protection - first and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I make changes in overdraft protection - first?

The editing procedure is simple with pdfFiller. Open your overdraft protection - first in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit overdraft protection - first straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing overdraft protection - first.

What is overdraft protection - first?

Overdraft protection is a service offered by banks to cover transactions that exceed the available balance in a checking account.

Who is required to file overdraft protection - first?

Customers who opt in for overdraft protection services are required to have it.

How to fill out overdraft protection - first?

To fill out overdraft protection, customers need to submit a form to their bank requesting the service.

What is the purpose of overdraft protection - first?

The purpose of overdraft protection is to prevent declined transactions and insufficient funds fees.

What information must be reported on overdraft protection - first?

Customers must report their personal information, account details, and the amount of overdraft protection requested.

Fill out your overdraft protection - first online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Overdraft Protection - First is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.