Get the free Key Information Memorandum & Application Form

Show details

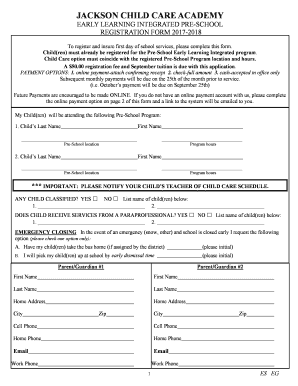

This document provides crucial information for prospective investors in the ICICI Prudential Child Care Plan, outlining investment objectives, associated risks, application processes, and additional

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign key information memorandum application

Edit your key information memorandum application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your key information memorandum application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing key information memorandum application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit key information memorandum application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out key information memorandum application

How to fill out Key Information Memorandum & Application Form

01

Start with your personal information: Fill out your name, address, and contact details accurately.

02

Provide business information: Include the name of the business, type of business entity, and registration details.

03

Outline the purpose of the application: Clearly state why you are submitting this form.

04

Specify the amount of funding needed: Indicate the exact amount and the intended use of funds.

05

Include financial projections: Present estimated revenue, expenses, and profit margins for the next few years.

06

Attach supporting documents: Include your business plan, financial statements, and any relevant certifications.

07

Review the completed form: Check for errors or missing information before submission.

08

Submit the application: Follow the specific submission guidelines provided by the organization.

Who needs Key Information Memorandum & Application Form?

01

Businesses seeking funding or investment.

02

Entrepreneurs applying for loans or grants.

03

Startups looking for venture capital.

04

Companies required to present their business model to potential investors.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between Kim Sid and Sai?

While the detailed Scheme Information Document (SID) and Statement of Additional Information (SAI) contain exhaustive details, they can often seem lengthy and complex while KIM is like a professional brochure for the mutual fund. SEBI (Securities and Exchange Board of India) has introduced and mandated the KIM.

What is the full form of Kim?

Key Information Memorandum (KIM)

What is a key information memorandum?

KIM stands for Key Information Memorandum, is a document that provides essential information about a mutual fund scheme to potential investors. It serves as a comprehensive guide that helps investors understand the nature, objectives, risks, and costs associated with investing in a particular mutual fund.

What is the key information document for a mutual fund?

The Key Information Document (KID) is a document containing the key information on an investment fund in a clear and standardised format (e.g. objectives, investment policy and risk classification of the fund, current annual costs). It must be made available to investors before they reach any investment decision.

What is an informational memorandum?

An information memorandum, on the other hand, is a document created by a company to provide potential investors with information about the company and its investment opportunity. It is typically used in private placements or private fundraising. For this reason, it's sometimes called a private placement memorandum.

What is the general information memorandum?

The purpose of an Information Memorandum (IM) is to: Provide an overview of the company's financial performance, including historical and projected financial statements. Highlight growth prospects, strategies, and competitive advantages. Disclose Material Risks, Challenges, and Possible Liabilities.

What is the key information memorandum?

KIM stands for Key Information Memorandum, is a document that provides essential information about a mutual fund scheme to potential investors. It serves as a comprehensive guide that helps investors understand the nature, objectives, risks, and costs associated with investing in a particular mutual fund.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Key Information Memorandum & Application Form?

The Key Information Memorandum (KIM) is a document that provides essential details about a financial product, such as mutual funds, including investment objectives, risks, and expenses. The Application Form is used by investors to apply for such financial products, serving as a formal request to invest.

Who is required to file Key Information Memorandum & Application Form?

Fund houses and asset management companies are required to file the Key Information Memorandum to ensure investors receive necessary information about their offerings. Investors must complete and submit the Application Form when applying for investments.

How to fill out Key Information Memorandum & Application Form?

To fill out the Key Information Memorandum, review all provided information carefully. When filling out the Application Form, provide personal identification details, contact information, investment amount, and any required declarations. Ensure accuracy and completeness before submission.

What is the purpose of Key Information Memorandum & Application Form?

The purpose of the Key Information Memorandum is to inform potential investors about the key aspects of an investment product, aiding them in making informed decisions. The Application Form serves as a means for investors to formally request to invest in those products.

What information must be reported on Key Information Memorandum & Application Form?

The Key Information Memorandum must report information such as the fund’s objectives, risk factors, fees, performance history, and investment strategy. The Application Form typically requires details like investor’s name, address, contact information, Social Security Number (or equivalent), investment choices, and signature.

Fill out your key information memorandum application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Key Information Memorandum Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.