Get the free Reliance Fixed Horizon Fund - XX - Series 9

Show details

This document provides information for investors interested in participating in the Reliance Fixed Horizon Fund - XX - Series 9, detailing investment objectives, application processes, terms, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign reliance fixed horizon fund

Edit your reliance fixed horizon fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reliance fixed horizon fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing reliance fixed horizon fund online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit reliance fixed horizon fund. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

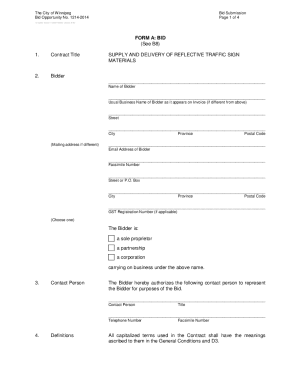

How to fill out reliance fixed horizon fund

How to fill out Reliance Fixed Horizon Fund - XX - Series 9

01

Gather all necessary personal and financial information.

02

Visit the official Reliance Mutual Fund website or authorized distributor.

03

Locate the Reliance Fixed Horizon Fund - XX - Series 9 application form.

04

Fill in your personal details such as name, address, and contact information.

05

Provide your PAN (Permanent Account Number) and KYC (Know Your Customer) details if required.

06

Specify the investment amount you wish to invest in Series 9.

07

Choose the mode of investment: lump sum or systematic investment plan (SIP).

08

Fill in the payment details: bank account information, payment mode, or attached cheque.

09

Review all the entered details for accuracy.

10

Sign the application form and submit it along with the necessary documents.

Who needs Reliance Fixed Horizon Fund - XX - Series 9?

01

Individuals looking for a fixed investment option with a defined maturity period.

02

Investors seeking a balanced risk-return profile and a structured exit.

03

Those who prefer an investment strategy with periodic returns and lower volatility.

04

Retirees needing consistent income over time while preserving capital.

Fill

form

: Try Risk Free

People Also Ask about

Which mutual fund has a 20% return?

We list out six top-performingfocused mutual funds which have delivered over 20 percent annualised return in the past five years. These schemes are 360 one-focused funds, Franklin India Focused Equity Fund, HDFC Focused Fund, ICICI Prudential Focused Equity Fund, Nippon India Focused Fund, and Quant Focused Fund.

What is the new name of Reliance Equity Fund Growth Plan?

Nippon India Mutual Fund (formerly Reliance Mutual Fund)

Can I get 20% return in mutual funds?

Based on historical analysis, mutual funds have provided solid returns, often around 9 – 12% annually. However, these returns can be higher depending on market conditions. For example, in India, mutual funds have given an average 20% return over ten years and have shown strong market growth.

Are Reliance and NIPPon mutual funds the same?

Nippon India Mutual Funds, formerly known as Reliance Mutual Fund, is a prominent asset management company in India. It oversees a diverse range of assets, including managed accounts, mutual funds, pension funds, alternative investments, and offshore funds.

Which mutual fund gives 30% return?

Nippon India Small Cap Fund, Bandhan Small Cap Fund, HDFC Small Cap Fund, HSBC Small Cap Fund, Invesco India Smallcap Fund, and Tata Small Cap Fund gave a CAGR of 32.92%, 31.39%, 30.97%, 30.55%, 30.41%, and 30.18% respectively, in the last five years.

Which fund gives a 25 percent return?

Top 12 Equity Mutual Funds Based on 5-Year Daily Rolling Returns Fund NameCategory5-Year CAGR (%) Bank of India Flexi Cap Fund Flexi Cap 28.06 Mirae Asset Midcap Fund Mid Cap 27.47 Quant Small Cap Fund Small Cap 26.71 Motilal Oswal Large & Midcap Fund Large & Mid Cap 26.708 more rows • Jul 16, 2025

Which mutual fund gives 40% return?

Five equity mutual funds have delivered over 40% returns on lumpsum investments from January 1, 2024 to October 21, 2024. Leading the list, Motilal Oswal Midcap Fund and Motilal Oswal ELSS Tax Saver Fund returned 47.62% and 43.43%, respectively. This high performance highlights potential gains for investors.

What happened to Reliance mutual fund?

Set up in June 1995 as Reliance Mutual Fund, it was a joint venture between India's Reliance Capital and Japan's Nippon Life Insurance company. In October 2019, Reliance's stake was bought by Nippon, and the fund house was renamed as Nippon India Mutual Fund.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Reliance Fixed Horizon Fund - XX - Series 9?

Reliance Fixed Horizon Fund - XX - Series 9 is a close-ended mutual fund scheme that invests in fixed income securities and aims to provide investors with stable returns over a specific investment horizon.

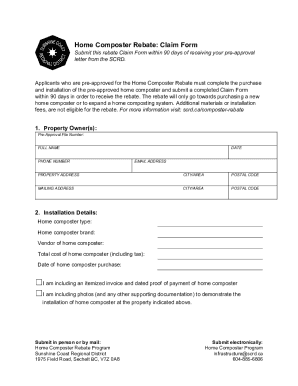

Who is required to file Reliance Fixed Horizon Fund - XX - Series 9?

Investors who participate in the Reliance Fixed Horizon Fund - XX - Series 9 are required to file necessary documentation and declarations as mandated by the fund’s compliance requirements.

How to fill out Reliance Fixed Horizon Fund - XX - Series 9?

To fill out Reliance Fixed Horizon Fund - XX - Series 9, investors need to complete the application form provided by the fund, including personal details, investment amount, and selecting the preferred option for payout.

What is the purpose of Reliance Fixed Horizon Fund - XX - Series 9?

The purpose of Reliance Fixed Horizon Fund - XX - Series 9 is to provide investors with an opportunity to invest in fixed income instruments while targeting a specific time frame for returns.

What information must be reported on Reliance Fixed Horizon Fund - XX - Series 9?

Investors must report personal identification details, investment amount, purpose of investment, and bank account information for transaction processing on Reliance Fixed Horizon Fund - XX - Series 9.

Fill out your reliance fixed horizon fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reliance Fixed Horizon Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.