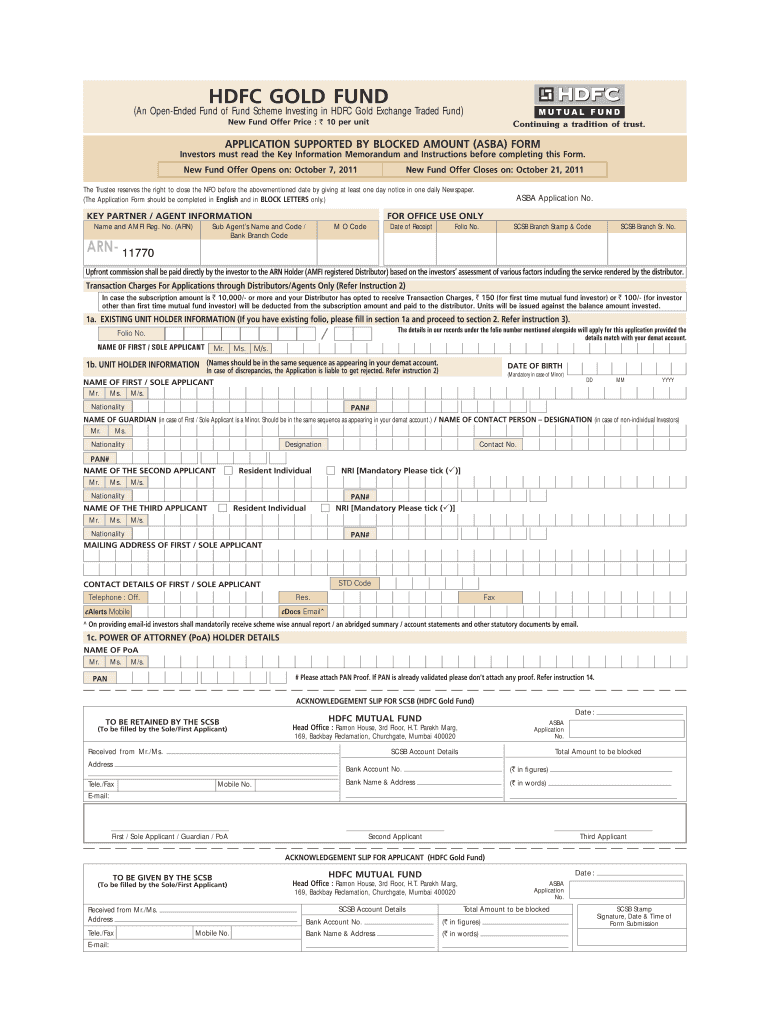

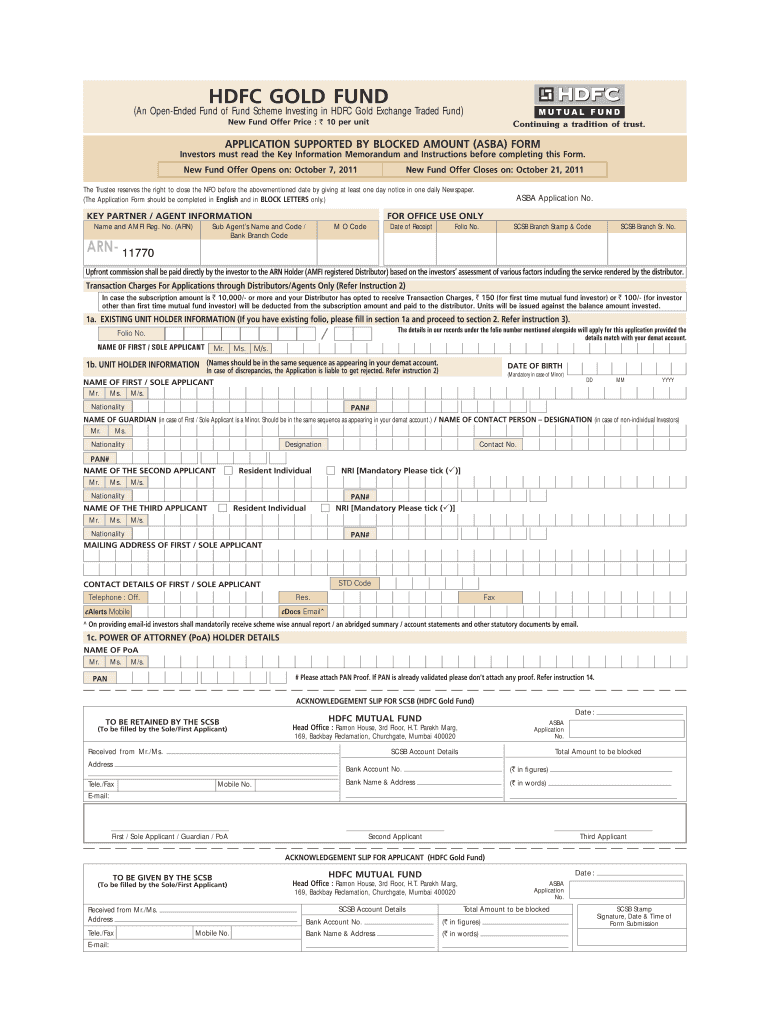

Get the free HDFC GOLD FUND

Show details

This document outlines the application process for investing in the HDFC Gold Fund, an open-ended fund of fund scheme that invests in HDFC Gold Exchange Traded Fund. It provides critical information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hdfc gold fund

Edit your hdfc gold fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hdfc gold fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hdfc gold fund online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit hdfc gold fund. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hdfc gold fund

How to fill out HDFC GOLD FUND

01

Visit the official HDFC Mutual Fund website.

02

Navigate to the 'Invest' section.

03

Select 'HDFC Gold Fund' from the list of available schemes.

04

Click on the 'Invest Now' button.

05

Choose your investment option: Lump sum or SIP (Systematic Investment Plan).

06

Fill in the required details such as amount, tenure, and personal information.

07

Complete the KYC (Know Your Customer) process if you haven't done it already.

08

Review your application and agree to the terms and conditions.

09

Submit your application and complete the payment transaction.

Who needs HDFC GOLD FUND?

01

Investors looking for a hedge against inflation.

02

Individuals who want to diversify their portfolio with gold.

03

People who believe in the value of gold as a long-term investment.

04

Those looking for a safe investment option during economic uncertainty.

05

Investors who want to invest in gold without physically purchasing and storing it.

Fill

form

: Try Risk Free

People Also Ask about

Is it wise to invest in gold funds?

Investing in gold is less risky and increases in value over time. However, there is no interest or dividends so investors do not have the option of reinvesting limiting returns on their gold investment. On the other hand, equity funds earn higher returns compared to gold which you can reinvest to maximize your returns.

Is HDFC Gold Fund good?

Why invest in HDFC Gold Fund? Seeks capital appreciation through gold investment: HDFC Gold Fund aims to generate capital appreciation by investing in units of HDFC Gold Exchange Traded Fund. Gold has historically been considered a valuable asset class that can potentially provide better returns over the long term.

How is HDFC Gold Fund Direct Growth taxed?

Capital Gains Taxation: If sold within 2 years of investment: The capital gains are added to the investor's income and taxed according to the applicable tax slab. If sold after 2 years of investment: The capital gains are taxed at a flat rate of 12.5%.

Which gold fund is best to invest in India?

List of Best Gold Mutual Funds LIC MF Gold ETF FOF Direct Growth. Aditya Birla Sun Life Gold Fund Direct Plan Growth. SBI Gold Fund Direct Plan Growth. HDFC Gold ETF Fund of Fund Direct Plan-Growth. ICICI Prudential Regular Gold Savings Fund(FOF) Direct Plan Growth. Quantum Gold Savings Fund Direct Growth.

Which gold fund gives the highest return?

List of Best Gold ETFs to Invest NameLTP (NAV)3 Yr Returns N Nippon Gold ETF (GOLDBEES) 91.26 Invest 109.31% H HDFC Gold ETF 94.16 Invest 81.67% S SBI Gold ETF 94.02 Invest 110.62% I ICICI Pru Gold ETF 94.29 Invest 70.66%18 more rows • 3 days ago

What is the new name of HDFC Gold Fund?

HDFC Gold Fund will be known as HDFC Gold ETF Fund of Fund. HDFC Index Fund - Nifty 50 Plan will be called HDFC Nifty 50 Index Fund.

Is it good to invest in HDFC Gold Fund?

1. Current NAV: The Current Net Asset Value of the HDFC Gold ETF as of Sep 12, 2025 is Rs 93.95 for IDCW option of its Regular plan. 2. Returns: Its trailing returns over different time periods are: 46.09% (1yr), 26.69% (3yr), 14.51% (5yr) and 11.35% (since launch).

What is 1 unit of HDFC Gold ETF equal to?

One Gold ETF unit is equal to 1 gram of gold and is backed by physical gold of very high purity. Gold ETFs combine the flexibility of stock investment and the simplicity of gold investments. Gold ETFs are listed and traded on the National Stock Exchange of India (NSE) and Bombay Stock Exchange Ltd.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is HDFC GOLD FUND?

HDFC Gold Fund is a mutual fund that aims to provide investors exposure to gold as an asset class, primarily through investments in gold ETFs or gold mining companies.

Who is required to file HDFC GOLD FUND?

Investors looking to invest in HDFC Gold Fund must fill out the application form and comply with KYC (Know Your Customer) norms, which usually involve identity and address verification.

How to fill out HDFC GOLD FUND?

To fill out HDFC Gold Fund application, you need to provide your personal information, select the investment option, complete the KYC process, and submit any required documents along with the form.

What is the purpose of HDFC GOLD FUND?

The purpose of HDFC Gold Fund is to provide investors a convenient and efficient way to invest in gold without the need to buy physical gold, thus aiming for capital appreciation over time.

What information must be reported on HDFC GOLD FUND?

Information to be reported on HDFC Gold Fund includes investor personal details, investment details, KYC compliance, and any financial goals related to the investment.

Fill out your hdfc gold fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hdfc Gold Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.