Get the free ICICI Prudential Fixed Maturity Plan - Series 70

Show details

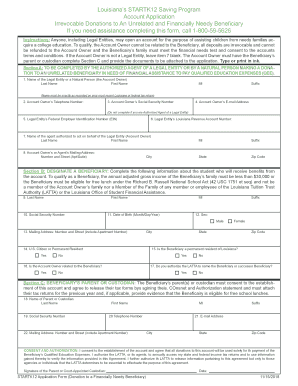

This Key Information Memorandum (KIM) provides essential information for investors indicating the objectives, risk factors, and structure of the ICICI Prudential Fixed Maturity Plan - Series 70.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign icici prudential fixed maturity

Edit your icici prudential fixed maturity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your icici prudential fixed maturity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing icici prudential fixed maturity online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit icici prudential fixed maturity. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out icici prudential fixed maturity

How to fill out ICICI Prudential Fixed Maturity Plan - Series 70

01

Visit the ICICI Prudential website or a bank branch.

02

Locate the Fixed Maturity Plan - Series 70 section.

03

Read the plan details and terms and conditions carefully.

04

Fill out the application form with required personal and financial details.

05

Choose the investment amount and select the tenure that suits you.

06

Provide KYC documents such as identity proof, address proof, and PAN card.

07

Submit the application form along with the KYC documents and payment.

08

Once processed, you will receive confirmation and details of your investment.

Who needs ICICI Prudential Fixed Maturity Plan - Series 70?

01

Investors looking for a safe, fixed-income investment option.

02

Individuals planning to invest over a medium to long-term horizon.

03

People seeking a predictable return on investment at maturity.

04

Those wanting to benefit from a debt-oriented investment with a defined maturity.

Fill

form

: Try Risk Free

People Also Ask about

How do I withdraw money from my policy?

How do you cash out a life insurance policy? There are three main ways to get cash out of your policy. You can borrow against your cash account typically with a low-interest life insurance loan, withdraw the cash (either as a lump sum or in regular payments), or you can surrender your policy.

Can I withdraw money from ICICI Prudential policy online?

The amount that you can withdraw will depend on the number of years you have completed in the policy. Please refer to the Partial Withdrawal section of your policy document for more details. You can submit your request through any of the options mentioned below: Online: 3 simple steps to submit your request online.

Which ICICI fund gives the highest return?

List of ICICI Prudential Mutual Fund in India Fund NameCategory1Y Returns ICICI Prudential Equity & Debt Fund Hybrid 6.5% ICICI Prudential Multi Asset Fund Hybrid 9.5% ICICI Prudential Large Cap Fund Equity 3.2% ICICI Prudential Income Plus Arbitrage Active FoF Fund Hybrid 6.7%12 more rows

What is a fixed maturity plan?

Fixed Maturity Plan (FMP) is a tenure-specific mutual fund scheme that aligns its investments in debt instruments with the scheme's duration. Spanning from months to years, FMPs suit investors seeking predictable returns over a defined investment horizon.

How to withdraw money from Prudential life insurance?

To request a loan or withdrawal from your Prudential policy, or to perform a cash surrender of your policy, contact your Prudential professional, or call our Customer Service Center at 1-800-778-2255, Mon. -Fri., 8 a.m.-8 p.m. ET. Please have your policy numbers available when you call.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ICICI Prudential Fixed Maturity Plan - Series 70?

ICICI Prudential Fixed Maturity Plan - Series 70 is a close-ended debt mutual fund scheme that aims to invest in fixed income securities with maturities that match the maturity of the fund.

Who is required to file ICICI Prudential Fixed Maturity Plan - Series 70?

Investors who wish to invest in the ICICI Prudential Fixed Maturity Plan - Series 70 are required to file and complete the application form as part of the investment process.

How to fill out ICICI Prudential Fixed Maturity Plan - Series 70?

To fill out the ICICI Prudential Fixed Maturity Plan - Series 70 application, investors must provide personal information, investment amount, and choose the preferred mode of payment along with necessary KYC documents.

What is the purpose of ICICI Prudential Fixed Maturity Plan - Series 70?

The purpose of ICICI Prudential Fixed Maturity Plan - Series 70 is to provide investors with a fixed return over the investment period, suitable for conservative investors looking for predictable income.

What information must be reported on ICICI Prudential Fixed Maturity Plan - Series 70?

Investors must report their personal details, financial information, investment objectives, and other relevant details as per the KYC guidelines while filling out the ICICI Prudential Fixed Maturity Plan - Series 70 application.

Fill out your icici prudential fixed maturity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Icici Prudential Fixed Maturity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.