Get the free TATA FIXED INVESTMENT PLAN - Moneycontrol

Show details

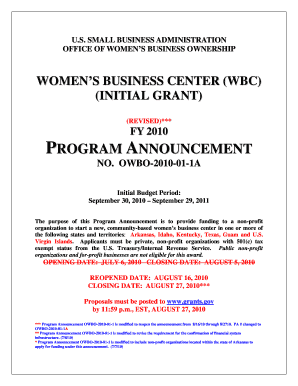

Name of the Mutual Fund : Tata Mutual Fund Name of the AMC : Tata Asset Management Ltd. KEY INFORMATION MEMORANDUM FIXED INVESTMENT PLAN 4 (Scheme — A) (A CLOSE ENDED DEBT FUND) Offer for Units

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tata fixed investment plan

Edit your tata fixed investment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tata fixed investment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tata fixed investment plan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tata fixed investment plan. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tata fixed investment plan

How to fill out Tata fixed investment plan:

01

Research and understand the details of the Tata fixed investment plan. Gather information about its features, benefits, investment options, and any associated fees or charges.

02

Determine your investment goal and assess your risk tolerance. This will help you choose the appropriate investment options within the Tata fixed investment plan.

03

Contact a financial advisor or visit the official Tata investment website to get detailed information about the plan and its application process.

04

Fill out the application form accurately and provide all the required personal and financial information.

05

Choose the investment options that align with your investment goals and risk profile. Tata fixed investment plans usually offer different funds or asset allocation models to choose from.

06

Decide on the investment amount or monthly SIP (Systematic Investment Plan) you wish to make. This can depend on your financial capacity and long-term investment objectives.

07

Provide the necessary documents as mentioned in the application form, which may include identification proof, address proof, and PAN card details.

08

Carefully review the filled-out application form, ensuring that all the information provided is correct and complete.

09

Submit the application form along with the required documents to the designated Tata investment office, or as instructed on the website.

10

Pay the initial investment amount, following the specified guidelines mentioned in the plan's terms and conditions.

Who needs Tata fixed investment plan:

01

Individuals who are looking for a long-term investment option to achieve their financial goals, such as retirement planning, child education, or buying a property.

02

Investors who prefer a disciplined and systematic approach to investing, using regular monthly contributions.

03

Individuals who are comfortable with market-linked returns and are willing to stay invested for a considerable time period.

04

Those who want the expertise of a reputed investment management company like Tata, which provides a range of investment options to suit different risk profiles and investment objectives.

05

Investors who want the convenience of managing their investments through a single platform and prefer the transparency offered by Tata fixed investment plans.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in tata fixed investment plan without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your tata fixed investment plan, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for the tata fixed investment plan in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out tata fixed investment plan on an Android device?

On Android, use the pdfFiller mobile app to finish your tata fixed investment plan. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is tata fixed investment plan?

Tata fixed investment plan is a financial product offered by Tata Group that allows individuals or organizations to invest a fixed amount of money for a specific period of time with a predetermined interest rate.

Who is required to file tata fixed investment plan?

Any individual or organization who wishes to invest in the Tata fixed investment plan is required to file it. There may be certain eligibility criteria and documentation requirements that need to be fulfilled.

How to fill out tata fixed investment plan?

To fill out the Tata fixed investment plan, you need to visit a Tata Group financial institution or their website. You will need to provide personal or organizational information, such as name, contact details, identification documents, and investment amount. It is advisable to consult with a financial advisor or representative for guidance.

What is the purpose of tata fixed investment plan?

The purpose of Tata fixed investment plan is to provide individuals or organizations with a secure and predictable investment option. It allows them to earn a fixed rate of return on their investment over a specific time period, helping them achieve their financial goals.

What information must be reported on tata fixed investment plan?

The information that must be reported on Tata fixed investment plan includes personal or organizational details, such as name, address, contact information, identification documents, and investment amount. The specific requirements may vary based on the policies of Tata Group and regulatory guidelines.

Fill out your tata fixed investment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tata Fixed Investment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.