Get the free SIP/MICRO SIP - EQUITY SCHEMES

Show details

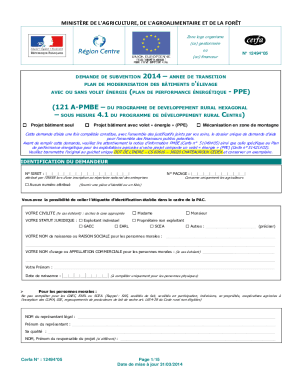

This document is an application form for enrolling in Systematic Investment Plans (SIPs) or Micro SIPs for equity schemes, detailing the information required from investors, payment details, and accompanying

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sipmicro sip - equity

Edit your sipmicro sip - equity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sipmicro sip - equity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sipmicro sip - equity online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sipmicro sip - equity. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sipmicro sip - equity

How to fill out SIP/MICRO SIP - EQUITY SCHEMES

01

Gather personal information: Collect your name, address, and identification details.

02

Choose the right equity scheme: Research different SIP (Systematic Investment Plan) or Micro SIP schemes to find one that aligns with your financial goals.

03

Fill out the application form: Complete the SIP/Micro SIP application form with the required personal details and scheme information.

04

Provide KYC documents: Submit Know Your Customer (KYC) documents such as PAN card, address proof, and passport-sized photographs.

05

Specify the investment amount: Decide how much you want to invest monthly and fill in the amount in the application form.

06

Choose the payment method: Select your preferred payment method, such as direct debit from your bank account.

07

Review and sign the application: Double-check all the details filled in the application form, then sign it.

08

Submit the application: Hand over the completed form and documents to the mutual fund distributor or send it directly to the fund house.

09

Monitor your investment: Regularly check your SIP investments and performance through the mutual fund’s portal or mobile app.

Who needs SIP/MICRO SIP - EQUITY SCHEMES?

01

New investors looking to start investing in the equity market in a structured way.

02

Individuals wanting to build a long-term wealth accumulation strategy.

03

Those with limited funds who prefer to invest in small amounts regularly rather than a lump sum.

04

People seeking to benefit from rupee cost averaging by investing consistently over time.

05

Retirement planners looking to grow their savings for long-term financial security.

06

Investors looking for a disciplined approach to investing that mitigates market volatility.

Fill

form

: Try Risk Free

People Also Ask about

How much is 1000 in SIP for 5 years?

How much is Rs. 1,000 for 5 years in SIP? If you invest Rs. 1,000 per month through SIP for 5 years, assuming 10% return. The estimate total returns will be Rs. 18,082 and the estimate future value of your investment will be Rs. 78,082.

Is smallcase SIP good?

Smallcases are a good investment option for investors who have a fair understanding of the stock markets and want to invest in a portfolio without paying fund management fees. This is because a smallcase offers a researched basket of stocks by an expert without bearing the expense ratio of a mutual fund.

What is a micro SIP?

A micro SIP is a form of mutual fund investment that enables investors to begin with a minimal monthly contribution of either Rs 100 or Rs 50. The aim of micro SIPs is to appeal to small investors, including daily wage earners, students, and children, who may have limited funds to invest.

What are 7 types of SIP?

The 7 different types of SIP are Regular, top-up, perpetual, trigger, SIP with insurance, flexible and multi-SIP. Read the full blog to pick the right plan. Systematic Investment Plans (SIPs) are a popular way to invest in mutual funds. They provide a structured approach to achieving financial goals more effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SIP/MICRO SIP - EQUITY SCHEMES?

SIP (Systematic Investment Plan) is a method of investing in mutual funds where investors can invest a fixed amount regularly, typically monthly. MICRO SIP refers to SIP investments that are smaller in size, allowing investors to contribute smaller amounts, usually below a certain threshold, making equity investment accessible to more individuals.

Who is required to file SIP/MICRO SIP - EQUITY SCHEMES?

Individuals and entities who want to invest in SIP or MICRO SIP equity schemes are required to register with the mutual fund and complete necessary documentation, including KYC (Know Your Customer) compliance.

How to fill out SIP/MICRO SIP - EQUITY SCHEMES?

To fill out SIP/MICRO SIP forms, investors need to provide personal details, select the equity scheme they wish to invest in, specify the amount and frequency of the investment, and complete KYC requirements. The forms can usually be obtained from the mutual fund’s website or offices.

What is the purpose of SIP/MICRO SIP - EQUITY SCHEMES?

The purpose of SIP/MICRO SIP equity schemes is to encourage disciplined and regular investing in equity markets, allowing investors to take advantage of market volatility and potentially grow their wealth over time with smaller, manageable contributions.

What information must be reported on SIP/MICRO SIP - EQUITY SCHEMES?

Investors must report their personal identification information, bank details for auto-debit, the chosen SIP/micro SIP scheme, investment amount, investment frequency, and any other relevant information required by the mutual fund to process the investment.

Fill out your sipmicro sip - equity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sipmicro Sip - Equity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.