Get the free sahara mutual fund

Show details

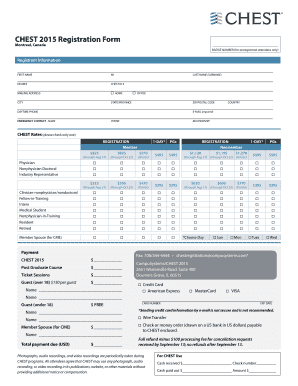

This document serves as a request form for additional purchase, redemption, or switch requests in Sahara Mutual Fund schemes, outlining the necessary details and declarations required from investors.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sahara mutual fund

Edit your sahara mutual fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sahara mutual fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sahara mutual fund online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sahara mutual fund. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sahara mutual fund

How to fill out sahara mutual fund

01

Gather all necessary personal identification documents.

02

Research and select the specific Sahara Mutual Fund you wish to invest in.

03

Visit the official Sahara Mutual Fund website or authorized agents.

04

Download the application form or obtain it from the agents.

05

Fill in the application form accurately with all required details.

06

Attach the necessary documents, such as KYC (Know Your Customer) compliance documents.

07

Specify the amount you wish to invest and the payment method.

08

Submit the completed application form along with the documents and payment to the designated office or via online submission.

09

Receive and retain the acknowledgment receipt as proof of your investment.

Who needs sahara mutual fund?

01

Individuals looking to invest in a managed mutual fund for long-term wealth creation.

02

Those who prefer a diversified investment portfolio without actively managing their investments.

03

Investors seeking potentially higher returns compared to traditional savings accounts or fixed deposits.

04

People who are looking for a systematic investment plan (SIP) option for disciplined investing.

05

Individuals looking for professional management of their investment funds.

Fill

form

: Try Risk Free

People Also Ask about

Why did the Sahara collapse?

Sahara's eventual collapse was rooted in its leadership's attempts to outmaneuver regulatory authorities and exploit the trust of its millions of investors — many of whom were unsophisticated, financially vulnerable individuals.

How do I redeem my Sahara mutual fund?

How to redeem Sahara Mutual Fund? To redeem Sahara Mutual Funds through offline mode, one can visit the nearest fund house and submit a form. Alternatively, an investor can also visit the official website and redeem the investment by signing in with the folio number.

Did Sahara pay back?

50,000/- is being disbursed to each genuine depositor of the Sahara Group of Cooperative Societies against verified claims through Aadhaar seeded Bank account. The Hon'ble Supreme Court has granted the extension for disbursement of refund to the Sahara depositors upto 31.12. 2025.

Is the Sahara refund true?

Yes, depositors of the Sahara Group of Cooperative Societies can get a refund of their money by applying for it in the Sahara Refund portal. How to apply for Sahara refund online? Depositors of the Sahara Group of Cooperative Societies can apply online for a refund by visiting the Sahara Refund portal.

What is the full form of MF in Sahara?

Sahara Mutual Fund (the “Mutual Fund”) has been constituted as a trust on 18/07/1996 in accordance with the provisions of the Indian Trusts Act, 1882 (2 of 1882) with Sahara India Financial Corporation Limited, as the Sponsor and Board of Trustees as the Trustee.

What happened to the Sahara mutual fund?

March 2014 - Roy, along with two other directors of Sahara, sent to Tihar jail. March 2015 - Supreme Court stated that the total dues from Sahara have gone up to Rs 40,000 crore with the accretion of interest. July 2015 - SEBI cancelled the licence of Sahara's mutual fund business.

Which mutual fund is best for Muslims?

Top Funds with Shariah Guidelines NameNAV3 Yr Returns Tata Ethical Fund Direct - Growth ₹ 427.34 Invest 11.39% Taurus Ethical Fund Direct - Growth ₹ 139.10 Invest 14.78% Quantum Ethical Fund Direct - Growth ₹ 9.81 Invest 0.00%

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sahara mutual fund?

Sahara Mutual Fund is an investment fund managed by Sahara Asset Management Company that pools money from investors to invest in various securities such as stocks, bonds, and other assets.

Who is required to file sahara mutual fund?

Investors who have invested in Sahara Mutual Fund or those managing funds on behalf of Sahara Mutual Fund are required to file the necessary documents and reports as per regulatory requirements.

How to fill out sahara mutual fund?

To fill out a Sahara Mutual Fund application, investors need to provide personal details, financial information, investment preferences, and any required documentation as specified by the fund.

What is the purpose of sahara mutual fund?

The purpose of Sahara Mutual Fund is to generate returns for its investors by investing in diversified securities while providing an opportunity for individuals to invest in a professionally managed fund.

What information must be reported on sahara mutual fund?

Information that must be reported on Sahara Mutual Fund includes the fund's performance, expense ratios, holdings, transactions, and any changes in fund management or investment strategy.

Fill out your sahara mutual fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sahara Mutual Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.