Get the free kontante ud og indbetalinger - midspar

Show details

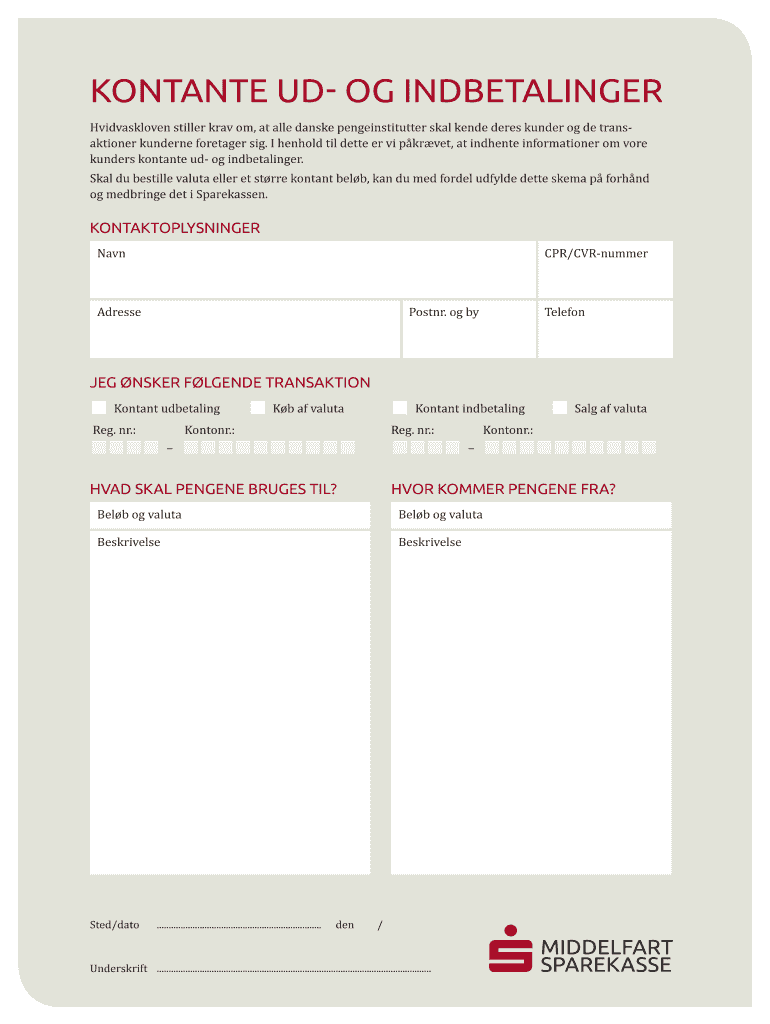

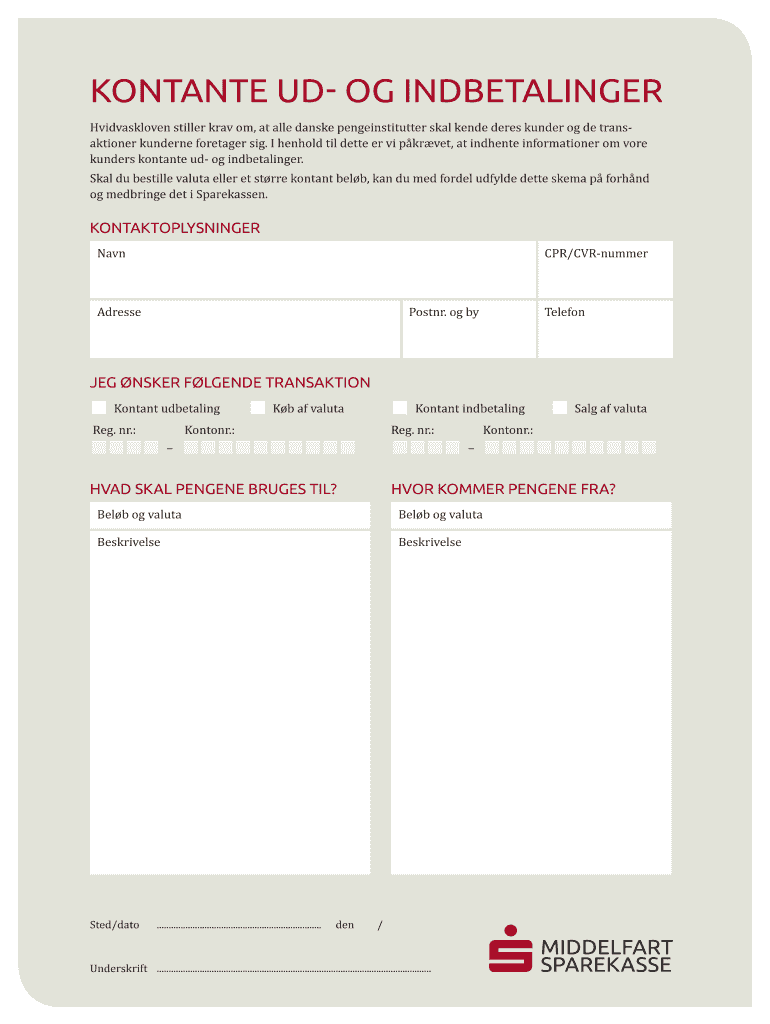

VKontakte up OG indbetalinger Hvidvaskloven stiller KAV on, at all dance pengeinstitutter seal Kendo dears under OG DE transaction under forager SIG. I hen hold til Bette her vi privet, at indented

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kontante ud og indbetalinger

Edit your kontante ud og indbetalinger form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kontante ud og indbetalinger form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kontante ud og indbetalinger online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit kontante ud og indbetalinger. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out kontante ud og indbetalinger

How to fill out kontante ud og indbetalinger:

01

Start by gathering all the necessary information related to the cash inflows and outflows. This may involve collecting receipts, invoices, and any other relevant documents.

02

Open the kontante ud og indbetalinger form or template provided by your financial institution or the relevant authorities.

03

Begin by entering the date of the transaction in the designated field. Make sure to accurately record the day, month, and year.

04

In the "Kontante ud" section, list all the cash outflows that occurred during the specified period. This may include expenses such as purchases, payments to suppliers, or any other cash payments made by the business.

05

For each cash outflow, specify the purpose of the payment and provide a brief description of the expense.

06

Enter the amount of each cash outflow in the appropriate column, ensuring that the figures are accurate and properly aligned.

07

Add up the total cash outflows for the given period and record it in the designated field.

08

In the "Kontante ind" section, list all the cash inflows received by the business during the specified period. This can include revenue from sales, cash received from customers, or any other forms of cash income.

09

For each cash inflow, specify the source of the payment and provide a brief description.

10

Enter the amount of each cash inflow in the corresponding column, ensuring accuracy and proper alignment.

11

Calculate the total cash inflows for the specified period and record it in the designated field.

12

Finally, subtract the total cash outflows from the total cash inflows to determine the net cash flow for the given period. Record this figure in the designated field as well.

13

Double-check all the entered information for accuracy and completeness.

14

Once you are satisfied with the accuracy of the data, submit the kontante ud og indbetalinger form to the appropriate authority or keep it for your records.

Who needs kontante ud og indbetalinger?

01

Small businesses: Kontante ud og indbetalinger are particularly useful for small businesses that handle cash transactions regularly. It helps them keep track of their cash flow, identify any discrepancies, and maintain accurate financial records.

02

Freelancers and self-employed individuals: Individuals who work on a freelance basis or are self-employed can also benefit from using kontante ud og indbetalinger. It allows them to document their cash inflows and outflows, making it easier to manage their finances and meet their tax obligations.

03

Financial institutions and tax authorities: Banks, loan providers, and tax authorities often require businesses and individuals to submit kontante ud og indbetalinger forms as part of their financial documentation. It helps them assess the financial health of an entity and ensures compliance with relevant regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send kontante ud og indbetalinger to be eSigned by others?

When your kontante ud og indbetalinger is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for signing my kontante ud og indbetalinger in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your kontante ud og indbetalinger and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit kontante ud og indbetalinger straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing kontante ud og indbetalinger right away.

What is kontante ud og indbetalinger?

Kontante ud og indbetalinger refers to cash deposits and withdrawals.

Who is required to file kontante ud og indbetalinger?

Businesses and individuals who handle cash transactions are required to file kontante ud og indbetalinger.

How to fill out kontante ud og indbetalinger?

Kontante ud og indbetalinger can be filled out online through the designated tax portal or with the assistance of a tax professional.

What is the purpose of kontante ud og indbetalinger?

The purpose of kontante ud og indbetalinger is to monitor and track cash transactions to prevent tax evasion and money laundering.

What information must be reported on kontante ud og indbetalinger?

Information such as the amount of cash deposited or withdrawn, date of transaction, and the parties involved must be reported on kontante ud og indbetalinger.

Fill out your kontante ud og indbetalinger online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kontante Ud Og Indbetalinger is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.