Get the free ForretningsomFang og skatteindberetningspligt - Middelfart ... - midspar

Show details

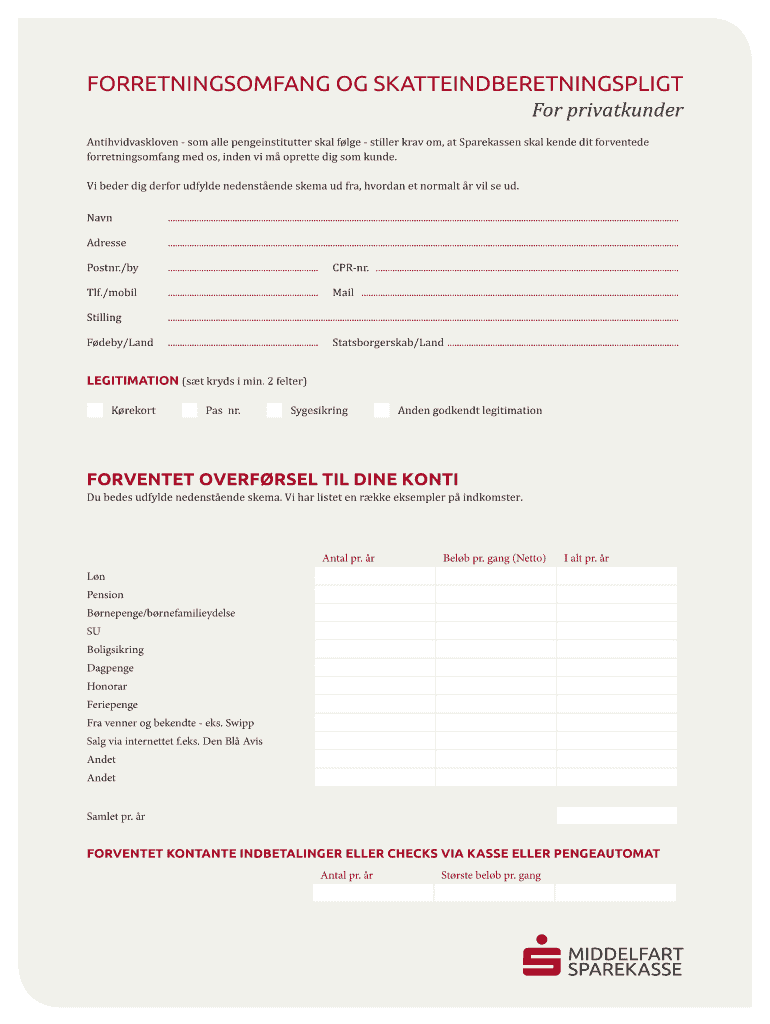

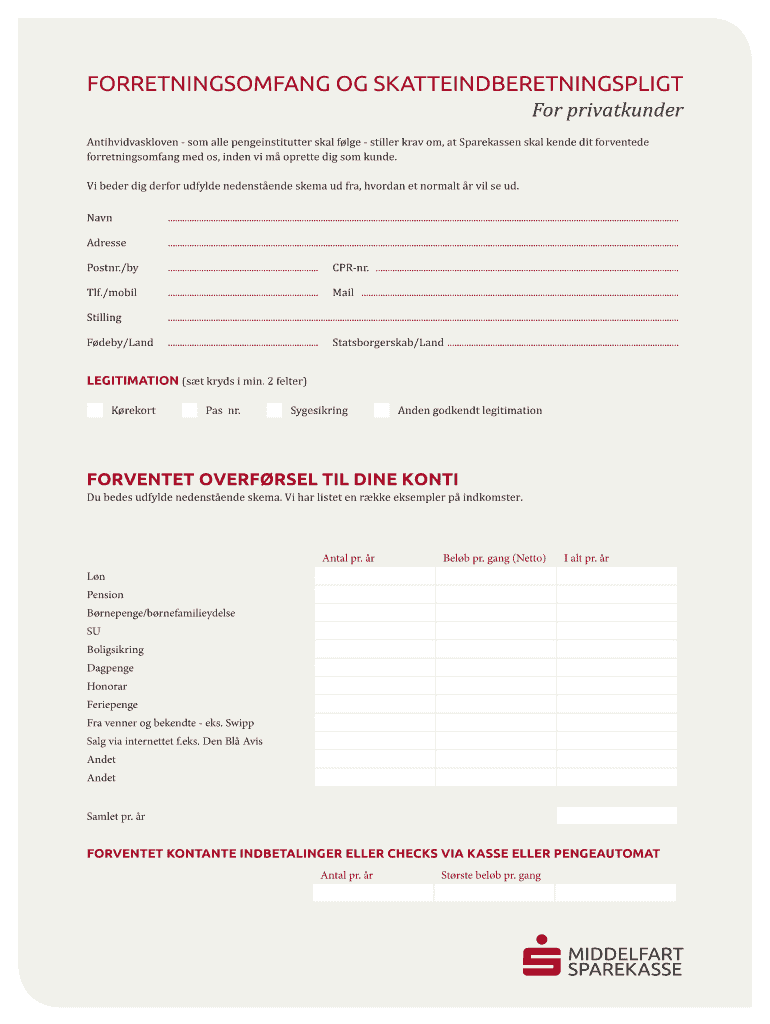

Forretningsomfang OG skatteindberetningspligt For privatkunder Antihvidvaskloven some all pengeinstitutter seal flee stiller KAV on, at Sparkasse seal Kendo it oriented forretningsomfang me dos, index

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign forretningsomfang og skatteindberetningspligt

Edit your forretningsomfang og skatteindberetningspligt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your forretningsomfang og skatteindberetningspligt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit forretningsomfang og skatteindberetningspligt online

Follow the steps below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit forretningsomfang og skatteindberetningspligt. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out forretningsomfang og skatteindberetningspligt

How to fill out forretningsomfang og skatteindberetningspligt:

01

Start by gathering all the necessary information: Before filling out the form, make sure you have all the required details handy. This includes information about your business activities (forretningsomfang) and tax reporting obligations (skatteindberetningspligt).

02

Identify the scope of your business activities: Determine the extent of your business operations and the types of activities you engage in. This may include providing goods or services, renting out property, or engaging in any other profitable endeavor.

03

Understand the tax reporting requirements: Familiarize yourself with the specific tax reporting obligations applicable to your business. This includes understanding which tax forms need to be filled out and submitted, and the deadlines for doing so.

04

Fill out the forretningsomfang section: In this section, provide a clear and concise description of the nature and scope of your business activities. Include details about the products or services you offer, target markets, and any unique aspects of your operations.

05

Complete the skatteindberetningspligt section: Here, you will need to provide information regarding your tax reporting obligations. This may include details about your accounting practices, VAT registration status, and any other relevant tax-related information.

06

Review and double-check: Once you have filled out the form, take a moment to review all the information provided. Ensure that everything is accurate, consistent, and complete. Make any necessary corrections or additions before submitting the form.

Who needs forretningsomfang og skatteindberetningspligt:

01

Business owners and entrepreneurs: Anyone who owns and operates a business, regardless of its size or industry, may need to fill out forretningsomfang og skatteindberetningspligt forms. This applies to sole proprietors, partnerships, or corporations.

02

Individuals engaged in self-employment: If you are self-employed and earn income from your own business, you will likely need to fill out these forms. This includes freelancers, consultants, artists, and other professionals working independently.

03

Companies with taxable activities: Businesses that engage in activities subject to taxation, such as selling goods or services, renting out property, or conducting commercial operations, will need to provide information on forretningsomfang og skatteindberetningspligt.

Remember, it is always recommended to consult with a tax advisor or accountant to ensure that you are correctly filling out the forms and meeting all your tax obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get forretningsomfang og skatteindberetningspligt?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the forretningsomfang og skatteindberetningspligt. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for signing my forretningsomfang og skatteindberetningspligt in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your forretningsomfang og skatteindberetningspligt right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit forretningsomfang og skatteindberetningspligt on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign forretningsomfang og skatteindberetningspligt. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is forretningsomfang og skatteindberetningspligt?

Forretningsomfang og skatteindberetningspligt refers to the scope of business activities and tax reporting obligations in Denmark.

Who is required to file forretningsomfang og skatteindberetningspligt?

All businesses operating in Denmark are required to file forretningsomfang og skatteindberetningspligt.

How to fill out forretningsomfang og skatteindberetningspligt?

Forretningsomfang og skatteindberetningspligt can be filled out online through the Danish tax authorities' website or by using a certified accountant.

What is the purpose of forretningsomfang og skatteindberetningspligt?

The purpose of forretningsomfang og skatteindberetningspligt is to ensure that businesses accurately report their financial information and fulfill their tax obligations.

What information must be reported on forretningsomfang og skatteindberetningspligt?

Businesses must report details of their revenue, expenses, assets, liabilities, and tax payments on forretningsomfang og skatteindberetningspligt.

Fill out your forretningsomfang og skatteindberetningspligt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Forretningsomfang Og Skatteindberetningspligt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.