Get the free Form 3903

Show details

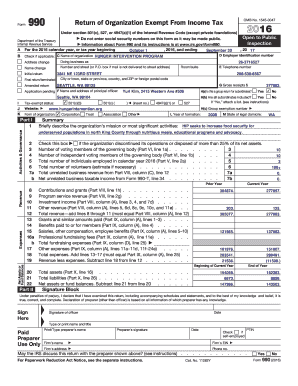

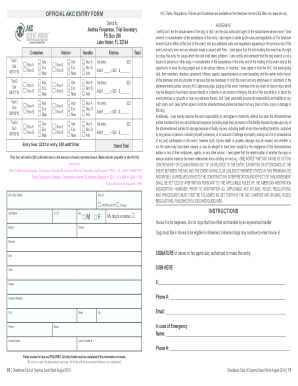

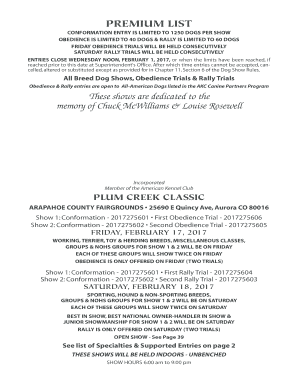

Use Form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 3903

Edit your form 3903 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 3903 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 3903 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 3903. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 3903

How to fill out Form 3903

01

Begin by downloading Form 3903 from the IRS website.

02

Provide your name and Social Security number at the top of the form.

03

Indicate the year for which you are filing the form.

04

Enter the details of the sale of your home including the address and the sale date.

05

Fill in the amount received from the sale and any allowable adjustments.

06

Calculate the gain or loss on the sale as directed in the form instructions.

07

Complete any additional sections that apply, such as exclusions for gain or loss.

08

Sign and date the form before submitting it with your tax return.

Who needs Form 3903?

01

Individuals who sold their primary residence and have a gain from the sale.

02

Taxpayers seeking to report capital gains or losses from the sale of their home.

03

People looking to apply for a capital gains tax exclusion on the sale of their principal residence.

Fill

form

: Try Risk Free

People Also Ask about

What qualifies as a moving expense in the IRS?

Definition of moving expenses This includes the cost of packing and shipping possessions, insuring belongings, transportation fees, lodging expenses during the move, and certain storage charges.

Is it worth claiming moving expenses on taxes?

Most people can't deduct these moving expenses on their taxes, even if they are moving for work. The only way you can deduct moving expenses on your taxes is if you are an active-duty member of the U.S. military moving because of a military order resulting in a permanent change of station.

What moving expenses are deductible for the military?

Deductible moving expenses - You can deduct expenses that are reasonable for the circumstances of your move. Your eligible moving expenses include household goods, personal effects, storage and traveling expenses (including lodging) to your new home. You can't deduct any expenses for meals.

Who qualifies for moving expense deduction?

If you move because of a permanent change of station, you can deduct the reasonable unreimbursed expenses of moving you and members of your household. See Specific Line Instructions, later, for how to report this deduction.

What qualifies as moving expenses in the IRS?

Moving expenses encompass a broad spectrum of costs incurred when relocating one's residence. The IRS defines these as the reasonable expenses directly related to the moving of household goods and personal effects, along with traveling costs from the old to the new home.

What form do I need to report moving expenses?

Moving Expense Deduction – For taxable years beginning on or after January 1, 2021, taxpayers should file California form FTB 3913, Moving Expense Deduction, to claim moving expense deductions.

Can the military write off haircuts on taxes?

No, you cannot claim haircuts and shaving expenses while in the military. These are considered personal expenses and are not deductible.

How much do you get back in taxes for moving expenses?

For most taxpayers, moving expenses are no longer deductible, meaning you can no longer claim this deduction on your federal return.

What is the 3903 form used for?

More In Forms and Instructions Use Form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace).

What is a 3903 form for the military?

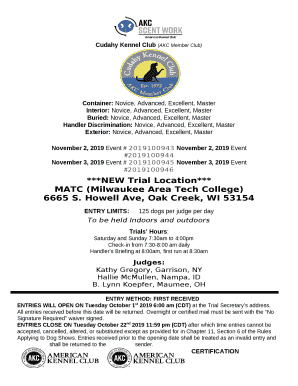

Military personnel should use Form 3903 to report their moving expenses: Shipping and storage costs for packing and moving your household goods and personal effects go on line 1 of Form 3903. Travel, lodging, and gas costs go on line 2. Reimbursements from your employer for any moving expenses are reported on line 4.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 3903?

Form 3903 is a tax form used by individuals to claim a deduction for moving expenses associated with a job-related move.

Who is required to file Form 3903?

Individuals who have incurred qualified moving expenses related to starting a new job or relocating for work may need to file Form 3903.

How to fill out Form 3903?

To fill out Form 3903, individuals must provide details about the move, including the new job location, old and new addresses, and a list of qualified moving expenses. Instructions are provided on the form.

What is the purpose of Form 3903?

The purpose of Form 3903 is to allow taxpayers to claim a deduction for moving expenses that meet certain criteria, thus reducing their taxable income.

What information must be reported on Form 3903?

Form 3903 requires reporting of the taxpayer's old and new addresses, the distance of the move, the date of the move, and a breakdown of the qualified moving expenses incurred.

Fill out your form 3903 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 3903 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.