Get the free form 27q

Show details

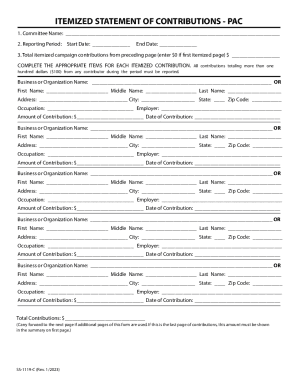

Form No.27Q See section 194E, 194LB, 194LC, 195, 196A, 196B, 196C, 196D, and rule 31A Quarterly statement of deduction of tax under subsection (3) of section 200 of the Income tax Act in respect of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 27q form

Edit your form 27q form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 27q form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 27q online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 27q. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 27q

How to fill out form 27q?

01

Start by obtaining the form: Form 27Q is a tax statement filed by individuals or entities making payments to non-residents in India, such as landlords, contractors, or freelancers. You can download the form from the official website of the Indian Income Tax Department or collect a physical copy from designated centers.

02

Fill in the basic details: Begin by entering the relevant information, such as name, address, and PAN (Permanent Account Number) of the individual or entity making the payment. Ensure accuracy and clarity while entering these details.

03

Specify the assessment year: Indicate the assessment year for which the form is being filled. The assessment year is the year following the financial year in which the payments were made. For example, if the payments were made during the financial year 2021-2022, the assessment year would be 2022-2023.

04

Provide details of the deductee: Fill in the required information about the non-resident individual or entity to whom the payment is being made. This includes their name, address, country of residence, and PAN, if available. If the PAN is not available, provide the reason for its non-availability.

05

Specify the nature of the payment: Identify and select the appropriate code to indicate the type of payment being made to the non-resident. These codes represent various categories such as rent, technical services, royalties, etc. Refer to the instructions provided with the form to select the correct code.

06

Enter the transaction details: Provide the details of each payment made to the non-resident. This includes the amount paid, the date of payment, and any tax deducted at source (TDS) if applicable. Ensure all the necessary columns are filled accurately to avoid any discrepancies.

07

Calculate the total amounts and TDS: Sum up the total payments made to the non-resident and calculate the total TDS withheld, if any. Ensure that the TDS calculations are accurate, and the appropriate tax rate is applied based on the nature of the payment and the relevant double taxation avoidance agreements (DTAA), if applicable.

08

Complete the verification section: Sign and date the form in the designated section to declare the information provided is true and correct to the best of your knowledge. If the form is being filled by an authorized person, their name and capacity should also be mentioned.

Who needs form 27q?

01

Employers: Employers in India who make payments to non-resident employees or expatriates working in the country need to fill out form 27Q. This includes salaries, bonuses, or any other remuneration paid to non-residents.

02

Renters: Individuals or entities who pay rent to non-resident landlords for properties in India are required to submit form 27Q. This form ensures the proper deduction and payment of TDS on the rental income.

03

Service recipients: If you are a business or an individual in India availing services from non-residents, such as technical services, consultancy, or professional fees, you need to fill out form 27Q. This form helps in the deduction and payment of TDS on such service payments.

04

Contractors and freelancers: Companies or individuals who make payments to non-resident contractors or freelancers for services rendered in India are obligated to submit form 27Q. It ensures the proper deduction and payment of TDS on such payments.

Note: It is advisable to consult a tax professional or refer to the official guidelines of the Indian Income Tax Department for accurate and up-to-date information on filling out form 27Q, as tax laws and regulations may change over time.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my form 27q in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your form 27q right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out the form 27q form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign form 27q. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I complete form 27q on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your form 27q by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is form 27q?

Form 27Q is a quarterly statement that needs to be filed by a person responsible for deducting tax at source (TDS) on payments made to non-residents. It is filed under the Indian Income Tax Act, 1961.

Who is required to file form 27q?

Any person who is responsible for deducting tax at source (TDS) on payments made to non-residents is required to file form 27Q. This includes individuals, companies, partnerships, trusts, etc.

How to fill out form 27q?

Form 27Q can be filled out online through the website of the Tax Information Network (TIN) or through authorized centers. The form requires various details such as the PAN of the deductor and deductee, nature of payment, amount paid, tax deducted, etc.

What is the purpose of form 27q?

The purpose of form 27Q is to report tax deducted at source (TDS) on payments made to non-residents. It helps in ensuring compliance with tax regulations and enables the government to keep track of such transactions.

What information must be reported on form 27q?

Form 27Q requires information such as PAN of the deductor and deductee, details of the payment made, nature of payment, amount paid, tax deducted, etc. It is important to accurately report all the required information.

Fill out your form 27q online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 27q is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.