Get the free Revolving Loan Fund Application - Sherburn

Show details

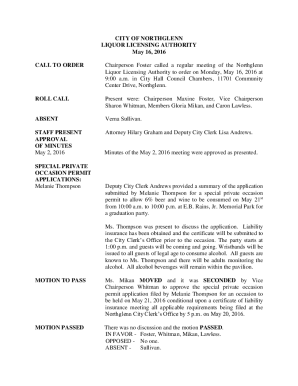

City of Hepburn P.O. Box 667, Hepburn, MN 56171 ×507× 7644491 Fax (507× 7643882 REVOLVING LOAN PROGRAM REAPPLICATION NAME: PHONE NUMBER: ADDRESS: CITY×STATE×ZIP: TOTAL PROJECT COST: PROJECT DESCRIPTION:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revolving loan fund application

Edit your revolving loan fund application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revolving loan fund application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit revolving loan fund application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit revolving loan fund application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revolving loan fund application

How to fill out a revolving loan fund application:

01

Gather necessary documents: Start by gathering all the documents you will need to complete the application. This may include personal identification, financial statements, and business plans.

02

Provide personal and business information: Begin the application by filling out your personal and business information. This may include your name, address, contact details, and legal business entity details.

03

Describe the loan purpose: Clearly articulate the purpose of the loan and how it will be used to benefit your business. This could involve investing in new equipment, expanding operations, or funding working capital.

04

Present a detailed financial analysis: Include a comprehensive financial analysis of your business. This should include income statements, balance sheets, and cash flow projections. Be sure to provide accurate and up-to-date information to demonstrate your ability to repay the loan.

05

Explain collateral and security: Describe any collateral or security you are willing to offer as a guarantee for the loan. This can provide reassurance to the lender and increase your chances of approval.

06

Identify co-signers or guarantors: If necessary, include information about any co-signers or guarantors who will be responsible for the loan repayment in case of default.

07

Provide supporting documents: Attach any additional supporting documents that can strengthen your loan application. This could include letters of recommendation, business contracts, or other relevant financial statements.

08

Review and double-check: Before submitting the application, thoroughly review all the information provided. Double-check for any errors or missing information that could hinder the processing of your application.

Who needs a revolving loan fund application?

01

Small business owners: Small business owners who need financial support for their ventures may require a revolving loan fund application. This type of loan can provide them with the necessary working capital or funds for growth and expansion.

02

Startups: Startups often require additional capital to launch and establish their business. A revolving loan fund application can help secure the funds needed for initial operations and growth.

03

Non-profit organizations: Revolving loan funds can be beneficial for non-profit organizations looking to finance their programs or initiatives. This application is relevant for organizations seeking financial assistance for community development, sustainability projects, or other non-profit activities.

In conclusion, filling out a revolving loan fund application involves gathering documents, providing personal and business information, explaining the loan purpose, presenting financial analysis, discussing collateral and guarantors, and including supporting documents. This application is commonly needed by small business owners, startups, and non-profit organizations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify revolving loan fund application without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your revolving loan fund application into a dynamic fillable form that you can manage and eSign from anywhere.

How do I complete revolving loan fund application online?

Easy online revolving loan fund application completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for the revolving loan fund application in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your revolving loan fund application in seconds.

What is revolving loan fund application?

The revolving loan fund application is a formal request for financial assistance from a revolving loan fund established to provide funding for eligible projects.

Who is required to file revolving loan fund application?

Any individual or organization seeking financial assistance from the revolving loan fund is required to file a revolving loan fund application.

How to fill out revolving loan fund application?

The revolving loan fund application must be completed with accurate and comprehensive information about the project, the requested amount of funding, the expected outcomes, and other relevant details.

What is the purpose of revolving loan fund application?

The purpose of the revolving loan fund application is to assess the eligibility of the project for funding, evaluate the potential impact of the project, and determine the amount of financial assistance to be provided.

What information must be reported on revolving loan fund application?

The revolving loan fund application must include details about the project, the funding amount requested, the project timeline, the expected outcomes, the budget, and other relevant information.

Fill out your revolving loan fund application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revolving Loan Fund Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.