Get the free Critical Illness and Accident enrollment form - Aetna

Show details

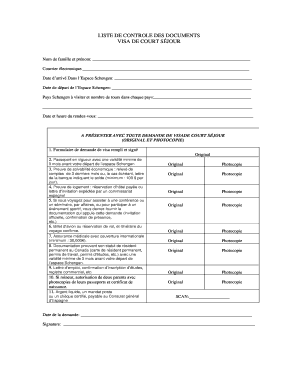

American Heritage Life Insurance Company (AHL) PO Box 40869 Jacksonville, FL 32224 877-750-5434 aetnasupport allstate.com New Certificate Change/Increase Certificate # U Group Critical Illness and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign critical illness and accident

Edit your critical illness and accident form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your critical illness and accident form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing critical illness and accident online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit critical illness and accident. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out critical illness and accident

How to fill out critical illness and accident insurance?

01

Obtain the necessary application form: Contact your insurance provider or visit their website to obtain the application form for critical illness and accident insurance. This form will require your personal information, medical history, and details about any existing coverage you may have.

02

Provide accurate personal information: Fill out the application form with accurate personal information such as your full name, date of birth, address, and contact details. Ensure that all details are correctly spelled and properly entered.

03

Disclose medical history: When filling out the form, provide a detailed and honest account of your medical history. Be sure to include any pre-existing medical conditions, previous surgeries or treatments, and any ongoing prescriptions or medications you currently take.

04

Understand coverage options: Review the different coverage options available for critical illness and accident insurance. Some policies may offer specific coverage for certain illnesses or accidents, while others may provide broader coverage. Be sure to read and understand the terms and conditions of each option before making a selection.

05

Choose coverage limits: Determine the coverage limits you require based on your personal needs and financial situation. Consider factors such as your income, existing insurance coverage, and potential medical expenses to determine an appropriate coverage limit.

06

Select additional benefits: Some critical illness and accident insurance policies offer additional benefits such as income protection or optional riders. Evaluate these benefits and determine if they align with your specific needs and preferences.

07

Submit the completed form: Once you have filled out the application form accurately and reviewed all the necessary information, sign and date the form. Follow the instructions provided by your insurance provider to submit the completed form, whether it be through email, mail, or an online portal.

Who needs critical illness and accident insurance?

01

Individuals with dependents: If you have dependents or a family relying on your income, critical illness and accident insurance can provide financial protection in the event of an unexpected illness or accident. It can help cover medical expenses and replace lost income during recovery.

02

Self-employed or freelancers: For self-employed individuals or freelancers who do not have access to employer-provided insurance, critical illness and accident insurance can be essential. It ensures financial stability in the face of unforeseen circumstances that could impact both health and income.

03

Those with high-risk lifestyles or occupations: People engaging in activities with a higher risk of accidents or illness, such as extreme sports enthusiasts or individuals employed in dangerous occupations, can benefit from having critical illness and accident insurance. It provides a safety net and financial protection in case of injury or severe illness.

04

Individuals with limited savings: If you have limited savings or financial reserves, the financial burden of unexpected medical expenses can be overwhelming. Critical illness and accident insurance can provide the necessary coverage to alleviate the financial strain and ensure access to quality medical care.

05

Anyone seeking peace of mind: Even individuals who may not fall into specific risk categories can benefit from critical illness and accident insurance. It offers peace of mind knowing that you are financially protected in the event of a critical illness or accident, allowing you to focus on recovery and well-being.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is critical illness and accident?

Critical illness and accident refers to a type of insurance coverage that provides financial protection in the event of a serious illness or accident. It typically pays out a lump sum amount to the policyholder or their beneficiaries to help cover medical expenses, lost income, or other related costs.

Who is required to file critical illness and accident?

Any individual or organization that has obtained a critical illness and accident insurance policy is required to file a claim in the event of a covered illness or accident. The policyholder or their designated beneficiaries are responsible for filing the claim.

How to fill out critical illness and accident?

To fill out a critical illness and accident claim, you will typically need to provide relevant information such as the policyholder's personal details, the nature of the illness or accident, medical reports, and any supporting documentation. This information is usually submitted to the insurance company either online or through a physical claim form.

What is the purpose of critical illness and accident?

The purpose of critical illness and accident insurance is to provide financial protection and support to individuals or their beneficiaries in the event of a serious illness or accident. It helps alleviate the financial burden associated with medical expenses, loss of income, and other related costs.

What information must be reported on critical illness and accident?

The information that must be reported on a critical illness and accident claim typically includes the policyholder's personal details (such as name, contact information), the date and nature of the illness or accident, medical reports or documentation supporting the claim, and any other relevant information requested by the insurance company.

How can I send critical illness and accident to be eSigned by others?

Once your critical illness and accident is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out critical illness and accident using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign critical illness and accident and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete critical illness and accident on an Android device?

On an Android device, use the pdfFiller mobile app to finish your critical illness and accident. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your critical illness and accident online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Critical Illness And Accident is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.