Get the free Investing for the long term - Scotiabank

Show details

SCHEDULE A (Adjustable Rate Mortgage) To a Mortgage or Charge (the mortgage×, covering residential property containing not more than 4 dwelling units made between and SCOTIA MORTGAGE CORPORATION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign investing for form long

Edit your investing for form long form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your investing for form long form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing investing for form long online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit investing for form long. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out investing for form long

01

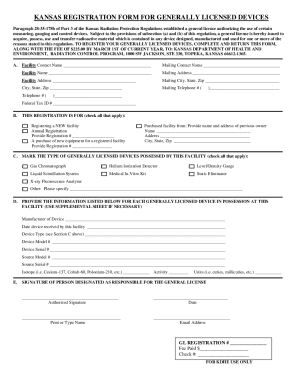

To fill out the investing for form long, start by gathering all the necessary documents such as personal identification, financial statements, and investment information.

02

Next, carefully read through the form and understand the instructions provided. Pay attention to any specific requirements or additional documents that may be needed.

03

Begin by providing your personal details such as name, address, and contact information. Ensure that all the information is accurate and up to date.

04

Moving on, enter your financial information including your income, assets, and liabilities. Be thorough and honest with these details to accurately assess your financial situation.

05

If required, provide information about your investment goals, risk tolerance, and investment knowledge. This helps the investment provider better understand your needs and preferences.

06

Carefully review the completed form to ensure that all the information provided is accurate and complete. Double-check for any errors or omissions.

07

Sign and date the form to certify that the information provided is true and accurate to the best of your knowledge.

08

If required, attach any supporting documents or proof to substantiate the information provided on the form.

09

Finally, submit the completed investing for form long to the appropriate investment provider or institution, following their specified submission process.

Who needs investing for form long?

01

Individuals who are planning to make long-term investments and grow their wealth over time.

02

Those who want to plan for retirement and are looking for investment options that offer long-term growth potential.

03

Individuals who want to diversify their investment portfolio and are interested in investing in various asset classes for the long term.

04

People who have specific financial goals such as buying a home, funding their children's education, or starting a business, and are looking for investment vehicles to help reach those goals.

05

Investors who are willing to tolerate short-term market fluctuations and are focused on accumulating wealth over an extended period.

Overall, investing for the long term can be suitable for a wide range of individuals who are willing to commit to a strategic investment approach and understand the risks associated with long-term investments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete investing for form long online?

pdfFiller has made it simple to fill out and eSign investing for form long. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit investing for form long straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing investing for form long.

How do I fill out investing for form long on an Android device?

Complete investing for form long and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is investing for form long?

Investing for form long refers to a type of investment strategy that involves holding on to assets for an extended period of time in order to potentially achieve long-term financial growth.

Who is required to file investing for form long?

Any individual or entity who engages in long-term investing activities is required to file investing for form long.

How to fill out investing for form long?

Investing for form long can be filled out by providing information about the assets held, the duration of investment, and the expected long-term growth goals.

What is the purpose of investing for form long?

The purpose of investing for form long is to build wealth over time through the appreciation of assets and the reinvestment of earnings.

What information must be reported on investing for form long?

Information such as the types of assets held, the dates of acquisition, the original cost, and any changes in value must be reported on investing for form long.

Fill out your investing for form long online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Investing For Form Long is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.