Get the free California Personal Automobile Policy

Show details

This document outlines the legal contract between the insured and Integon National Insurance Company for automobile insurance in California. It details the policy provisions, coverages, limitations,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign california personal automobile policy

Edit your california personal automobile policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california personal automobile policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing california personal automobile policy online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit california personal automobile policy. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out california personal automobile policy

How to fill out California Personal Automobile Policy

01

Gather personal information, including your name, address, and date of birth.

02

Provide details about the vehicle, including the make, model, year, and VIN (Vehicle Identification Number).

03

Select the coverage options you need, such as liability, collision, and comprehensive coverage.

04

Determine your policy limits for liability coverage based on your financial situation and needs.

05

Fill in the details regarding any drivers who will be covered under the policy, including their licenses and driving history.

06

Review any discounts you may qualify for, such as multi-policy or safe driver discounts.

07

Read the policy terms and conditions carefully before finalizing the application.

08

Submit the completed application form to your insurance provider.

Who needs California Personal Automobile Policy?

01

California residents who own or lease a personal vehicle.

02

Individuals who want to protect themselves financially in the event of an accident.

03

Drivers who are required by law to carry liability insurance coverage in California.

04

People looking for comprehensive coverage options to protect against theft, damage, and other risks.

Fill

form

: Try Risk Free

People Also Ask about

Why are auto insurance companies not insuring in California?

Several insurance companies have either fled California, stopped writing new policies or otherwise reduced their exposure in the Golden State, citing business risks amid rising replacement costs and the inability to adequately raise premiums.

What is the new insurance mandate in California?

The individual mandate means that Californians must either have qualifying health insurance, or pay a penalty when filing their state tax return unless they qualify for an exemption. How much? For tax year 2023, the penalty will cost at least $900 per adult and $450 per dependent child under 18 in your household.

What are the three basic sections of a personal auto policy?

Most auto insurance policies contain three major parts: liability insurance for bodily injury, liability insurance for property damage and uninsured/under-insured motorists coverage.

What is the new law for car insurance in California?

Beginning January 1,2025, as auto insurance policies come up for renewal throughout the year, all standard auto insurance policies in California will have higher minimum liability limits: $30,000 for bodily injury or death per person (up from $15,000) $60,000 for bodily injury or death per accident (up from $30,000)

What does $100 k /$ 300k /$ 100k mean?

The numbers in the coverage refer to the maximum amount your insurer will pay out for each type of claim. So, in a 100/300/100 policy, you would have $100,000 coverage per person, $300,000 in bodily injury coverage per accident, and $100,000 in property damage coverage per accident.

Which car insurance is mandatory in California?

The law says that you must have auto liability insurance. However, if you have a low income, it can be hard to pay the premium. California has a program to help you. This program helps income-eligible good drivers get insurance.

What is a personal automobile policy?

Personal automobile insurance covers private passenger vehicles. It provides protection against economic loss to an insured from bodily injury or property damage to others (liability) arising from the operation, maintenance, or use of a covered automobile.

What is the new car insurance policy in California?

Beginning January 1,2025, as auto insurance policies come up for renewal throughout the year, all standard auto insurance policies in California will have higher minimum liability limits: $30,000 for bodily injury or death per person (up from $15,000) $60,000 for bodily injury or death per accident (up from $30,000)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is California Personal Automobile Policy?

The California Personal Automobile Policy is an insurance policy designed to provide coverage for personal vehicles owned by individuals in California, offering protection against financial loss from accidents, theft, and other damages.

Who is required to file California Personal Automobile Policy?

Drivers who own personal vehicles and wish to have insurance coverage to comply with California law are required to file a California Personal Automobile Policy.

How to fill out California Personal Automobile Policy?

To fill out the California Personal Automobile Policy, individuals must provide personal information such as name, address, vehicle details, coverage options selected, and relevant driving history.

What is the purpose of California Personal Automobile Policy?

The purpose of the California Personal Automobile Policy is to provide financial protection to individuals from losses incurred due to accidents, injuries, property damage, and legal liabilities associated with operating their personal vehicles.

What information must be reported on California Personal Automobile Policy?

Information that must be reported includes the insured's name and address, information about all vehicles covered, driver's license numbers, the coverage amounts selected, and any previous claims or violations.

Fill out your california personal automobile policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Personal Automobile Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

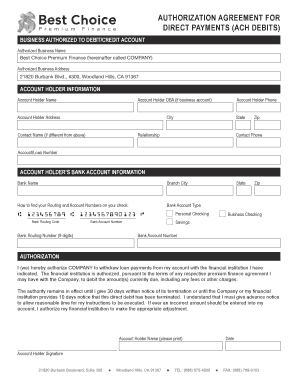

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.