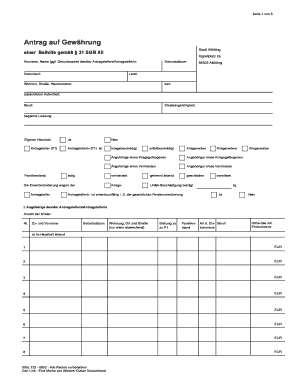

Get the free Health Savings 3000

Show details

This document outlines the Health Savings 3000 plan, detailing coverage, deductibles, co-pays, and exclusions for medical services in Florida.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign health savings 3000

Edit your health savings 3000 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your health savings 3000 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit health savings 3000 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit health savings 3000. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out health savings 3000

How to fill out Health Savings 3000

01

Gather necessary personal information such as your Social Security number and tax identification details.

02

Obtain the Health Savings 3000 form from the appropriate source, typically from your employer or insurance provider.

03

Fill out your personal information in the designated sections of the form.

04

Review the instructions for eligibility to confirm you qualify for Health Savings 3000.

05

Follow the guidelines for reporting any contributions or deductions related to your health savings account (HSA).

06

Double-check all entries for accuracy before submission.

07

Submit the completed form according to the provided instructions, whether electronically or by mail.

Who needs Health Savings 3000?

01

Individuals and families with high-deductible health plans (HDHPs) who want to save for medical expenses.

02

Those looking to take advantage of tax benefits associated with Health Savings Accounts (HSAs).

03

People who expect to incur out-of-pocket medical costs and wish to save funds tax-free for future health expenses.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between HSA 3000 and HSA 1500?

An important difference between the HSA 3000 and the HSA 1500 is the calculation of the annual deductible when you cover yourself and other family members. you cover, s pays 100% for in-network preventive care services. You don't need to meet the annual deductible first.

Is a 3000 health insurance deductible good?

Somewhere between 3000-6000 in expenses it's better to have the low deductible, but only marginally because the HSA provides tax benefits that the low deductible doesn't have. And if we are going to have an out of pocket max year, the high deductible wins even without the HSA.

What is medical ppo 3000?

When you go in for medical care, you pay 100% of the cost of most covered services out of your HSA until you reach the deductible of $3,000 for individuals or $6,000 for families. Then, you pay a lower percentage of the cost for covered services until you reach the out-of-pocket maximum for the year.

Should I choose a high-deductible health plan with HSA?

If you would benefit from reducing your taxable income by contributing to your HSA, you should consider an HDHP. If you would like to save for medical expenses in the future or qualified medical expenses not covered by the health plan (Lasix, orthodontia), you should consider an HDHP.

Which HSA to choose?

The best HSA accounts in 2024 Best for accessibility: Lively. Best for investment options: Fidelity Investments. Best for short-term spending: HealthEquity. Best for reimbursement of out-of-pocket expenses: HSA Bank. Best HSA offered by a traditional bank: .

What is a good HSA amount?

Contribute the maximum amount: Since the money in your HSA does not expire, it's a good idea to contribute as much as you can each year. The HSA contribution limit for 2024 is $4,150 for individuals and $8,300 for family coverage.

What is a good amount for an HSA?

The short answer: As much as you're able to (within IRS contribution limits), if that's financially viable. If you're covered by an HSA-eligible health plan (or high-deductible health plan), the IRS allows you to put as much as $4,300 per year (in 2025) into your health savings account (HSA).

Should I withdraw excess HSA contributions?

If you have an excess, you should withdraw it. Otherwise, you are subject to a 6% excise tax on excess contributions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Health Savings 3000?

Health Savings 3000 is a tax form used to report contributions to and distributions from Health Savings Accounts (HSAs).

Who is required to file Health Savings 3000?

Individuals who have contributed to or withdrawn from a Health Savings Account (HSA) during the tax year are required to file Health Savings 3000.

How to fill out Health Savings 3000?

To fill out Health Savings 3000, individuals must provide information about their HSA contributions, distributions, and any tax-related information regarding qualified medical expenses.

What is the purpose of Health Savings 3000?

The purpose of Health Savings 3000 is to allow individuals to report their HSA activities to the IRS in order to track contributions, distributions, and to ensure compliance with tax regulations.

What information must be reported on Health Savings 3000?

Health Savings 3000 requires reporting of total HSA contributions, distributions taken, and details about eligible medical expenses that the funds were used for.

Fill out your health savings 3000 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Health Savings 3000 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.