Get the free Group Life Insurance Application

Show details

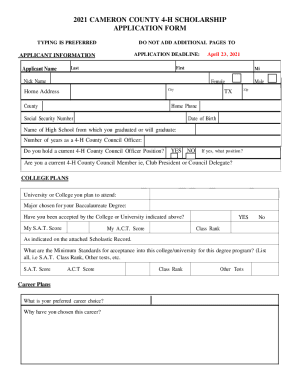

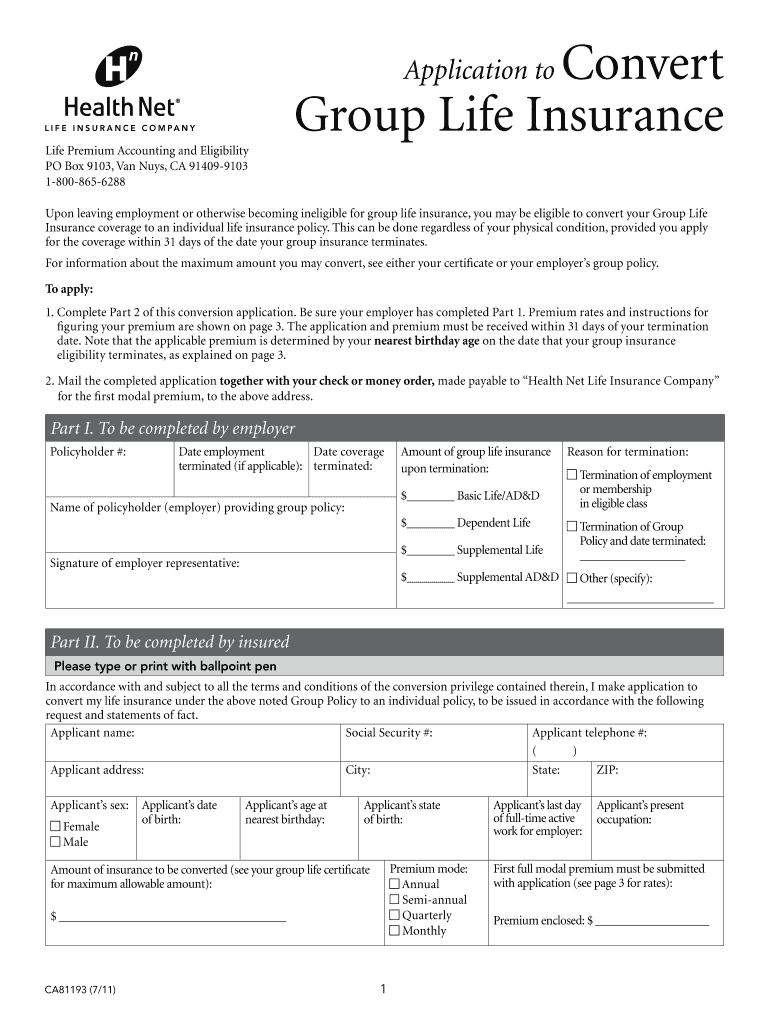

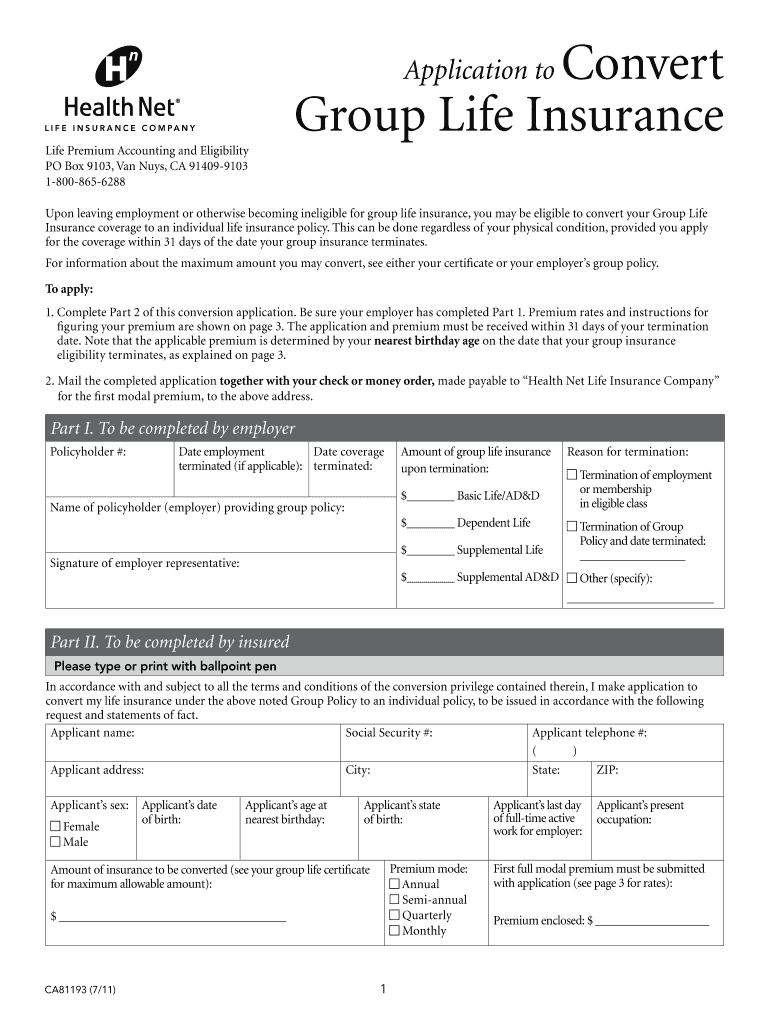

This document serves as an application to convert group life insurance coverage to an individual policy upon termination of employment or eligibility, detailing the process and requirements for conversion.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign group life insurance application

Edit your group life insurance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your group life insurance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing group life insurance application online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit group life insurance application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out group life insurance application

How to fill out Group Life Insurance Application

01

Obtain the Group Life Insurance Application form from the provider.

02

Fill out the employer or organization details on the application.

03

Provide information about the group members, including names, ages, and any other required personal information.

04

Include details about the desired coverage amount for each member.

05

Answer any health-related questions as required in the application.

06

Sign the application form as required by the insurance provider.

07

Submit the completed application form to the insurance provider for processing.

Who needs Group Life Insurance Application?

01

Organizations with employees looking to offer life insurance benefits.

02

Businesses seeking to enhance employee benefits packages.

03

Associations wanting to provide life insurance options to their members.

04

Non-profits aiming to support their staff with insurance coverage.

05

Groups that wish to pool resources for more affordable life insurance options.

Fill

form

: Try Risk Free

People Also Ask about

What should you not say when applying for life insurance?

Lying about anything on a life insurance application constitutes insurance fraud. Purposefully omitting or lying about your health information can lead to your life insurance application being denied — or much worse — your beneficiaries not receiving their death benefit after you pass away.

What not to say when applying for life insurance?

Qualifying for group policies is easy, with coverage guaranteed to all group members. Unlike individual policies, group insurance doesn't require a medical exam. However, low cost and convenience aren't everything.

How long does it take for a life insurance application to be approved?

A single policy that covers many people, most often provided by an employer or a group (like a union). Covers an individual for a certain amount of time only, in contrast to permanent insurance like whole life. Pays a lump sum to a deceased person's beneficiaries.

Is group life insurance easy to get?

Typically, it takes four to eight weeks for traditionally underwritten policies to be approved and issued. For instant life insurance policies that use accelerated underwriting, it's possible for coverage to go into effect on the same day.

What will disqualify me from life insurance?

Understanding Life Insurance Eligibility Pre-existing conditions, such as cancer, heart disease, and severe mental-nervous disorders, can potentially lead to the denial of life insurance coverage.

How honest should I be for life insurance?

When it comes to life insurance, don't lie. They will find your secret from a Facebook picture or something and then not pay a cent. If you are truthful, you may get denied or premiums raised, but they'll pay out if you speak truths.

What happens if insurance finds out you lied?

If you lie to your insurance company, the consequences can be severe, potentially leading to claim denial, policy cancellation, increased premiums, and even criminal charges for insurance fraud, depending on the extent of the lie and your location.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Group Life Insurance Application?

Group Life Insurance Application is a formal document submitted by an organization or employer to an insurance company to obtain life insurance coverage for a group of individuals, typically employees.

Who is required to file Group Life Insurance Application?

The organization or employer seeking to provide life insurance coverage to its employees is required to file the Group Life Insurance Application.

How to fill out Group Life Insurance Application?

To fill out a Group Life Insurance Application, the employer should provide accurate information about the organization, the number of employees, coverage amounts, and any necessary employee details such as names and dates of birth.

What is the purpose of Group Life Insurance Application?

The purpose of the Group Life Insurance Application is to facilitate the issuance of life insurance coverage for a group, ensuring financial protection for beneficiaries in the event of a member's death.

What information must be reported on Group Life Insurance Application?

The information that must be reported on a Group Life Insurance Application includes the organization's details, the number of insured members, the type and amount of coverage requested, and other relevant employee information.

Fill out your group life insurance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Group Life Insurance Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.