Get the free Gift Annuity Details - alc

Show details

This document outlines the process of creating a charitable gift annuity, including funding options such as cash, appreciated securities, and real estate. It explains the tax benefits, income options,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift annuity details

Edit your gift annuity details form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift annuity details form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gift annuity details online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit gift annuity details. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift annuity details

How to fill out Gift Annuity Details

01

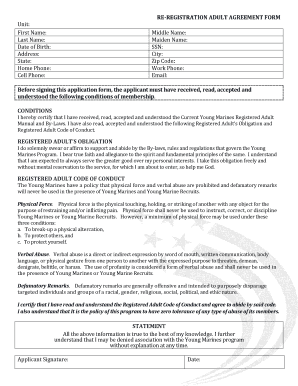

Start with the donor's information, including their full name and contact details.

02

Specify the amount of the gift being donated for the annuity.

03

Indicate the start date for the annuity payments.

04

Choose the payment frequency (monthly, quarterly, annually).

05

Provide details on the beneficiaries, including their names and relationship to the donor.

06

Include any relevant tax identification numbers or codes.

07

Review all information for accuracy before submission.

Who needs Gift Annuity Details?

01

Individuals who wish to create a gift annuity for charitable purposes.

02

Financial advisors guiding clients in charitable gifting strategies.

03

Non-profit organizations managing donor contributions and annuity agreements.

04

Legal and tax professionals assisting clients with estate planning.

Fill

form

: Try Risk Free

People Also Ask about

How does a gift annuity work?

With a charitable gift annuity you agree to make a gift to the Foundation and we, in return, agree to pay you (and someone else, if you choose) a fixed amount each year for the rest of your life. The balance is used to support our work.

Can an annuity be given as a gift?

Gifting an annuity to a family member If the annuity is in the accumulation phase when it is gifted, taxes on any gains will likely need to be paid. However, waiting until the annuity's payout phase before it is gifted can provide a tax-free source of lifetime income for the recipient.

How to report charitable gift annuity?

The charity that issues the annuity will send a Form 1099-R to the annuitant. This form will specify how the payments should be reported for income tax purposes.

What is the maximum charitable gift annuity?

Other CGA considerations Are a one-time opportunity for those funded directly from an IRA: You can fund more than one CGA, but they must all be completed in the same tax year and collectively cannot exceed a total of $54,000 in 2025.

How does an annuity get paid out?

Immediate annuity: Payout starts shortly after a single premium payment is made. Deferred annuity: Payout starts at a set date in the future. Fixed annuity: Payout is based on an amount guaranteed in the contract. Payments are normally fixed, and the insurance company bears the investment risk.

What is the charitable gift annuity limit for 2025?

How much can I donate? For a QCD-funded charitable gift annuity, there is an aggregate limit of $54,000 per taxpayer in 2025. A married couple can each contribute $54,000 from their respective IRAs, for a total of $108,000. These dollar limits may be adjusted for inflation in future years.

What is a term of years gift annuity?

With a term-of-years gift annuity, the donor receives a charitable tax deduction and income for a period of years. As long as the annuitant elects the term-of-years option prior to the annuity starting date, the annuitant receives payments that are partially taxed as ordinary income and partially tax-free.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Gift Annuity Details?

Gift Annuity Details refer to the information and documentation related to financial agreements where a donor makes a gift to a charity in exchange for a lifetime annuity. This includes terms regarding the payment amount, frequency, and duration of the annuity.

Who is required to file Gift Annuity Details?

Charitable organizations that issue gift annuities must file Gift Annuity Details to ensure compliance with regulatory requirements and maintain transparency with donors and tax authorities.

How to fill out Gift Annuity Details?

To fill out Gift Annuity Details, organizations need to provide information such as donor details, the amount of the gift, payment terms, the annuity rate, and any other related provisions or terms stipulated in the annuity agreement.

What is the purpose of Gift Annuity Details?

The purpose of Gift Annuity Details is to formally document the annuity agreement between a donor and a charitable organization, ensuring both parties understand the financial implications and regulatory obligations of the annuity arrangement.

What information must be reported on Gift Annuity Details?

Gift Annuity Details must report information such as the donor's name, Social Security number, the amount of the gift, the annuity payment schedule, the value of the annuity, and any specific terms or conditions associated with the gift.

Fill out your gift annuity details online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift Annuity Details is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.