Get the free Pre-Authorized Debit Agreement (Payor's PAD Agreement) ATT AC ... - stemileschool

Show details

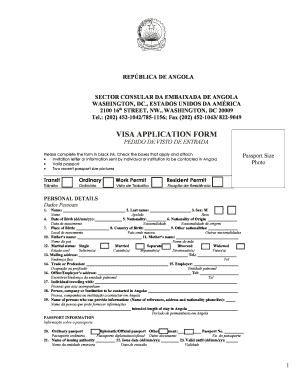

Reset Print PreAuthorized Debit Agreement (Mayors PAD Agreement) New Authorization: Cancellation Notice: Change to Existing: Payee Information: Credit (Transfer to) Account Holder’s) (the Payee):

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pre-authorized debit agreement payor39s

Edit your pre-authorized debit agreement payor39s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pre-authorized debit agreement payor39s form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pre-authorized debit agreement payor39s online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pre-authorized debit agreement payor39s. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pre-authorized debit agreement payor39s

How to fill out pre-authorized debit agreement payor's:

01

Gather the necessary information: Before filling out the pre-authorized debit agreement, make sure you have all the required information. This includes your banking information, such as your account number and transit number, as well as the name and contact information of the payee.

02

Read the agreement carefully: Take the time to carefully read the pre-authorized debit agreement. Understand the terms and conditions, including the frequency of the debits, the payment amounts, and any cancellation policies. Make sure you agree with all the terms before proceeding.

03

Provide accurate information: Fill out the agreement accurately and ensure that the information you provide is correct. Any mistakes or incorrect information can lead to payment issues or delays. Double-check your banking details and contact information before submitting the form.

04

Sign and date the agreement: Once you have filled in all the necessary information, sign and date the pre-authorized debit agreement. This serves as your authorization for the payee to withdraw funds from your specified bank account. Make sure your signature is clear and legible.

05

Keep a copy: After completing the agreement, make a copy for your records. This will serve as a reference in case you need to review the terms or resolve any disputes in the future. It's always a good idea to keep a record of any financial agreements you enter into.

Who needs pre-authorized debit agreement payor's:

01

Individuals paying recurring bills: Pre-authorized debit agreements are commonly used by individuals who have recurring bills, such as rent, mortgage payments, utility bills, or subscription services. By setting up a pre-authorized debit agreement, they can automate these payments, ensuring they are paid on time without the need for manual intervention.

02

Businesses collecting payments: Businesses that offer products or services on a recurring basis often require customers to sign a pre-authorized debit agreement. This allows them to collect payments directly from the customer's bank account at regular intervals, streamlining the payment process and reducing the risk of missed or late payments.

03

Organizations receiving donations or contributions: Non-profit organizations or charitable causes may use pre-authorized debit agreements to collect regular donations or contributions from supporters. This provides a convenient and efficient way for donors to contribute regularly, and it helps the organization maintain a stable source of funding.

In summary, anyone who wishes to automate regular payments or collect recurring payments can benefit from a pre-authorized debit agreement payor's. It simplifies the payment process, ensures timely payments, and provides convenience for both payors and payees.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is pre-authorized debit agreement payor39s?

Pre-authorized debit agreement payor39s is an agreement where a payor gives permission to a payee to withdraw funds from their account on a regular basis.

Who is required to file pre-authorized debit agreement payor39s?

Any individual or organization that wishes to set up pre-authorized debits from a payor's account is required to file a pre-authorized debit agreement.

How to fill out pre-authorized debit agreement payor39s?

To fill out a pre-authorized debit agreement, both the payee and payor must provide their contact information, banking details, and agree to the terms of the authorization.

What is the purpose of pre-authorized debit agreement payor39s?

The purpose of pre-authorized debit agreements is to simplify the payment process for recurring bills and expenses.

What information must be reported on pre-authorized debit agreement payor39s?

The pre-authorized debit agreement must include information such as the payor's name, address, banking information, and the amount and frequency of the debit.

How can I get pre-authorized debit agreement payor39s?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific pre-authorized debit agreement payor39s and other forms. Find the template you need and change it using powerful tools.

Can I create an eSignature for the pre-authorized debit agreement payor39s in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your pre-authorized debit agreement payor39s directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete pre-authorized debit agreement payor39s on an Android device?

Use the pdfFiller mobile app and complete your pre-authorized debit agreement payor39s and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your pre-authorized debit agreement payor39s online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pre-Authorized Debit Agreement payor39s is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.