Get the free Annual Giving Donation Form - jmu

Show details

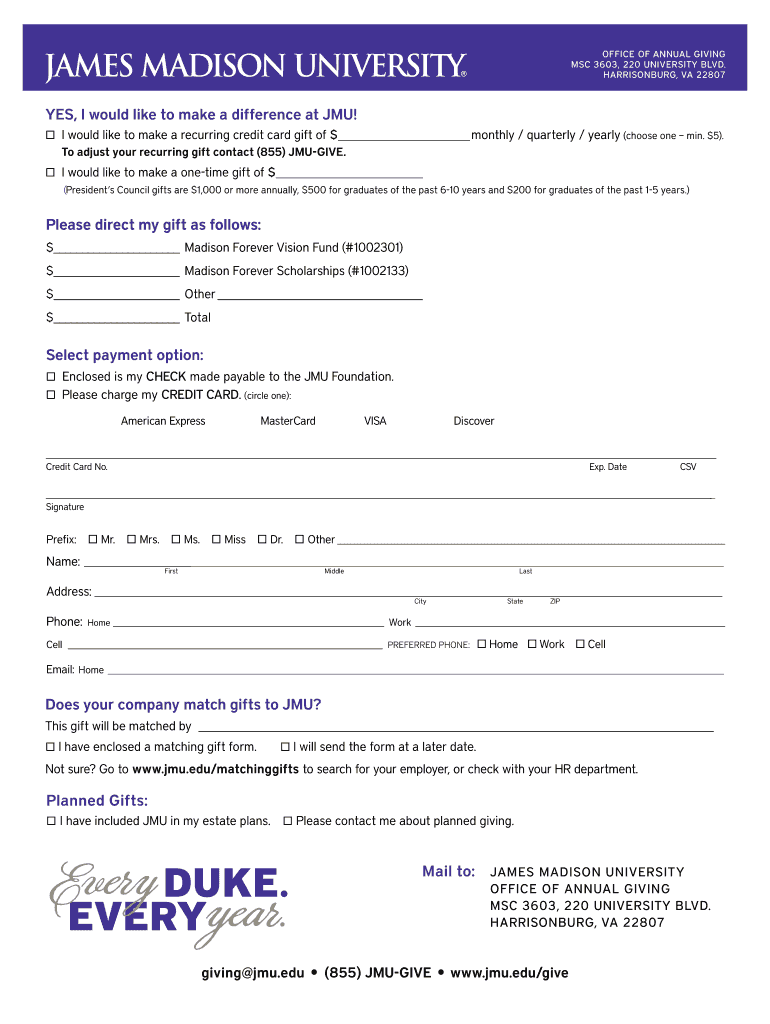

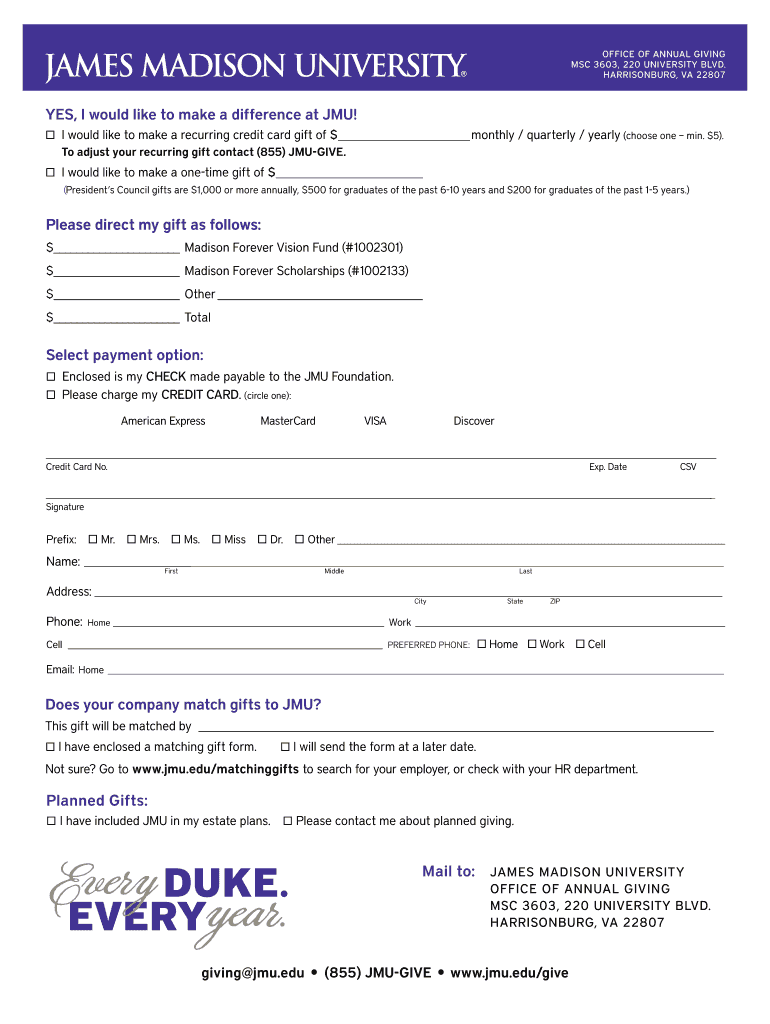

This document is for individuals wishing to make a recurring or one-time gift to James Madison University (JMU), with options for specific funds and payment methods.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual giving donation form

Edit your annual giving donation form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual giving donation form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annual giving donation form online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit annual giving donation form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual giving donation form

How to fill out Annual Giving Donation Form

01

Obtain the Annual Giving Donation Form from the organization's website or office.

02

Fill in your personal information, including your name, address, and contact details.

03

Decide on the amount you wish to donate and enter it in the designated field.

04

Choose the payment method: credit card, check, or bank transfer.

05

If you are donating in honor or memory of someone, include their name and specify the occasion.

06

Review all the information for accuracy.

07

Sign and date the form if required.

08

Submit the completed form according to the provided instructions, either online or by mail.

Who needs Annual Giving Donation Form?

01

Individuals wishing to support a nonprofit organization through financial contributions.

02

Alumni of educational institutions engaging in philanthropic activities.

03

Members of the community who want to contribute to local charities.

04

Businesses looking to participate in corporate giving or sponsorship.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a contribution letter?

Dear __ (the event organizer or person the letters should be returned to): This letter is to confirm that I am donating __ (an item or other physical contribution), worth $ for the (name of the program).

How to create a donation request form?

Here's a step-by-step guide to help you design a donation form that meets your organization's needs and maximizes donor engagement. Start with the Right Template or a Blank Form: Select the Appropriate Layout: Add Essential Form Elements: Customize the Form's Appearance: Set Up Email Notifications and Acknowledgments:

What is the form for donation?

Form 10BD is required to be furnished to the Income-tax authority by a Trust or an institution or an NGO which is approved under section 80G of the Income-tax Act, 1961. Rule 18AB of the Income-tax Rules, 1962 prescribes for furnishing a statement of donation in Form No.

How to write a letter of giving a donation?

Start your donation letter with a warm greeting and a brief introduction to your non-profit's mission. Clearly state the purpose of the letter and how donations will be used. Include a specific call to action with easy ways to donate, such as online links or mailing addresses. Keep the tone sincere and concise.

What is an example of a short donation message?

Examples of “please donate” messages: “Please support our cause with a small donation today!” “Your donation will make a real impact on the lives of others. Please consider donating today. Thank you for your generosity.”

How do I write a donation form?

7 Pro Tips to Build a Charitable Donation Form that Works Include suitable donation amounts. Share how gifts are used. Don't ask too many questions. Add recurring donation intervals. Use branding. Add multiple payment options. Test your donation form before sharing it with donors.

How to write a donation form?

Here's a template of the essential elements that any effective donation letter will include: Salutation. Explanation of your mission. Your project, event, or needs. Compelling details. A specific request. A call-to-action.

How to write "making a donation" in short notes?

Here's how to do it: Begin with something that grabs attention. Maybe it's a fact, a question, or a story about how your cause makes a difference. Clearly say why help is needed. Tell them what their donation will do. Don't beat around the bush. End by thanking them.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Annual Giving Donation Form?

The Annual Giving Donation Form is a document used by organizations to collect contributions from donors on a yearly basis.

Who is required to file Annual Giving Donation Form?

Typically, organizations that collect donations must file the Annual Giving Donation Form, but individuals are not required to file it unless specified by the organization.

How to fill out Annual Giving Donation Form?

To fill out the Annual Giving Donation Form, provide your personal information, specify the donation amount, choose payment method, and sign the form.

What is the purpose of Annual Giving Donation Form?

The purpose of the Annual Giving Donation Form is to facilitate the collection of donations, maintain accurate records, and ensure proper acknowledgment of contributions.

What information must be reported on Annual Giving Donation Form?

The information that must be reported includes donor's name, contact information, donation amount, payment method, and date of donation.

Fill out your annual giving donation form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Giving Donation Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.