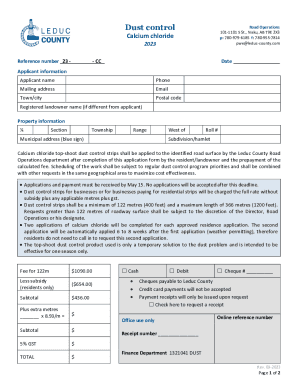

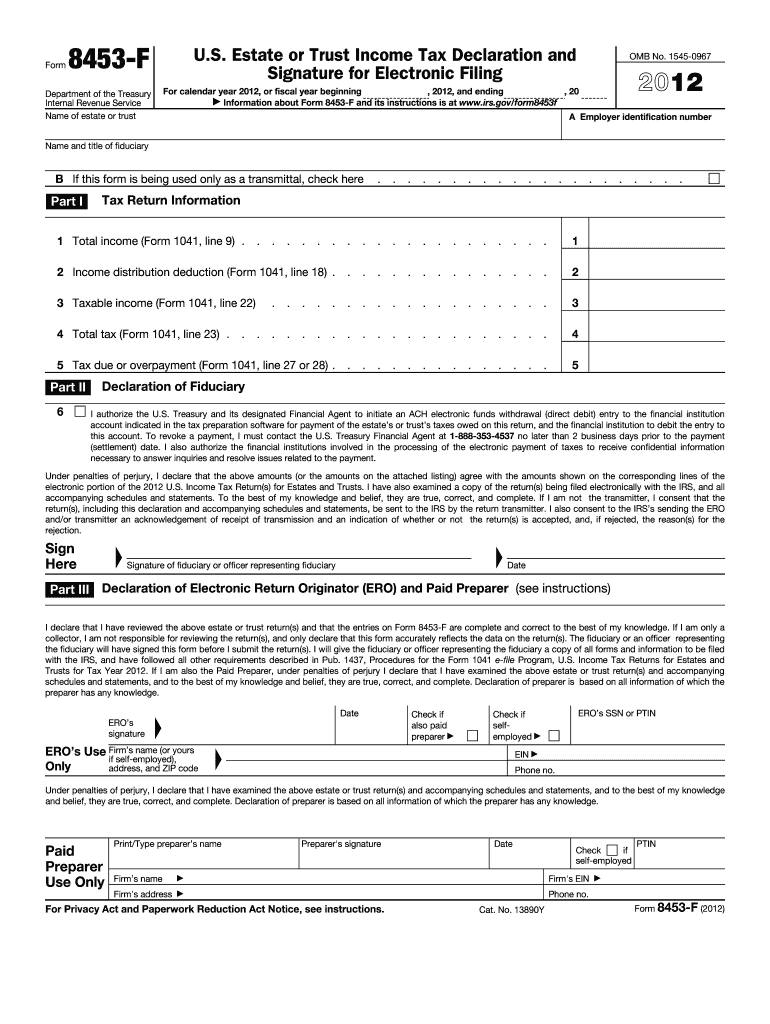

IRS 8453-FE 2012 free printable template

Instructions and Help about IRS 8453-FE

How to edit IRS 8453-FE

How to fill out IRS 8453-FE

About IRS 8453-FE 2012 previous version

What is IRS 8453-FE?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8453-FE

What should I do if I need to correct a mistake on my IRS 8453-FE after filing?

If you discover an error on your IRS 8453-FE after submission, you can file an amended form. Make sure to include a detailed explanation of the correction and refer to the original submission to ensure clarity. It's important to retain copies of all documents for your records.

How can I verify the status of my submitted IRS 8453-FE?

To verify the submission status of your IRS 8453-FE, you can contact the IRS e-file customer support or use the IRS online tools to track your filing. Keeping track of your confirmation number, if provided, can also assist in monitoring the processing of your form.

What are the common reasons for the rejection of an IRS 8453-FE when e-filing?

Common rejection codes for the IRS 8453-FE might include errors in taxpayer identification numbers or mismatches with IRS records. Always double-check your entries against official documents, and refer to the IRS guidelines for specific rejection codes to troubleshoot effectively.

What should I know about the privacy and security of my information when filing IRS 8453-FE?

When filing your IRS 8453-FE, be aware that the IRS implements various security measures to protect your sensitive information. Ensure that you use a secure internet connection and trusted e-filing software. Retain copies of your filed forms in a secure location to safeguard your data.

What if I receive a notice from the IRS regarding my filed IRS 8453-FE?

If you receive a notice from the IRS about your IRS 8453-FE, carefully read the communication to understand the issue. It may require you to provide additional documentation or clarify certain aspects. Respond promptly and gather any necessary supporting documents to resolve the matter effectively.