Get the free Income Withholding for Support (IWO) Sample Form.pdf - acf hhs

Show details

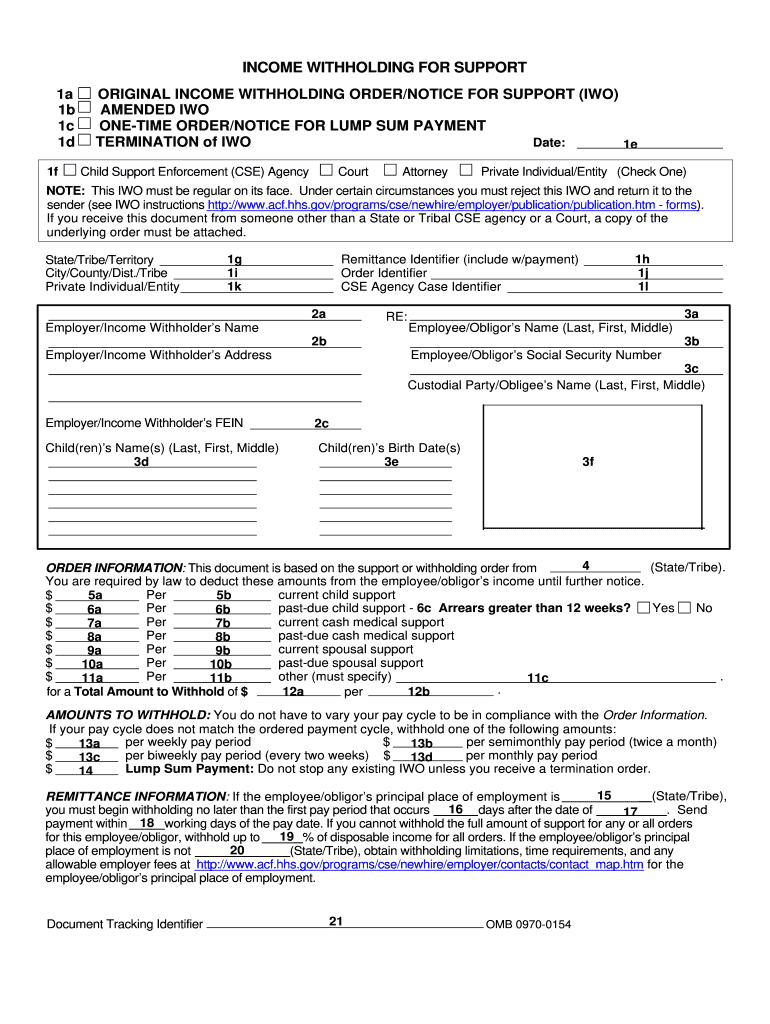

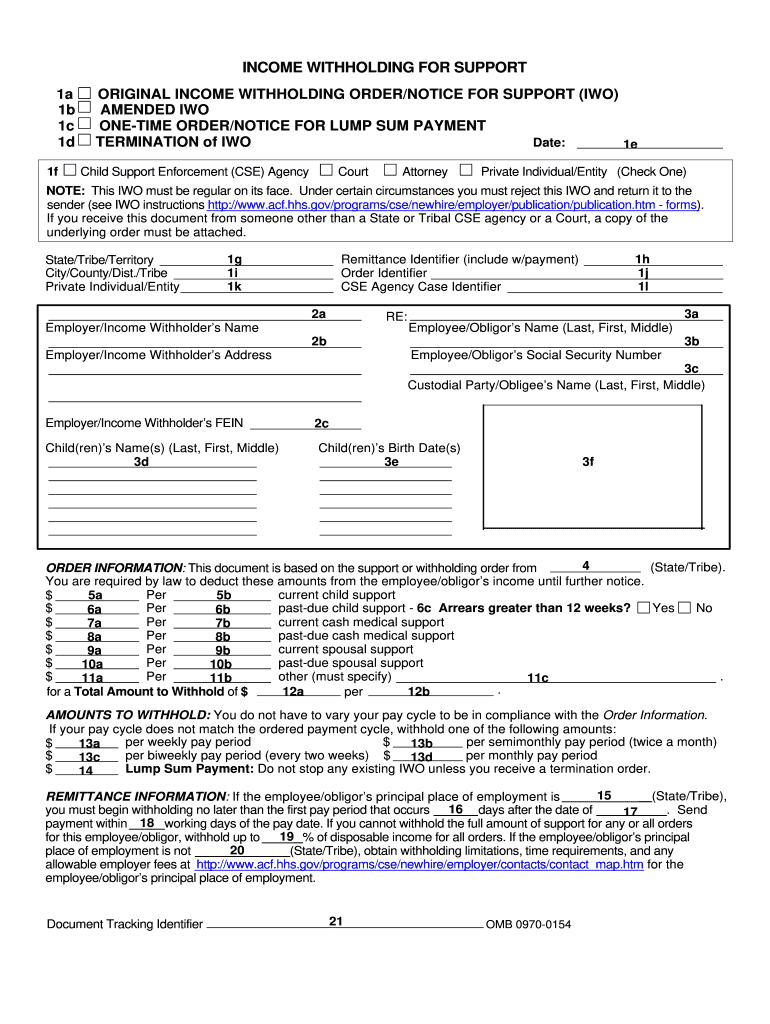

INCOME WITHHOLDING FOR SUPPORT 1a 1b 1c 1d 1f ORIGINAL INCOME WITHHOLDING ORDER/NOTICE FOR SUPPORT (TWO) AMENDED TWO ONE-TIME ORDER/NOTICE FOR LUMP SUM PAYMENT TERMINATION of TWO Date: 1e Child Support

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income withholding for support

Edit your income withholding for support form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income withholding for support form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing income withholding for support online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit income withholding for support. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out income withholding for support

How to fill out income withholding for support:

01

Identify the appropriate form: To fill out income withholding for support, you need to obtain the correct form from your local child support enforcement agency or download it from their website.

02

Provide basic information: The form will typically require you to enter your personal information, including your name, address, and contact details.

03

Include relevant employment details: You will need to provide information about your employer, such as their name, address, and contact details. Additionally, you may be asked to provide details about your employment status and income.

04

Specify the support order details: Enter the necessary details regarding the support order, including the name of the custodial parent or agency receiving the support, the amount of support to be withheld, and the effective date of the order.

05

Complete the Employer section: If you are an employer filling out the form, you will need to provide information about your business, such as your employer identification number and the pay cycle details.

06

Sign and date the form: Finally, make sure to sign and date the form to certify its accuracy and completeness.

Who needs income withholding for support:

01

Individuals owing child support: Income withholding for support is typically required for individuals who owe child support and have a support order in place.

02

Custodial parents or child support agencies: Income withholding for support is needed by custodial parents or child support agencies who are responsible for collecting child support on behalf of the children.

03

Employers: Employers play a crucial role in income withholding for support as they are responsible for deducting the specified amount from the employee's wages and remitting it to the appropriate agency or individual.

Fill

form

: Try Risk Free

People Also Ask about

How long does an income withholding order take in Illinois?

The payor shall pay the amount withheld to the State Disbursement Unit within 7 business days after the date the amount would (but for the duty to withhold income) have been paid or credited to the obligor.

What is child support supposed to cover in Ohio?

When the court orders one parent to pay the other parent child support, those funds are meant to cover the basic living expenses of their child. This includes rent, utilities, food, and clothing.

What is OMB 0970 0154?

Income Withholding for Support (IWO)

What is the income withholding for support in Ohio?

An employer may not withhold more than 50 percent of an employee's disposable income if the employee supports another dependent, or 60 percent if the employee does not support someone else.

What is an income withholding order for support California?

Income Withholding for Support (FL-195) Tells an employer that the court made an order for you or the other person in the case to pay child support, medical support, spousal or domestic partner support (and any past-due support).

How much is child support in Ohio per month?

Use this table to get an idea of the basic amount of child support in Ohio for your income level. Annual IncomeOne ChildFour Children13,200$1,200$1,58413,800$1,230$1,66214,400$1,260$1,74015,000$1,290$1,81857 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my income withholding for support directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your income withholding for support and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I get income withholding for support?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific income withholding for support and other forms. Find the template you want and tweak it with powerful editing tools.

Can I sign the income withholding for support electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your income withholding for support in seconds.

What is income withholding for support?

Income withholding for support is a legal process that allows for the automatic deduction of a specified amount of an individual's income to fulfill child support or spousal support obligations.

Who is required to file income withholding for support?

Employers are required to file income withholding for support when they receive an income withholding order from a court or state agency, usually involving non-custodial parents who owe child or spousal support.

How to fill out income withholding for support?

To fill out an income withholding for support, one must complete the designated form provided by the court or state agency, which includes details such as the non-custodial parent's information, the amount to be withheld, and the recipient's details.

What is the purpose of income withholding for support?

The purpose of income withholding for support is to ensure that child or spousal support payments are made regularly and on time, minimizing the risk of non-payment or arrears.

What information must be reported on income withholding for support?

The information that must be reported on income withholding for support includes the non-custodial parent's name, Social Security number, the amount to be withheld, the frequency of payment, and the name and address of the person receiving the support.

Fill out your income withholding for support online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Withholding For Support is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.