Get the free Capital Bridging - How to add Buy to Let Club as the payment route

Show details

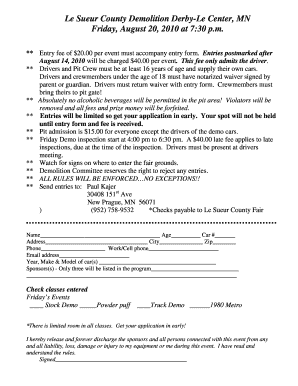

Capital Bridging How to add Buy to Let Club as the payment route Using Buy to Let Club as the payment route: The Capital Bridging application form is attached to this document. Print and complete

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign capital bridging - how

Edit your capital bridging - how form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your capital bridging - how form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing capital bridging - how online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit capital bridging - how. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out capital bridging - how

How to fill out capital bridging - how?

01

Start by gathering all the necessary information and documents required for filling out the capital bridging application form. This may include personal identification documents, financial statements, business plans, and any other relevant information.

02

Carefully review the instructions provided with the application form to understand the specific requirements and guidelines for filling it out. This will ensure that you provide accurate and complete information.

03

Begin filling out the application form by entering your personal details, such as your name, contact information, and social security number. Make sure to double-check the accuracy of these details before moving forward.

04

Proceed to fill out the sections related to your business, such as its name, address, industry, and legal structure. If applicable, provide information about any partners, shareholders, or directors involved in the business.

05

Provide a thorough description of your business and its operations. Include details about the products or services offered, target market, and any competitive advantages or unique selling points.

06

Fill out the financial information section, which typically requires you to provide details about your business's revenue, expenses, assets, and liabilities. This may include providing financial statements, bank statements, and tax returns.

07

If requested, provide any additional supporting documents, such as business licenses, permits, or contracts, to strengthen your application.

08

Before submitting the application, carefully review all the information you have entered to ensure its accuracy and completeness. Make any necessary corrections or additions as needed.

Who needs capital bridging - how?

01

Entrepreneurs and small business owners who require immediate funding for their business operations or growth plans may benefit from capital bridging. It can provide short-term liquidity to overcome financial gaps before obtaining traditional financing or generating revenue.

02

Startups that are in the early stages of development and do not have a proven track record may also need capital bridging to sustain their operations until they can generate sustainable revenue.

03

Businesses undergoing a transition, such as mergers, acquisitions, or restructuring, might require capital bridging to manage cash flow issues or finance necessary changes.

04

Companies experiencing unexpected expenses or financial challenges, such as equipment breakdowns, sudden market changes, or unforeseen events, may seek capital bridging to ensure continuity and stability.

05

Individuals or organizations involved in real estate projects, such as property developers or investors, may utilize capital bridging to secure short-term financing for property purchases, renovations, or refinancing.

In summary, capital bridging can be beneficial for entrepreneurs, small business owners, startups, businesses in transition, and real estate professionals who require immediate funding or short-term financing solutions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is capital bridging - how?

Capital bridging is a process by which a company or individual temporarily bridges a gap in financing by obtaining short-term funding. This can be done through various means such as a bridge loan or other financial instruments.

Who is required to file capital bridging - how?

Companies or individuals who need short-term funding to bridge a financing gap are required to file capital bridging. This is typically done through financial institutions or lenders.

How to fill out capital bridging - how?

To fill out a capital bridging form, one must provide information about the amount of funding needed, the purpose of the financing, the intended repayment schedule, and any collateral that will be used to secure the loan or funding.

What is the purpose of capital bridging - how?

The purpose of capital bridging is to provide temporary financing to bridge a gap between the need for funds and the availability of long-term financing. This can help companies or individuals meet financial obligations or take advantage of investment opportunities.

What information must be reported on capital bridging - how?

The information that must be reported on capital bridging includes the amount of funding requested, the purpose of the financing, the repayment terms, any collateral provided, and the intended use of the funds.

How do I edit capital bridging - how online?

The editing procedure is simple with pdfFiller. Open your capital bridging - how in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I edit capital bridging - how on an iOS device?

Use the pdfFiller mobile app to create, edit, and share capital bridging - how from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Can I edit capital bridging - how on an Android device?

The pdfFiller app for Android allows you to edit PDF files like capital bridging - how. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your capital bridging - how online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Capital Bridging - How is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.