Get the free National flood insurance bloss noticeb - AWS Insurance Company

Show details

O.M.B. No. 30670021 Expires June 30, 2003, FEDERAL EMERGENCY MANAGEMENT AGENCY FEDERAL INSURANCE ADMINISTRATION NATIONAL FLOOD INSURANCE PROGRAM NOTICE OF LOSS (See reverse side for Privacy Act Statement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign national flood insurance bloss

Edit your national flood insurance bloss form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your national flood insurance bloss form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit national flood insurance bloss online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit national flood insurance bloss. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out national flood insurance bloss

How to Fill Out National Flood Insurance Forms:

01

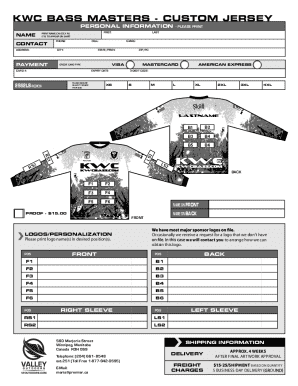

Gather necessary information: Before starting to fill out the national flood insurance forms, gather all the relevant information such as your contact details, property information, and insurance policy details.

02

Complete the property information section: Provide accurate and detailed information about the property that needs flood insurance coverage. This includes the property's address, type of construction, year built, and number of floors.

03

Determine the coverage: Decide on the amount of coverage you need for your property. Consider factors such as the property's value, potential flood risks, and your budget. It is recommended to consult with insurance professionals for guidance.

04

Provide insurance policy information: If you have an existing insurance policy, you may need to provide details such as the policy number, effective dates, and the name of the insurance company.

05

Fill out the applicant information: In this section, provide your personal details including your name, contact information, and social security number.

06

Determine the flood zone: Determine the flood zone in which your property is located. You can usually find this information on flood maps issued by FEMA (Federal Emergency Management Agency).

07

Sign and date the form: Once you have completed all the necessary sections, don't forget to sign and date the form. Unsigned forms may lead to delays in processing.

08

Submit the form: After thoroughly reviewing the completed form, submit it to the appropriate authority. This may involve sending it to your insurance agent, the insurance company, or directly to FEMA, depending on the instructions provided.

Who Needs National Flood Insurance:

01

Homeowners in flood-prone areas: If you live in an area that is vulnerable to flooding, having national flood insurance is crucial. This includes properties located near rivers, coastal areas, or regions prone to heavy rainfall.

02

Property owners with mortgage requirements: In some cases, mortgage lenders may require homeowners to have flood insurance if their property is in a high-risk flood area as determined by FEMA.

03

Business owners: Commercial property owners, including small business owners, may also need national flood insurance to protect their assets and ensure business continuity in the event of a flood.

04

Renters: While flood insurance typically covers the building structure, renters may also consider purchasing flood insurance to protect their personal belongings and contents within the rental property.

05

Those seeking financial protection: Even if you are not located in a designated flood zone, purchasing national flood insurance can provide you with financial protection against unexpected flooding events that may not be covered by standard homeowners insurance policies.

Note: It is important to consult with insurance professionals or FEMA to determine if you need national flood insurance based on your specific circumstances and the flood risk associated with your property.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send national flood insurance bloss to be eSigned by others?

Once your national flood insurance bloss is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for signing my national flood insurance bloss in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your national flood insurance bloss and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I complete national flood insurance bloss on an Android device?

Use the pdfFiller Android app to finish your national flood insurance bloss and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is national flood insurance bloss?

National flood insurance bloss is a form that property owners in flood-prone areas must fill out to obtain coverage for flood-related damage.

Who is required to file national flood insurance bloss?

Property owners in flood-prone areas who have mortgages from federally regulated or insured lenders are required to file national flood insurance bloss.

How to fill out national flood insurance bloss?

National flood insurance bloss can be filled out by providing information about the property and its location, as well as details about the current insurance coverage.

What is the purpose of national flood insurance bloss?

The purpose of national flood insurance bloss is to assess the risk of flood damage and determine the appropriate insurance coverage to protect the property owner.

What information must be reported on national flood insurance bloss?

Information such as property location, current insurance coverage, and details about the property's flood zone must be reported on national flood insurance bloss.

Fill out your national flood insurance bloss online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

National Flood Insurance Bloss is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.